Answered step by step

Verified Expert Solution

Question

1 Approved Answer

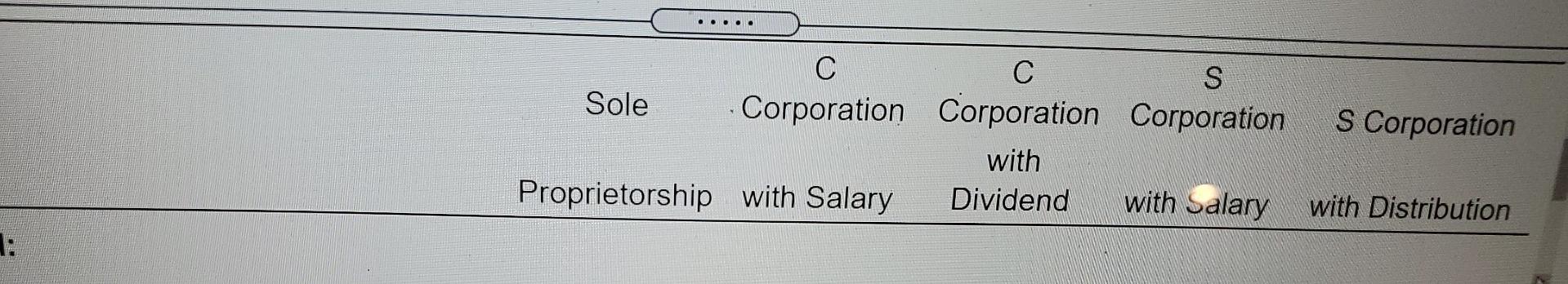

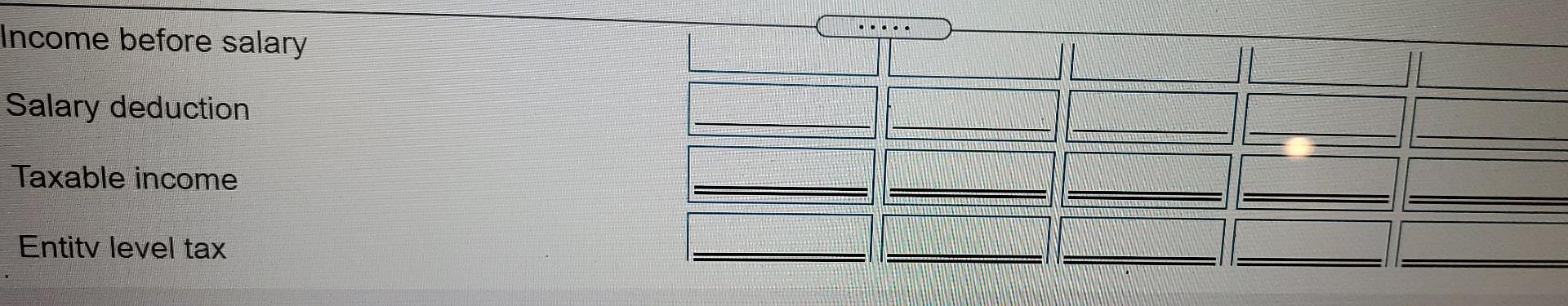

It will be for all entities for Sole Proprietorship, C Corp with salary, C Corp with Dividend, S Corp with Salary, and S Corp with

It will be for all entities for Sole Proprietorship, C Corp with salary, C Corp with Dividend, S Corp with Salary, and S Corp with distribution has to be answered for under the Entity Level please see the pictures. Thanks for your help.

