it says my answer still not complete.

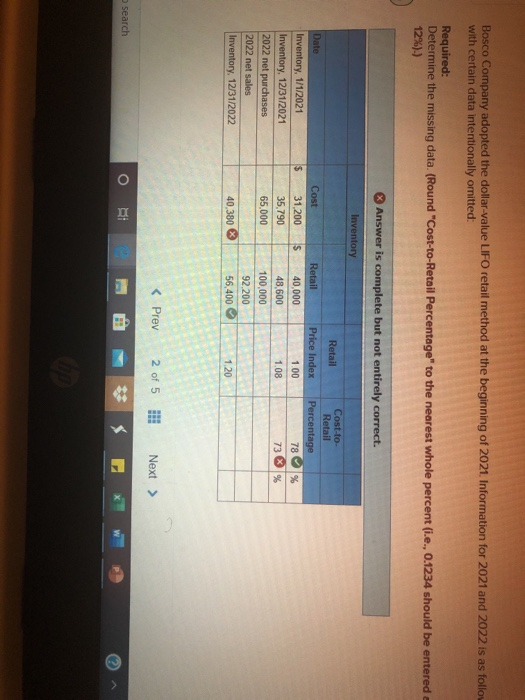

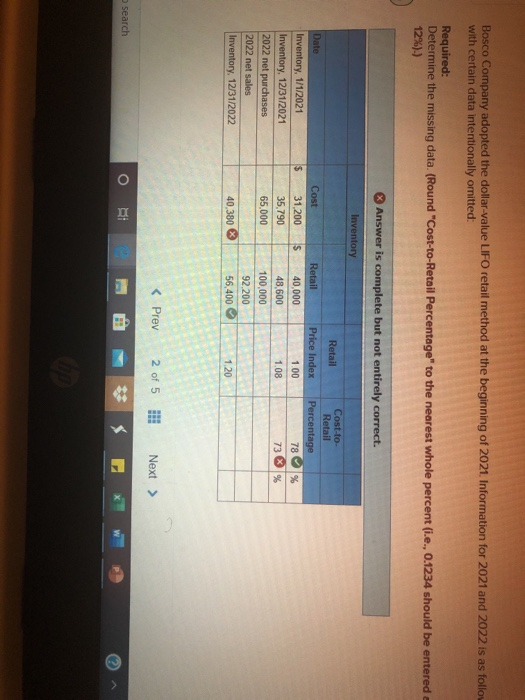

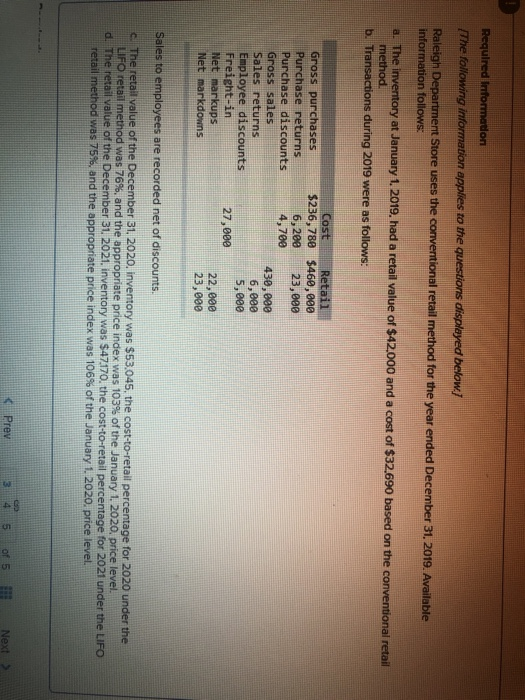

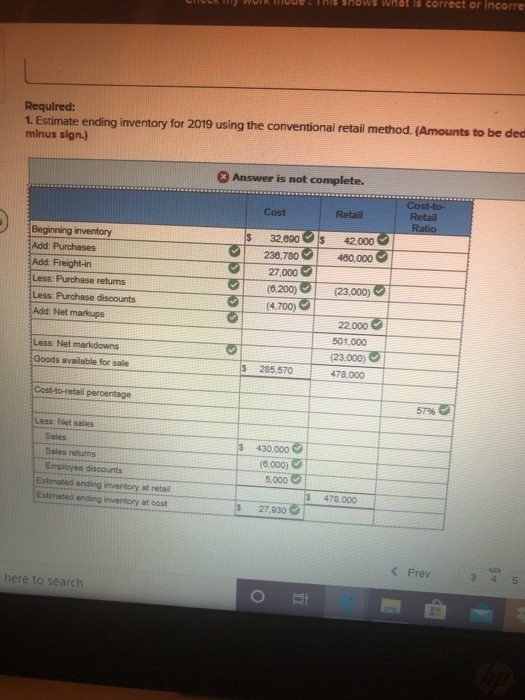

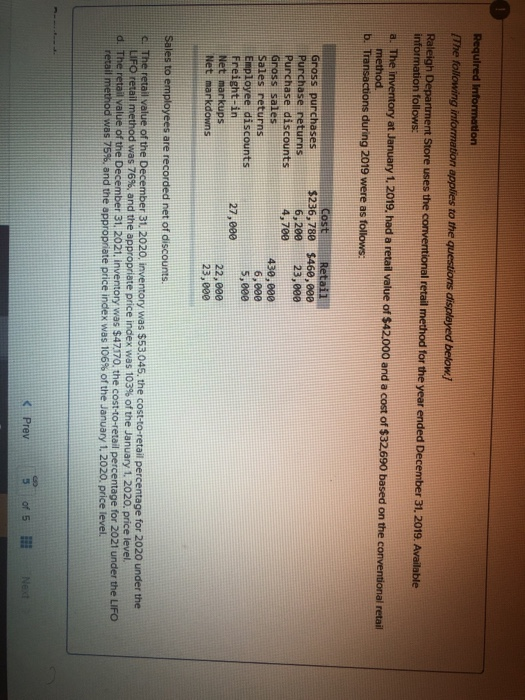

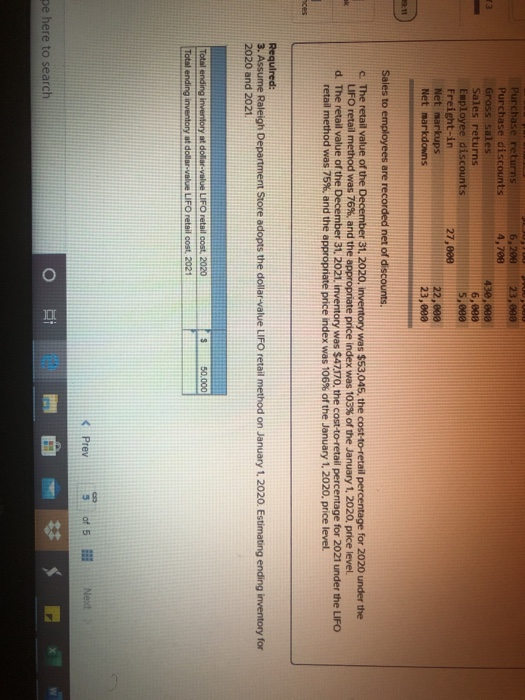

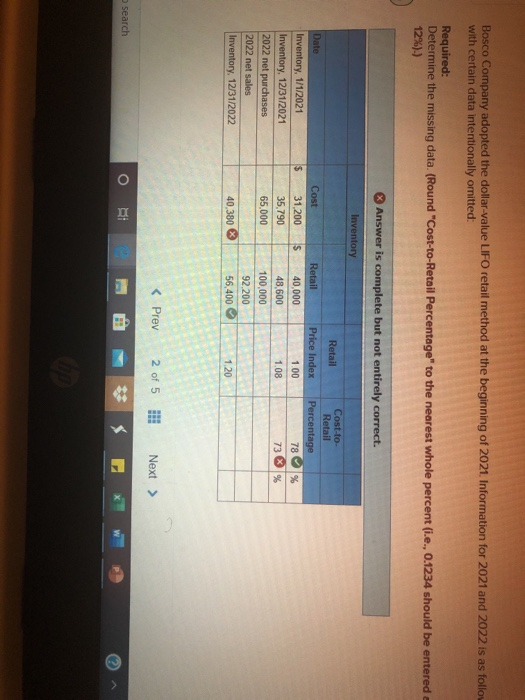

Bosco Company adopted the dollar-value LIFO retail method at the beginning of 2021. Information for 2021 and 2022 is as follo with certain data intentionally omitted: Required: Determine the missing data (Round "Cost-to-Retail Percentage" to the nearest whole percent (ie., 0.1234 should be entered 12%).) Answer is complete but not entirely correct. Inventory Date Inventory, 1/1/2021 Inventory, 12/31/2021 2022 net purchases 2022 net sales Inventory, 12/31/2022 Cost 31,200 35,790 65,000 $ Retail Price Index 1.00 1.08 Retail 40,000 48,600 100.000 92,200 56.400 56.400 Cost-to- Retail Percentage 78 73 % % 40,380 X 1 1.20 search Required Information The following information applies to the questions displayed below.) Raleigh Department Store uses the conventional retail method for the year ended December 31, 2019. Available information follows: a. The inventory at January 1, 2019, had a retail value of $42,000 and a cost of $32,690 based on the conventional retail method. b. Transactions during 2019 were as follows: Gross purchases Purchase