Answered step by step

Verified Expert Solution

Question

1 Approved Answer

it pays a $35 coupon every 6 months). Bond D is scheduled to mature in 9 years and has a price of $1,140. It is

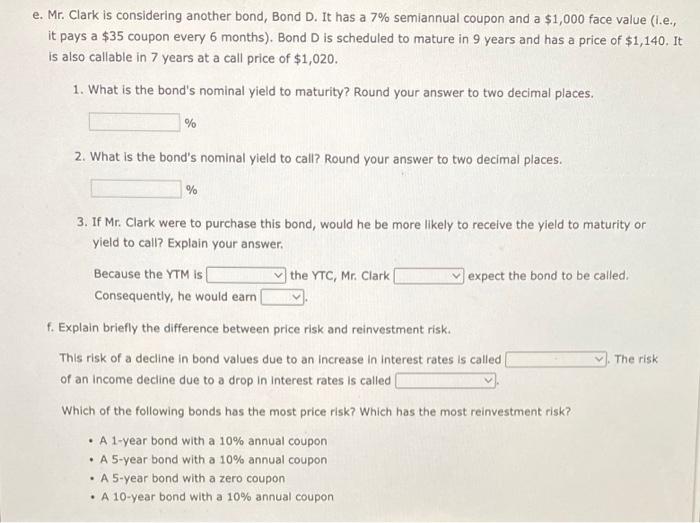

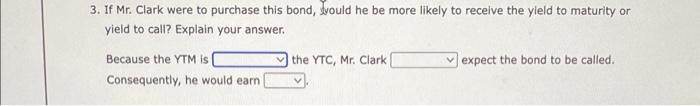

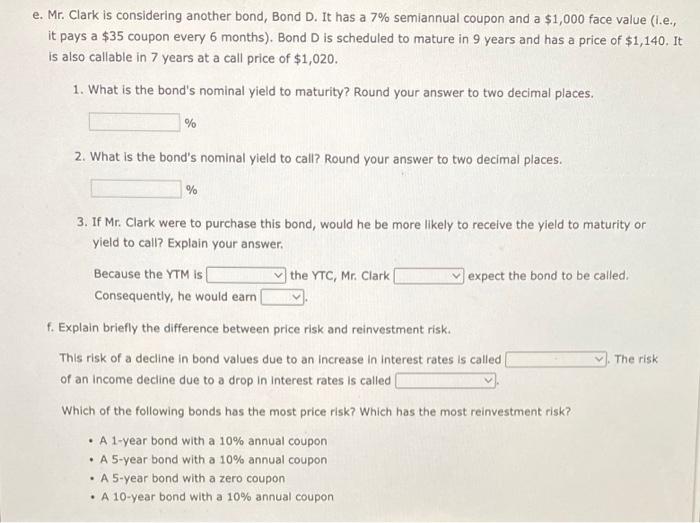

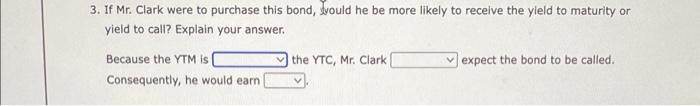

it pays a $35 coupon every 6 months). Bond D is scheduled to mature in 9 years and has a price of $1,140. It is also callable in 7 years at a call price of $1,020. 1. What is the bond's nominal yield to maturity? Round your answer to two decimal places. % 2. What is the bond's nominal yield to call? Round your answer to two decimal places. % 3. If Mr. Clark were to purchase this bond, would he be more likely to receive the yield to maturity or yield to call? Explain your answer. Because the YTM is the YTC, Mr. Clark expect the bond to be called. Consequently, he would earn Explain briefly the difference between price risk and reinvestment risk. This risk of a decline in bond values due to an increase in interest rates is called The risk of an income decline due to a drop in interest rates is called Which of the following bonds has the most price risk? Which has the most reinvestment risk? - A 1-year bond with a 10\% annual coupon - A 5-year bond with a 10\% annual coupon - A 5-year bond with a zero coupon 3. If Mr. Clark were to purchase this bond, dyould he be more likely to receive the yield to maturity or yield to call? Explain your answer. Because the YTM is the YTC, Mr. Clark expect the bond to be called. Consequently, he would earn

it pays a $35 coupon every 6 months). Bond D is scheduled to mature in 9 years and has a price of $1,140. It is also callable in 7 years at a call price of $1,020. 1. What is the bond's nominal yield to maturity? Round your answer to two decimal places. % 2. What is the bond's nominal yield to call? Round your answer to two decimal places. % 3. If Mr. Clark were to purchase this bond, would he be more likely to receive the yield to maturity or yield to call? Explain your answer. Because the YTM is the YTC, Mr. Clark expect the bond to be called. Consequently, he would earn Explain briefly the difference between price risk and reinvestment risk. This risk of a decline in bond values due to an increase in interest rates is called The risk of an income decline due to a drop in interest rates is called Which of the following bonds has the most price risk? Which has the most reinvestment risk? - A 1-year bond with a 10\% annual coupon - A 5-year bond with a 10\% annual coupon - A 5-year bond with a zero coupon 3. If Mr. Clark were to purchase this bond, dyould he be more likely to receive the yield to maturity or yield to call? Explain your answer. Because the YTM is the YTC, Mr. Clark expect the bond to be called. Consequently, he would earn

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started