Question

It is your first week on the job and to orient you to your new position, your supervisor has given you the following assignment. In

It is your first week on the job and to orient you to your new position, your supervisor has given you the following assignment. In approaching this assignment, you want to do an excellent case analysis to make a favorable first impression.

REQUIREMENTS

Please use year 2019 Comprehensive Annual Financial Reports (CAFRs) of YOUR STATE to answer the following case questions. You may download the CAFRs via their websites or googling the key words CAFR & name of YOUR STATE.

Part I Preliminary Analysis of CAFR

Find the total assets, total liabilities, net assets, unrestricted net assets, total revenues, total expenses, and change in net assets of YOUR STATE for 2019. Explain the trends.

Part II : Additional Analysis of the CAFR

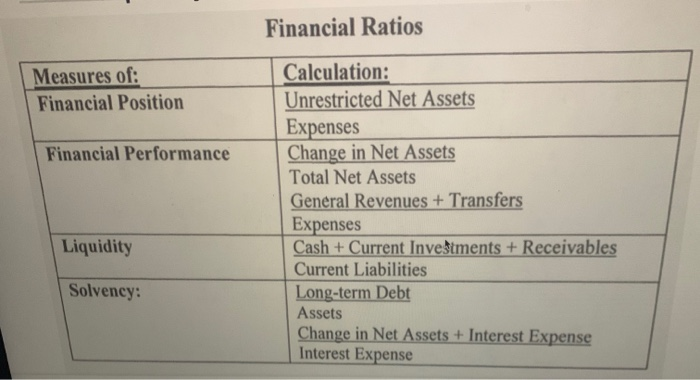

An article by Chancy, Mead and Schermann (2002) summarizes six government-wide ratios to measure fiscal distress and related financial risk factors of municipalities. One ratio provides an overall measure of financial position for the government. Two ratios provide measures of financial performance. A fourth ratio provides a measure of liquidity. Two final ratios provide measures of solvency. These ratios in comparison to the ratios measured for similar governments, combined with other useful information, provide a starting point for evaluating the overall financial condition of a governmental entity. The definitions and measurements of these ratios and factors are listed in the following table.

Calculate the risk ratios for YOUR STATE for 2019, and answer

What conclusions concerning the sates financial position can be drawn from these ratios?

What conclusions concerning the states liquidity can be drawn from these ratios?

What conclusions concerning the states financial performance can be drawn from these ratios?

What conclusions concerning the states solvency can be drawn from these ratios?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started