Please provide work and formulas used, thanks!

Please provide work and formulas used, thanks!

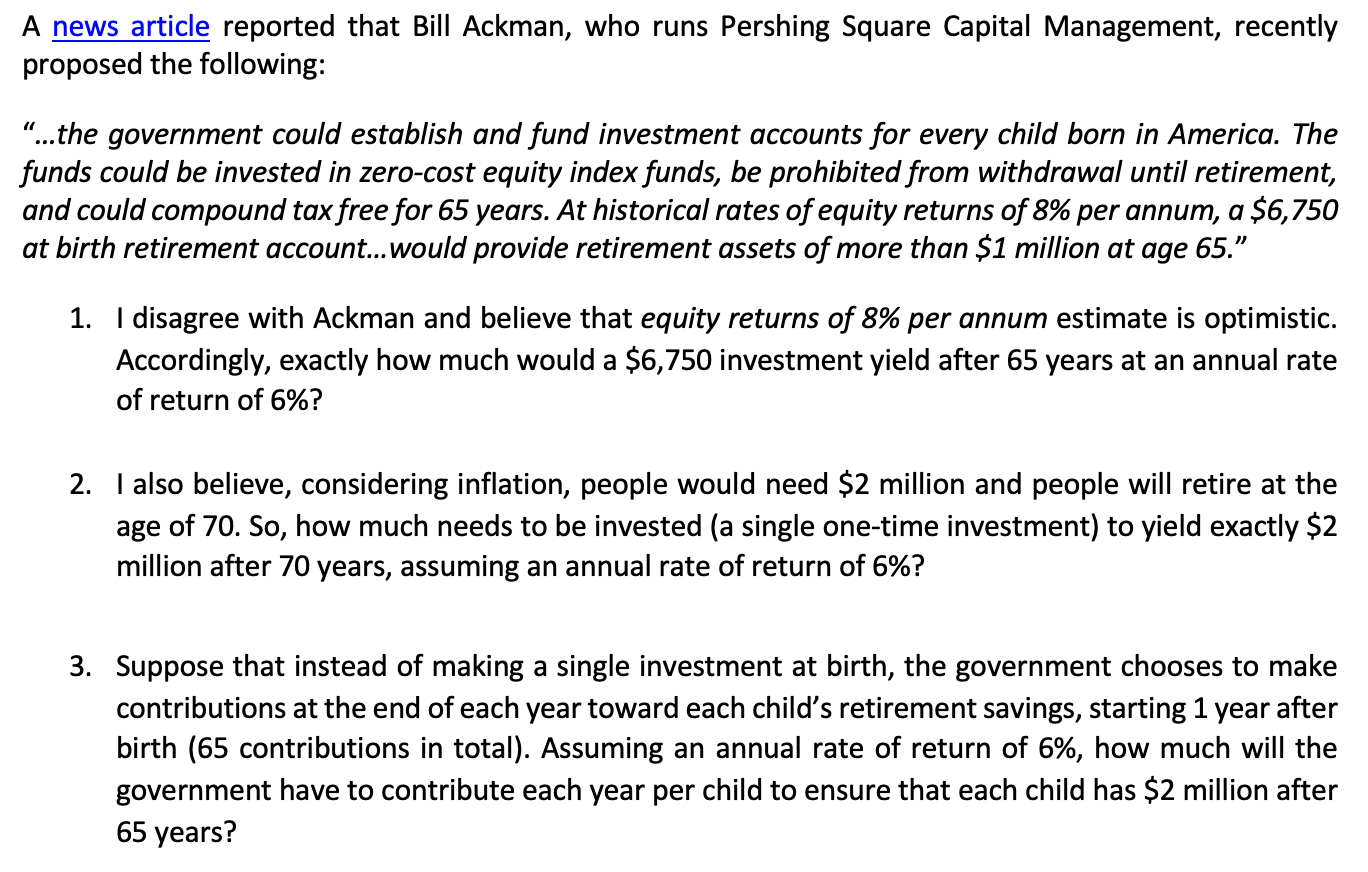

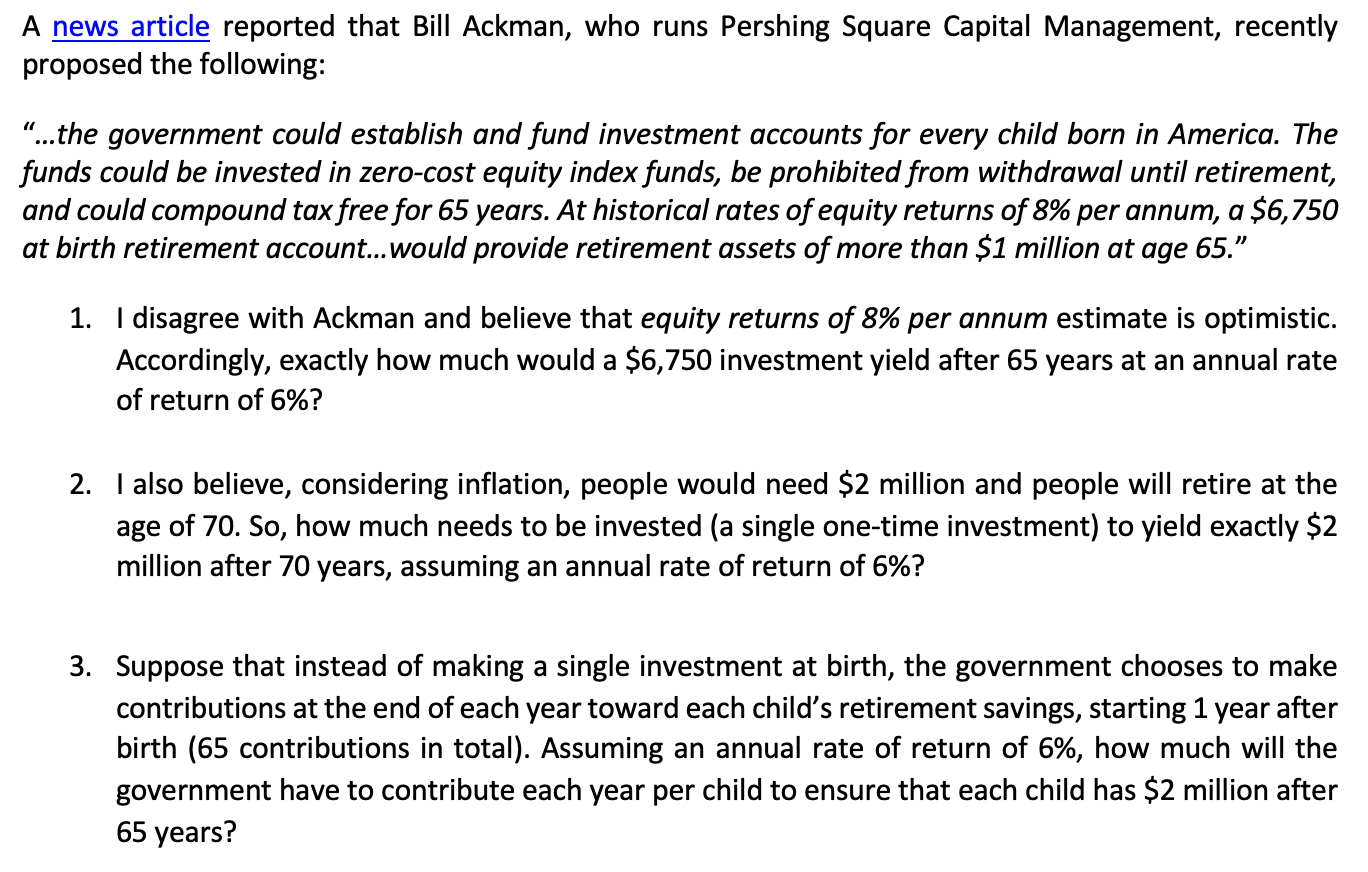

A news article reported that Bill Ackman, who runs Pershing Square Capital Management, recently proposed the following: "...the government could establish and fund investment accounts for every child born in America. The funds could be invested in zero-cost equity index funds, be prohibited from withdrawal until retirement, and could compound tax free for 65 years. At historical rates of equity returns of 8% per annum, a $6,750 at birth retirement account...would provide retirement assets of more than $1 million at age 65. 1. I disagree with Ackman and believe that equity returns of 8% per annum estimate is optimistic. Accordingly, exactly how much would a $6,750 investment yield after 65 years at an annual rate of return of 6%? 2. I also believe, considering inflation, people would need $2 million and people will retire at the age of 70. So, how much needs to be invested (a single one-time investment) to yield exactly $2 million after 70 years, assuming an annual rate of return of 6%? 3. Suppose that instead of making a single investment at birth, the government chooses to make contributions at the end of each year toward each child's retirement savings, starting 1 year after birth (65 contributions in total). Assuming an annual rate of return of 6%, how much will the government have to contribute each year per child to ensure that each child has $2 million after 65 years? A news article reported that Bill Ackman, who runs Pershing Square Capital Management, recently proposed the following: "...the government could establish and fund investment accounts for every child born in America. The funds could be invested in zero-cost equity index funds, be prohibited from withdrawal until retirement, and could compound tax free for 65 years. At historical rates of equity returns of 8% per annum, a $6,750 at birth retirement account...would provide retirement assets of more than $1 million at age 65. 1. I disagree with Ackman and believe that equity returns of 8% per annum estimate is optimistic. Accordingly, exactly how much would a $6,750 investment yield after 65 years at an annual rate of return of 6%? 2. I also believe, considering inflation, people would need $2 million and people will retire at the age of 70. So, how much needs to be invested (a single one-time investment) to yield exactly $2 million after 70 years, assuming an annual rate of return of 6%? 3. Suppose that instead of making a single investment at birth, the government chooses to make contributions at the end of each year toward each child's retirement savings, starting 1 year after birth (65 contributions in total). Assuming an annual rate of return of 6%, how much will the government have to contribute each year per child to ensure that each child has $2 million after 65 years

Please provide work and formulas used, thanks!

Please provide work and formulas used, thanks!