Answered step by step

Verified Expert Solution

Question

1 Approved Answer

It must be solved using a business calculator. (N, I, PMT, PV, etc) Iron Man has been offered an investment that will pay him $250,000

It must be solved using a business calculator. (N, I, PMT, PV, etc)

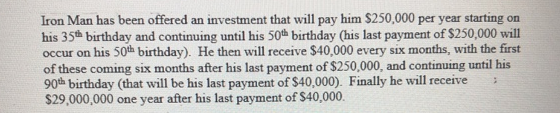

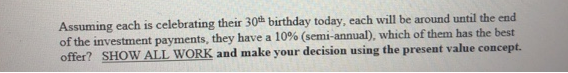

Iron Man has been offered an investment that will pay him $250,000 per year starting on his 35th birthday and continuing until his 50th birthday (his last payment of $250,000 will occur on his 50th birthday). He then will receive $40,000 every six months, with the first of these coming six months after his last payment of $250,000, and continuing until his 90th birthday (that will be his last payment of $40,000). Finally he will receive : $29,000,000 one year after his last payment of $40,000. Assuming each is celebrating their 30 birthday today, each will be around until the end of the investment payments, they have a 10% (semi-annual), which of them has the best offer? SHOW ALL WORK and make your decision using the present value concept. Iron Man has been offered an investment that will pay him $250,000 per year starting on his 35th birthday and continuing until his 50th birthday (his last payment of $250,000 will occur on his 50th birthday). He then will receive $40,000 every six months, with the first of these coming six months after his last payment of $250,000, and continuing until his 90th birthday (that will be his last payment of $40,000). Finally he will receive : $29,000,000 one year after his last payment of $40,000. Assuming each is celebrating their 30 birthday today, each will be around until the end of the investment payments, they have a 10% (semi-annual), which of them has the best offer? SHOW ALL WORK and make your decision using the present value conceptStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started