Question

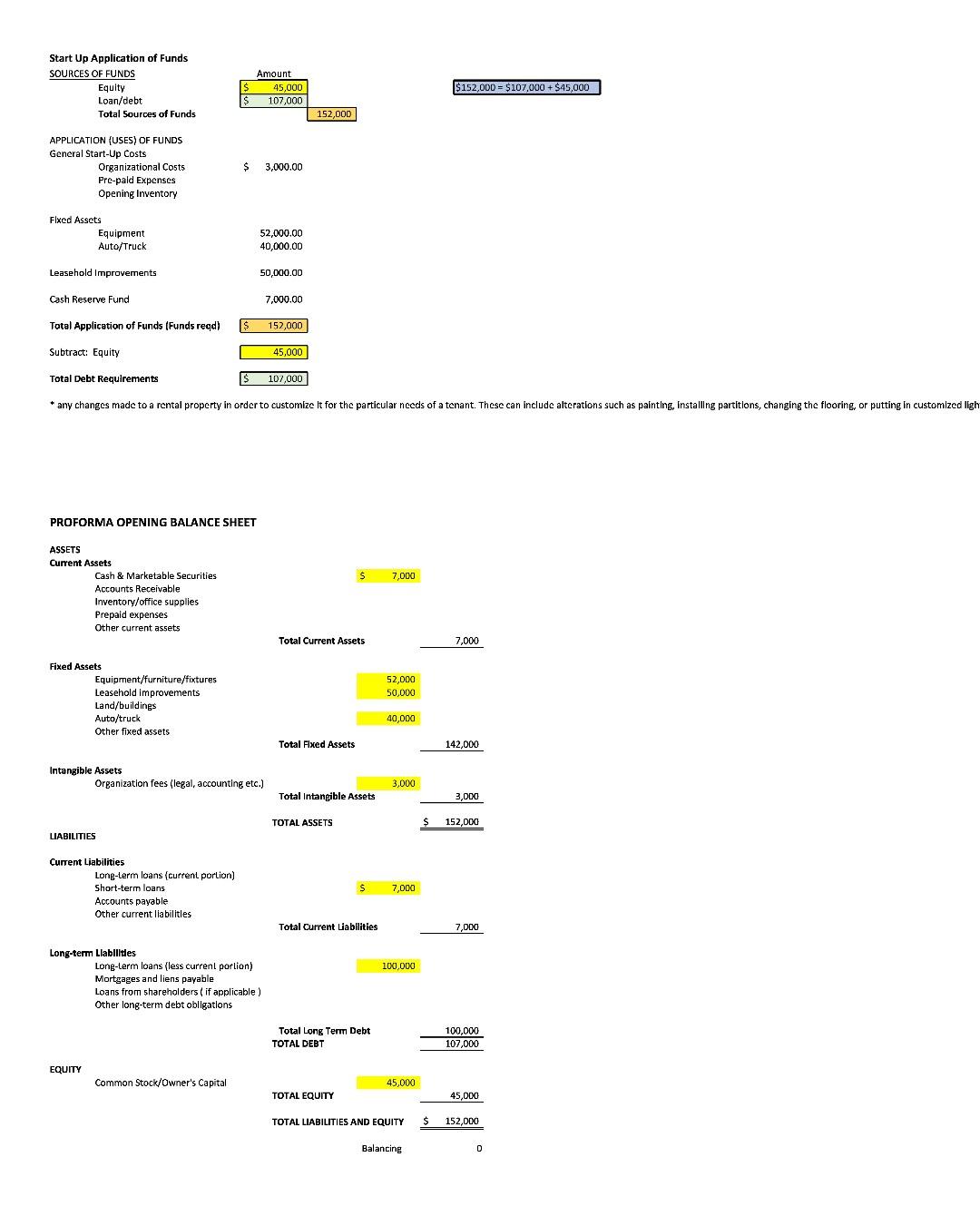

It looks like you have provided a breakdown of the sources and uses of funds for a startup, along with details of equity, loans, and

It looks like you have provided a breakdown of the sources and uses of funds for a startup, along with details of equity, loans, and the application of funds. If you need assistance with solving this in an Excel sheet, you can follow these steps:

Create a new Excel spreadsheet.

