It says that some of the information in the table is wrong, please keep the same formatting so that it is easy to follow as I have seen some bad formatting which confused me further, thanks.

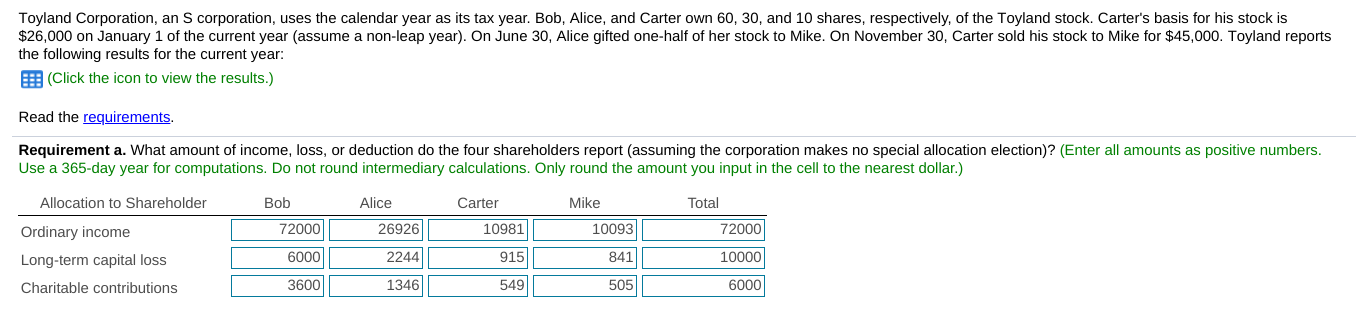

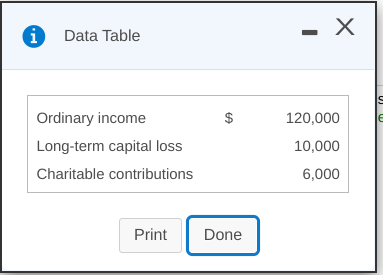

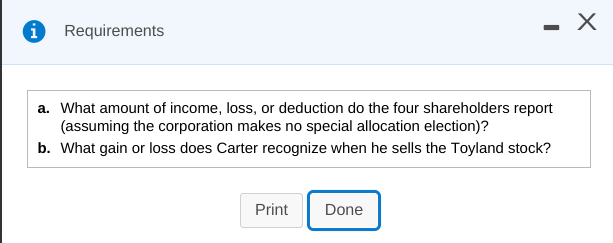

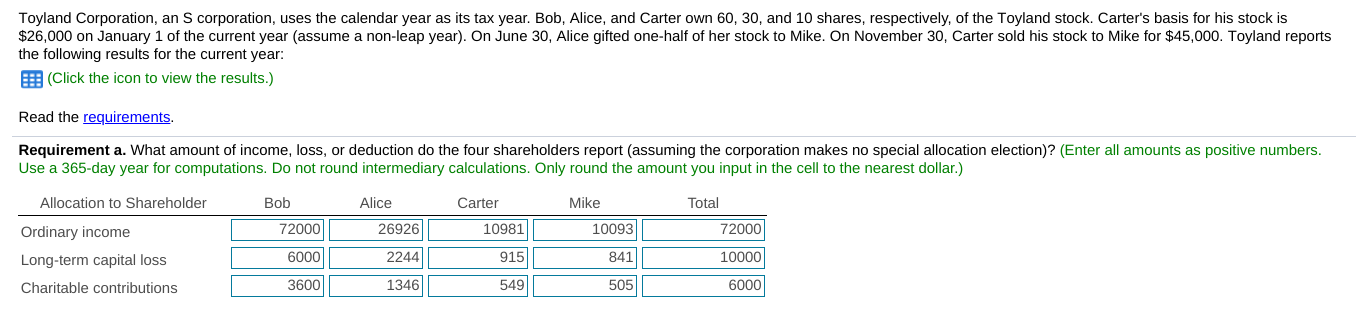

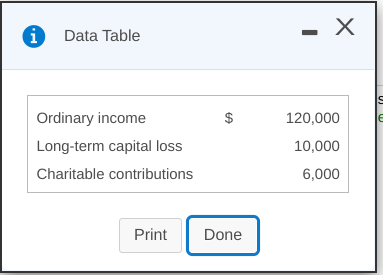

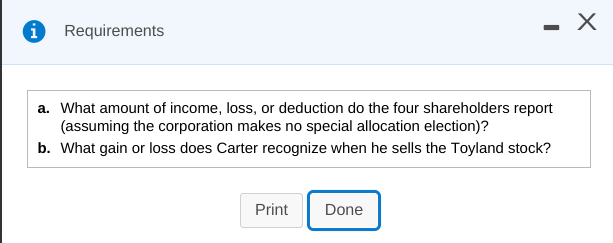

Toyland Corporation, an S corporation, uses the calendar year as its tax year. Bob, Alice, and Carter own 60, 30, and 10 shares, respectively, of the Toyland stock. Carter's basis for his stock is $26,000 on January 1 of the current year (assume a non-leap year). On June 30, Alice gifted one-half of her stock to Mike. On November 30, Carter sold his stock to Mike for $45,000. Toyland reports the following results for the current year: (Click the icon to view the results.) Read the requirements. Requirement a. What amount of income, loss, or deduction do the four shareholders report (assuming the corporation makes no special allocation election)? (Enter all amounts as positive numbers. Use a 365-day year for computations. Do not round intermediary calculations. Only round the amount you input in the cell to the nearest dollar.) Allocation to Shareholder Bob Alice Carter Mike Total 72000 26926 10981 10093 72000 Ordinary income Long-term capital loss Charitable contributions 6000 2244 915 841 10000 3600 1346 549 505 6000 1 . Data Table $ 120,000 le Ordinary income Long-term capital loss Charitable contributions 10,000 6,000 Print Done -X Requirements a. What amount of income, loss, or deduction do the four shareholders report (assuming the corporation makes no special allocation election)? b. What gain or loss does Carter recognize when he sells the Toyland stock? Print Done Toyland Corporation, an S corporation, uses the calendar year as its tax year. Bob, Alice, and Carter own 60, 30, and 10 shares, respectively, of the Toyland stock. Carter's basis for his stock is $26,000 on January 1 of the current year (assume a non-leap year). On June 30, Alice gifted one-half of her stock to Mike. On November 30, Carter sold his stock to Mike for $45,000. Toyland reports the following results for the current year: (Click the icon to view the results.) Read the requirements. Requirement a. What amount of income, loss, or deduction do the four shareholders report (assuming the corporation makes no special allocation election)? (Enter all amounts as positive numbers. Use a 365-day year for computations. Do not round intermediary calculations. Only round the amount you input in the cell to the nearest dollar.) Allocation to Shareholder Bob Alice Carter Mike Total 72000 26926 10981 10093 72000 Ordinary income Long-term capital loss Charitable contributions 6000 2244 915 841 10000 3600 1346 549 505 6000 1 . Data Table $ 120,000 le Ordinary income Long-term capital loss Charitable contributions 10,000 6,000 Print Done -X Requirements a. What amount of income, loss, or deduction do the four shareholders report (assuming the corporation makes no special allocation election)? b. What gain or loss does Carter recognize when he sells the Toyland stock? Print Done