Answered step by step

Verified Expert Solution

Question

1 Approved Answer

it needs to be done in Excel, but I don't know what formula to use. Thank you! Accrued Interest Payable Recall from Transaction No. 2

it needs to be done in Excel, but I don't know what formula to use. Thank you!

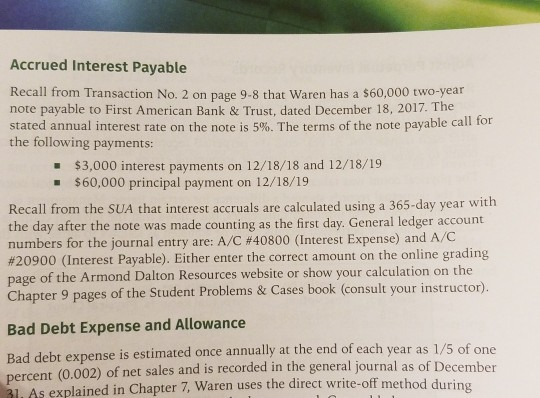

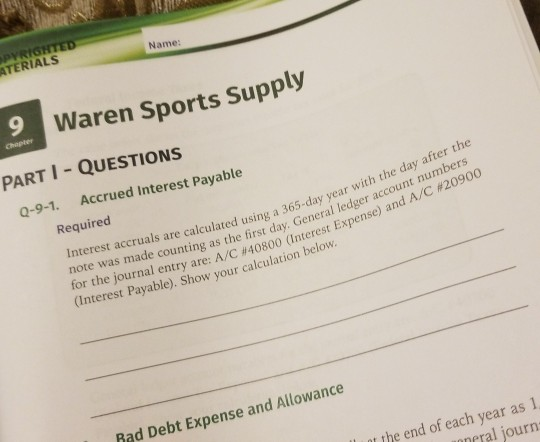

Accrued Interest Payable Recall from Transaction No. 2 on page 9-8 that Waren has a $60,000 two-year note payable to First American Bank & Trust, dated December 18, 2017. The stated annual interest rate on the note is 5%. The terms of the note payable call for the following payments: $3,000 interest payments on 12/18/18 and 12/18/19 $60,000 principal payment on 12/18/19 Recall from the SUA that interest accruals are calculated using a 365-day year with the day after the note was made counting as the first day. General ledger account numbers for the journal entry are: A/C #40800 (Interest Expense) and A/C #20900 (Interest Payable). Either enter the correct amount on the online grading page of the Armond Dalton Resources website or show your calculation on the Chapter 9 pages of the Student Problems & Cases book (consult your instructor). Bad Debt Expense and Allowance Bad debt expense is estimated once annually at the end of each year as 1/5 of one percent (0.002) of net sales and is recorded in the general journal as of December 31. As explained in Chapter 7, Waren uses the direct write-off method during Name: PYRIGHTED ATERIALS 9 Waren Sports Supply Chapter ountarter S PARTI - QUESTIONS Q-9-1. Accrued Interest Payable Required Interest accruals are calculated using a 365 note was made counting as the first day. General for the journal entry are: A/C #40800 (interest (Interest Payable). Show your calculation below. ing a 365-day year with the day after the ay. General ledger account numbers (Interest Expense) and A/C #20900 Bad Debt Expense and Allowance at the end of each year as 1 uneral journStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started