Label your columns:

Column A: Categories (e.g., Equity, Loan/debt, Organizational Costs, Equipment, etc.) Column B: Amount Enter the data:

In Column A, list all the categories mentioned in your breakdown. In Column B, input the corresponding amounts. Calculate Total Sources of Funds:

In a new cell, use the formula =SUM(B2:B3) to calculate the total sources of funds. Calculate Total Application of Funds:

In a new cell, use the formula =SUM(B7:B11) to calculate the total application of funds. Calculate Total Debt Requirements:

In a new cell, use the formula =B8-B16 to calculate the total debt requirements. Format your spreadsheet:

You can format cells as currency for better readability. You may want to use different colors or bold text to highlight important information.

Start Up Application of Funds SOURCES OF FUNDS Amount $152,000=$107,000+$45,000 Equity Loan/debt Total Sources of Funds APPLICATION \{USES\} DF FUNDS General Start-Up Costs Organizational Cost5 Pre-paid Expenses Opening Inventory Flxed Assets Equipment Auto/Truck Leasehold Improvements Cash Reserve Fund Total Application of Funds (Funds recd) Subtract: Equity Total Debt Requirements $3,000.00 52,000,00 40,000.00 50,000.00 7,000.00 $152,000 45,000 107,000 PROFORMA OPENING BALANCE SHEET ASSETS Current Assets Cash \& Marketable Securities $7,000 Accounts Receivable Inventory/office supplies Prepaid expenses Other current assets Total Current Assets 7,000 Fixed Assets Equipment/furniture/fixtures Leasehold improvements Land/buildings Auto/truck Other fixed assets Intangible Assets Organization fees (legal, accounting etc.) Total Fliced Assets 142,000 52,000 50,000 40,000 Total Flyed Assets 3,000 Total Intangible Assets 3,000 TOTAL ASSETS LABILITIES Current Liabilities Lone-term loans (curtent portion) Short-term loans Accounts payable Other current liabilitles Total Current Liablities 7,000 Long-term Llabllitles Long-term loans (less current portion) 100,000 Mortgages and liens payable Loans from shareholders ( if applicable) Other long-term debt obllgatlons Total Long Term Debt TOTAL DEBT 100,000 EQUITY Common Stock/Owner's Capital Start Up Application of Funds SOURCES OF FUNDS Amount $152,000=$107,000+$45,000 Equity Loan/debt Total Sources of Funds APPLICATION \{USES\} DF FUNDS General Start-Up Costs Organizational Cost5 Pre-paid Expenses Opening Inventory Flxed Assets Equipment Auto/Truck Leasehold Improvements Cash Reserve Fund Total Application of Funds (Funds recd) Subtract: Equity Total Debt Requirements $3,000.00 52,000,00 40,000.00 50,000.00 7,000.00 $152,000 45,000 107,000 PROFORMA OPENING BALANCE SHEET ASSETS Current Assets Cash \& Marketable Securities $7,000 Accounts Receivable Inventory/office supplies Prepaid expenses Other current assets Total Current Assets 7,000 Fixed Assets Equipment/furniture/fixtures Leasehold improvements Land/buildings Auto/truck Other fixed assets Intangible Assets Organization fees (legal, accounting etc.) Total Fliced Assets 142,000 52,000 50,000 40,000 Total Flyed Assets 3,000 Total Intangible Assets 3,000 TOTAL ASSETS LABILITIES Current Liabilities Lone-term loans (curtent portion) Short-term loans Accounts payable Other current liabilitles Total Current Liablities 7,000 Long-term Llabllitles Long-term loans (less current portion) 100,000 Mortgages and liens payable Loans from shareholders ( if applicable) Other long-term debt obllgatlons Total Long Term Debt TOTAL DEBT 100,000 EQUITY Common Stock/Owner's CapitalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started