Answered step by step

Verified Expert Solution

Question

1 Approved Answer

MCDL, LLC would like to invest $3M in Apple and needs you to analyze the financial data and provide the following items: The analysis will

| MCDL, LLC would like to invest $3M in Apple and needs you to analyze the financial data and provide the following items: |

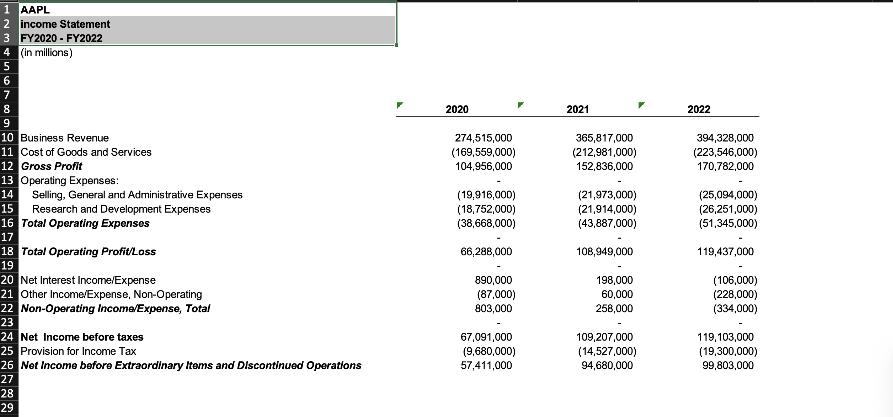

| The analysis will be based on the last two years of financial data for Apple: |

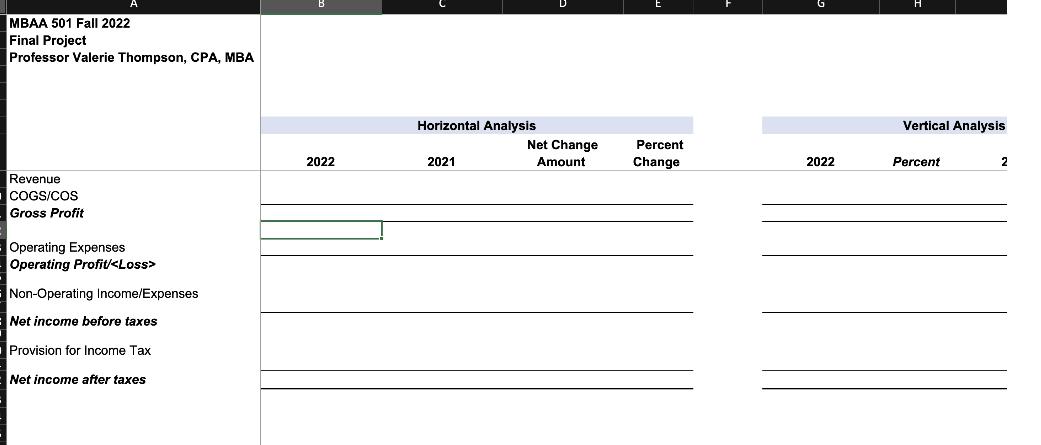

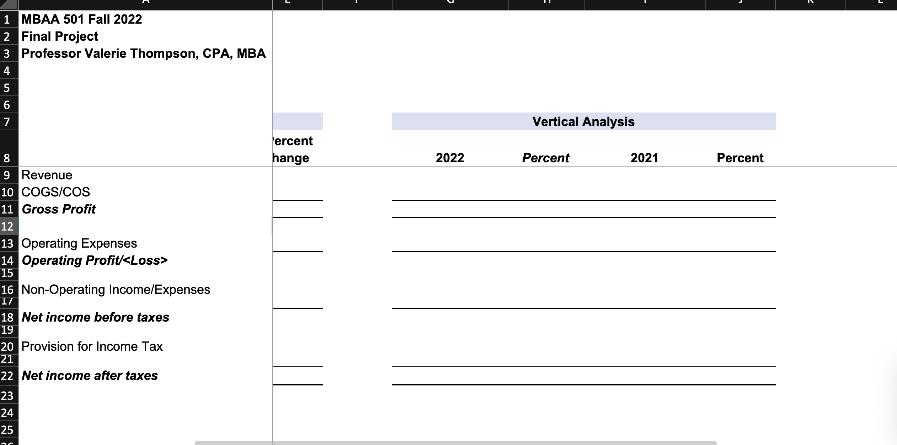

| 1. Prepare a comparative P&L horizontal and vertical analysis using the financial information on the Income Statement "tab". (40 points) |

