Answered step by step

Verified Expert Solution

Question

1 Approved Answer

IT Limited (ITL) is a company that manufactures and sells computer equipment. The company's plant is based in Harare Zimbabwe but ITL sells its

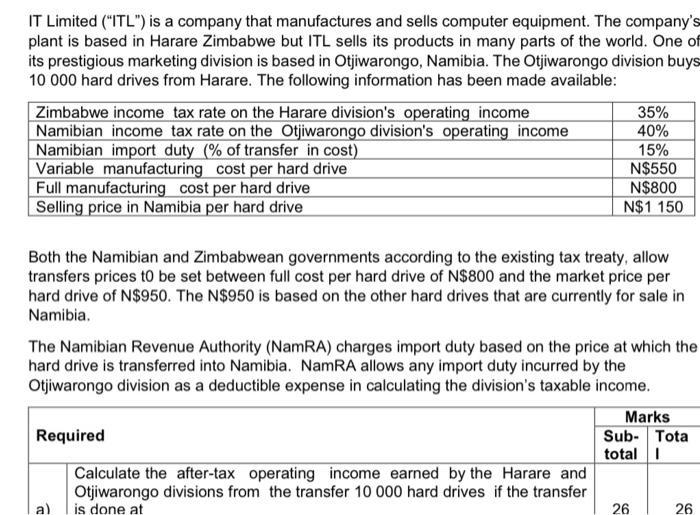

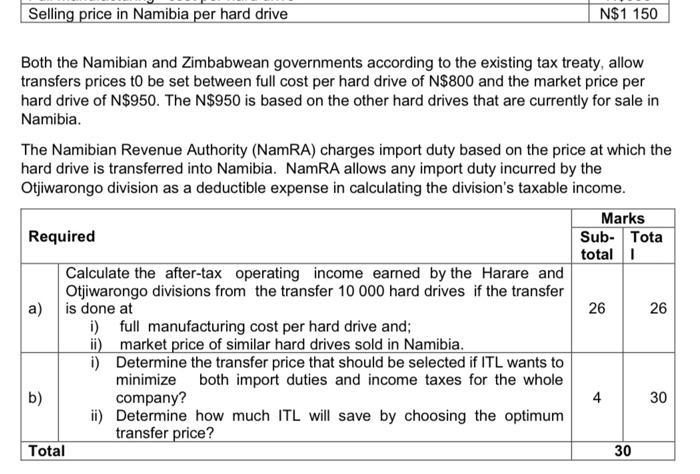

IT Limited ("ITL") is a company that manufactures and sells computer equipment. The company's plant is based in Harare Zimbabwe but ITL sells its products in many parts of the world. One of its prestigious marketing division is based in Otjiwarongo, Namibia. The Otjiwarongo division buys 10 000 hard drives from Harare. The following information has been made available: Zimbabwe income tax rate on the Harare division's operating income Namibian income tax rate on the Otjiwarongo division's operating income Namibian import duty (% of transfer in cost) Variable manufacturing cost per hard drive Full manufacturing cost per hard drive Selling price in Namibia per hard drive 35% 40% 15% N$550 N$800 N$1 150 Both the Namibian and Zimbabwean governments according to the existing tax treaty, allow transfers prices t0 be set between full cost per hard drive of N$800 and the market price per hard drive of N$950. The N$950 is based on the other hard drives that are currently for sale in Namibia. The Namibian Revenue Authority (NamRA) charges import duty based on the price at which the hard drive is transferred into Namibia. NamRA allows any import duty incurred by the Otjiwarongo division as a deductible expense in calculating the division's taxable income. Marks Sub- Tota total I Required Calculate the after-tax operating income earned by the Harare and Otjiwarongo divisions from the transfer 10 000 hard drives if the transfer is done at 26 26 Selling price in Namibia per hard drive N$1 150 Both the Namibian and Zimbabwean governments according to the existing tax treaty, allow transfers prices t0 be set between full cost per hard drive of N$800 and the market price per hard drive of N$950. The N$950 is based on the other hard drives that are currently for sale in Namibia. The Namibian Revenue Authority (NamRA) charges import duty based on the price at which the hard drive is transferred into Namibia. NamRA allows any import duty incurred by the Otjiwarongo division as a deductible expense in calculating the division's taxable income. Marks Required Sub- Tota total I Calculate the after-tax operating income earned by the Harare and Otjiwarongo divisions from the transfer 10 000 hard drives if the transfer a) is done at i) full manufacturing cost per hard drive and; ii) market price of similar hard drives sold in Namibia. i) Determine the transfer price that should be selected if ITL wants to minimize both import duties and income taxes for the whole company? ii) Determine how much ITL will save by choosing the optimum transfer price? 26 26 b) 4 30 Total 30 IT Limited ("ITL") is a company that manufactures and sells computer equipment. The company's plant is based in Harare Zimbabwe but ITL sells its products in many parts of the world. One of its prestigious marketing division is based in Otjiwarongo, Namibia. The Otjiwarongo division buys 10 000 hard drives from Harare. The following information has been made available: Zimbabwe income tax rate on the Harare division's operating income Namibian income tax rate on the Otjiwarongo division's operating income Namibian import duty (% of transfer in cost) Variable manufacturing cost per hard drive Full manufacturing cost per hard drive Selling price in Namibia per hard drive 35% 40% 15% N$550 N$800 N$1 150 Both the Namibian and Zimbabwean governments according to the existing tax treaty, allow transfers prices t0 be set between full cost per hard drive of N$800 and the market price per hard drive of N$950. The N$950 is based on the other hard drives that are currently for sale in Namibia. The Namibian Revenue Authority (NamRA) charges import duty based on the price at which the hard drive is transferred into Namibia. NamRA allows any import duty incurred by the Otjiwarongo division as a deductible expense in calculating the division's taxable income. Marks Sub- Tota total I Required Calculate the after-tax operating income earned by the Harare and Otjiwarongo divisions from the transfer 10 000 hard drives if the transfer is done at 26 26 Selling price in Namibia per hard drive N$1 150 Both the Namibian and Zimbabwean governments according to the existing tax treaty, allow transfers prices t0 be set between full cost per hard drive of N$800 and the market price per hard drive of N$950. The N$950 is based on the other hard drives that are currently for sale in Namibia. The Namibian Revenue Authority (NamRA) charges import duty based on the price at which the hard drive is transferred into Namibia. NamRA allows any import duty incurred by the Otjiwarongo division as a deductible expense in calculating the division's taxable income. Marks Required Sub- Tota total I Calculate the after-tax operating income earned by the Harare and Otjiwarongo divisions from the transfer 10 000 hard drives if the transfer a) is done at i) full manufacturing cost per hard drive and; ii) market price of similar hard drives sold in Namibia. i) Determine the transfer price that should be selected if ITL wants to minimize both import duties and income taxes for the whole company? ii) Determine how much ITL will save by choosing the optimum transfer price? 26 26 b) 4 30 Total 30

Step by Step Solution

There are 3 Steps involved in it

Step: 1

answers Answer a Computation of After Tax Operating Income of Manufacturing Plant in Harare Zimbabwe ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started