returns Purchase discounts Gross sales Sales returns Employee discounts Freight-in Net markups Net markdowns Cost Retail $236,780 $460, 800 6,200 23,000 4,700 430,000 6,000 5,000 27,000 22,000 23,000 Sales to employees are recorded net of discounts. c. The retail value of the December 31, 2020, inventory was $53.045, the cost-to-retail percentage for 2020 under the LIFO retail method was 76%, and the appropriate price index was 103% of the January 1, 2020. price level d. The retail value of the December 31, 2021, inventory was $47,170, the cost-to-retail percentage for 2021 under the LIFO retail method was 75%, and the appropriate price index was 106% of the January 1, 2020. price level. Prev 3 4 5 of 5 Next > CIULA NI WUTA l e : Inis Snows what is correct or Incorre Required: 1. Estimate ending inventory for 2019 using the conventional retail method. (Amounts to be ded minus sign.) Answer is not complete. Cost Retail Cost to Retail Ratio 32 000 42000 Beginning inventory Add: Purchases Add: Freight-in Less: Purchase returns 238 78 480.000 SOCCO (23,000) Less Purchase discounts Add: Net markups (4.700) Less Net markdowns 22.000 501,000 (23.000) 478.000 Goods available for sale Cost-to-retail percentage Less: Net sales Sales rens Employee discounts 430,000 (6.000) 5.000 Estimated ending inventory Estimated ending inventory at cost 3 478 000 27.030 here to search