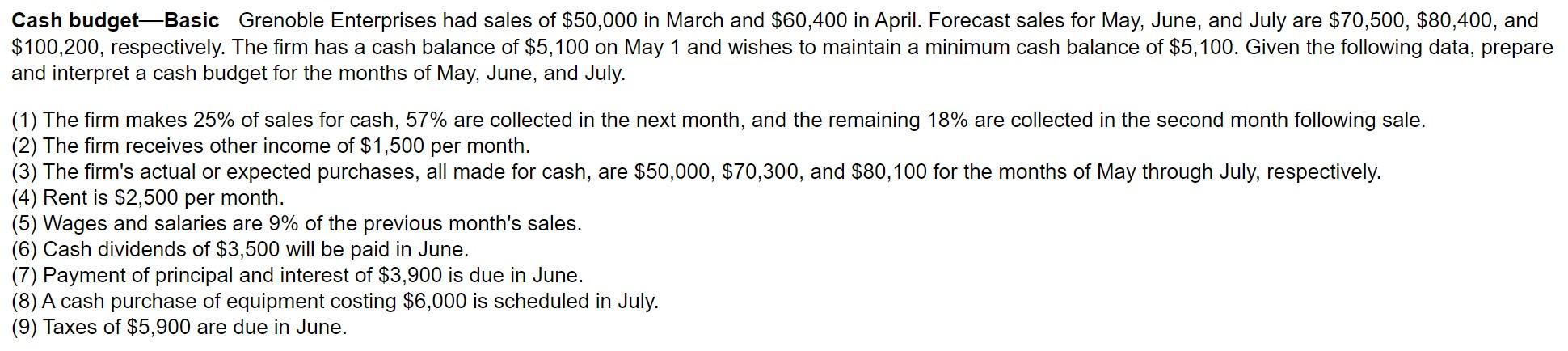

Question

It should look like this. March April May June July in the columns The rows will have the following Sales Cash Sales (30%) Lag 1

It should look like this. March April May June July in the columns The rows will have the following Sales Cash Sales (30%) Lag 1 month (65%) Lag 2 months (5%) Other income Total Cash receipts with totals for MAY June and July

The next table will have March April May June JULY in columns The rows will have the following Purchases Rent Wages and salaries Dividends Principle and Interest Purchase of new equipment Taxes due Total cash disbursements

The next table will have March April June July The rows will have the following Net cash flow Add: Beginning cash Ending Cash Minimum cash Requiring total financing (notes payable) Excess cash balance (marketable securities)

Lastly how much a firm should establish for a line of credit For example The firm should establish a credit line of at least $40,125, but may need to secure three to four times this amount based on scenario analysis

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started