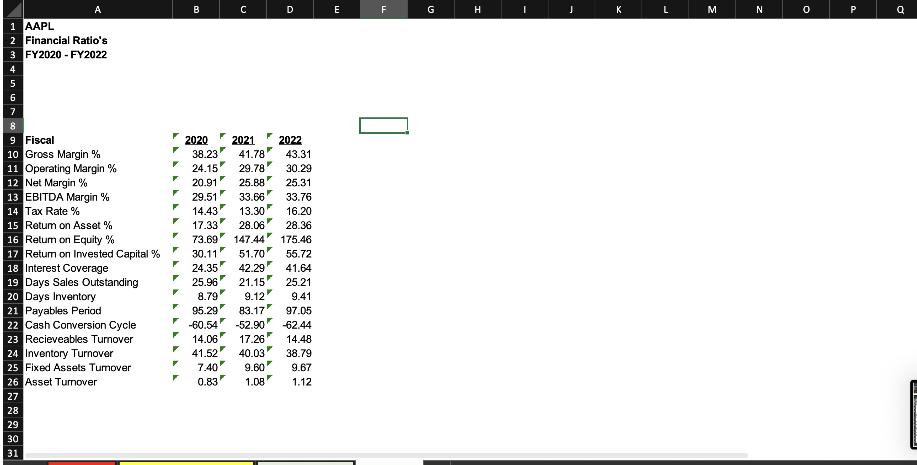

| 2. Solvency & Profitability ratio - Provide a detailed analysis for each ratio listed below, comparing ratios to industry standards (if available)(20 points). |

| a. Solvency – Times Interest Earned |

| b. Profitability – Gross Margin |

| 3. Liquidity ratio - Provide a detailed analysis for each ratio listed below, comparing ratios to industry standards(if available). (20 points) |

a. Working Capital, Quick Ratio, AR Turnover, DSO AR, Inventory Turnover, and, DSO Inventory 4. Provide recommendations to the management and discuss why? |

MBAA 501 Fall 2022 Final Project Professor Valerie Thompson, CPA, MBA Revenue COGS/COS Gross Profit Operating Expenses Operating Profit/ Non-Operating Income/Expenses Net income before taxes Provision for Income Tax Net income after taxes 2022 Horizontal Analysis 2021 Net Change Amount Percent Change 2022 Vertical Analysis Percent 2 1 MBAA 501 Fall 2022 2 Final Project NM 4567 3 Professor Valerie Thompson, CPA, MBA 8 9 Revenue 10 COGS/COS 11 Gross Profit 12 13 Operating Expenses 14 Operating Profit/ 15 16 Non-Operating Income/Expenses 1/ 18 Net income before taxes 19 20 Provision for Income Tax 21 22 Net income after taxes 23 24 25 ercent hange 2022 Vertical Analysis Percent 2021 Percent A 1 AAPL 2 Financial Ratio s TN34567 3 FY2020-FY2022 8 9 Fiscal 10 Gross Margin % 11 Operating Margin % 12 Net Margin % 13 EBITDA Margin % 14 Tax Rate % 15 Retum on Asset% 16 Return on Equity % 17 Return on Invested Capital % 18 Interest Coverage 19 Days Sales Outstanding 20 Days Inventory 21 Payables Period 22 Cash Conversion Cycle 23 Recieveables Turnover 24 Inventory Turnover 25 Fixed Assets Tumover 26 Asset Turnover 27 28 29 30 31 F F F F F F F F B 20.91 29.51 C 2020 2021 2022 38.23 41.78 43.31 24.15 29.78 30.29 25.88 25.31 33.76 16.20 28.36 175.46 55.72 41.64 25.21 9.41 97.05 -62.44 33.66 13.30 28.06 73.69 147.44 30.11 51.70 24.35 42.29 25.96 21.15 8.79 9.12 95.29 83.17 14.43 17.33 D -60.54 -52.90 14.06 17.26 41.52 40.03 7.40 9.60 0.83 1.08 14.48 38.79 9.67 1.12 E F G H J K L M N Q 1 AAPL 2 income Statement 3 FY2020-FY2022 4 (in millions) 100SWNI 9 10 Business Revenue 11 Cost of Goods and Services 12 Gross Profit 13 Operating Expenses: 14 Selling, General and Administrative Expenses 15 Research and Development Expenses 16 Total Operating Expenses 17 18 Total Operating Profit/Loss 19 20 Net Interest Income/Expense 21 Other Income/Expense, Non-Operating 22 Non-Operating Income/Expense, Total 23 24 Net Income before taxes 25 Provision for Income Tax 26 Net Income before Extraordinary Items and Discontinued Operations 27 28 29 2020 274,515,000 (169,559,000) 104,956,000 (19,916,000) (18,752,000) (38,668,000) 66,288,000 890,000 (87,000) 803,000 67,091,000 (9,680,000) 57,411,000 2021 365,817,000 (212,981,000) 152,836,000 (21,973,000) (21,914,000) (43,887,000) 108,949,000 198,000 60,000 258,000 109,207,000 (14,527,000) 94,680,000 2022 394,328,000 (223,546,000) 170,782,000 (25,094,000) (26,251,000) (51,345,000) 119,437,000 (106,000) (228,000) (334,000) 119,103,000 (19,300,000) 99,803,000

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

FORMULA FOR VERTICAL ANALYSIS Option D is correct 1p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started