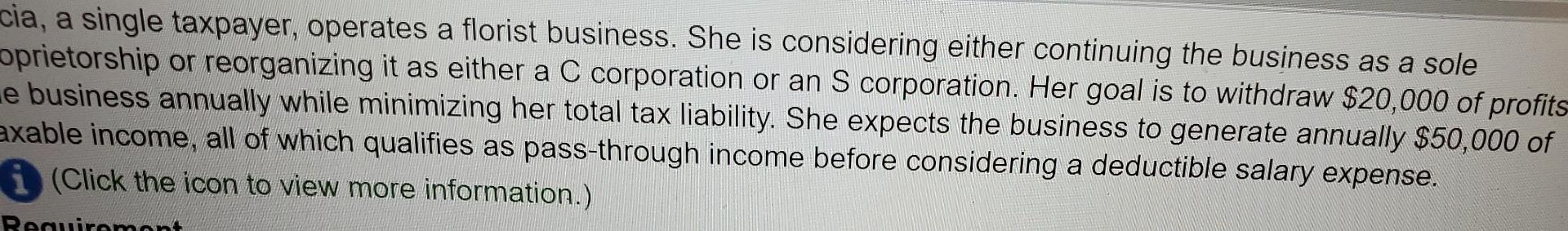

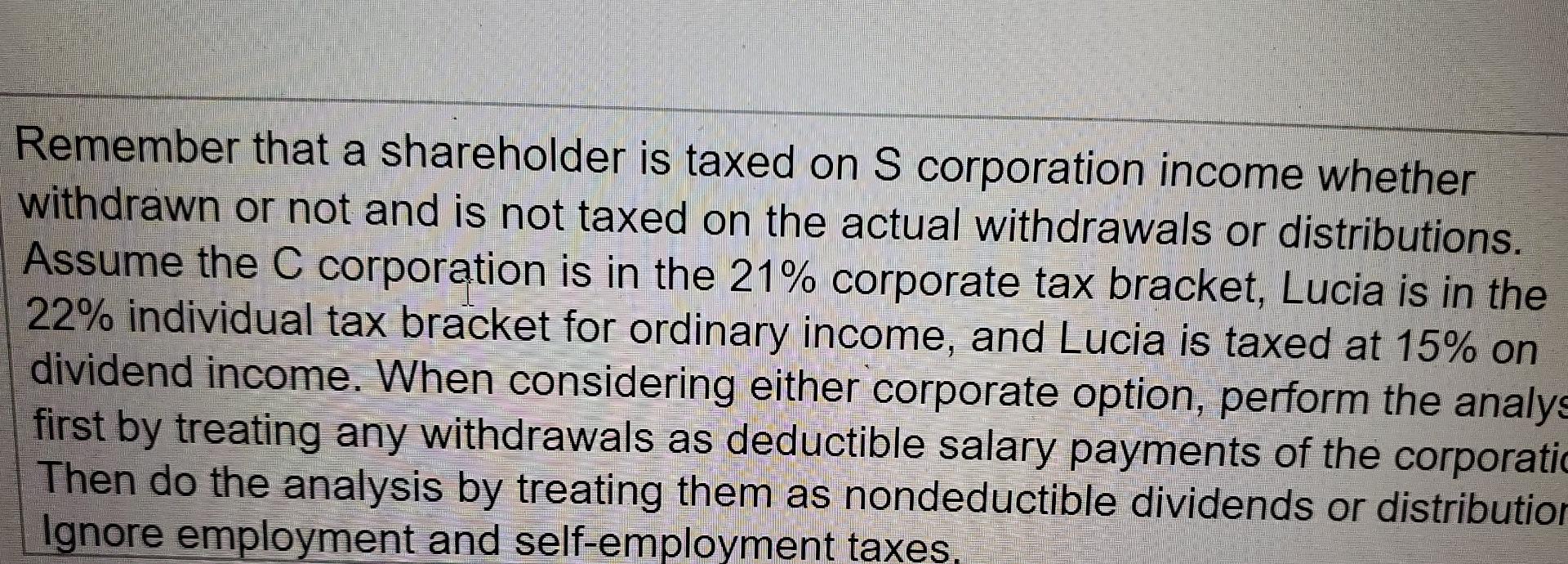

cia, a single taxpayer, operates a florist business. She is considering either continuing the business as a sole oprietorship or reorganizing it as either a C corporation or an S corporation. Her goal is to withdraw $20,000 of profits e business annually while minimizing her total tax liability. She expects the business to generate annually $50,000 of exable income, all of which qualifies as pass-through income before considering a deductible salary expense. i (Click the icon to view more information.) Requirement a Remember that a shareholder is taxed on S corporation income whether withdrawn or not and is not taxed on the actual withdrawals or distributions. Assume the C corporation is in the 21% corporate tax bracket, Lucia is in the 22% individual tax bracket for ordinary income, and Lucia is taxed at 15% on dividend income. When considering either corporate option, perform the analys first by treating any withdrawals as deductible salary payments of the corporatic Then do the analysis by treating them as nondeductible dividends or distribution Ignore employment and self-employment taxes, . . . . . S Sole Corporation Corporation Corporation with Proprietorship with Salary Dividend with Salary S Corporation with Distribution 1: ODGO. Income before salary Salary deduction Taxable income Entity level tax cia, a single taxpayer, operates a florist business. She is considering either continuing the business as a sole oprietorship or reorganizing it as either a C corporation or an S corporation. Her goal is to withdraw $20,000 of profits e business annually while minimizing her total tax liability. She expects the business to generate annually $50,000 of exable income, all of which qualifies as pass-through income before considering a deductible salary expense. i (Click the icon to view more information.) Requirement a Remember that a shareholder is taxed on S corporation income whether withdrawn or not and is not taxed on the actual withdrawals or distributions. Assume the C corporation is in the 21% corporate tax bracket, Lucia is in the 22% individual tax bracket for ordinary income, and Lucia is taxed at 15% on dividend income. When considering either corporate option, perform the analys first by treating any withdrawals as deductible salary payments of the corporatic Then do the analysis by treating them as nondeductible dividends or distribution Ignore employment and self-employment taxes, . . . . . S Sole Corporation Corporation Corporation with Proprietorship with Salary Dividend with Salary S Corporation with Distribution 1: ODGO. Income before salary Salary deduction Taxable income Entity level taxStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started