Answered step by step

Verified Expert Solution

Question

1 Approved Answer

It will be grateful by providing assistance to question 2 and 5 from the image above (with worked solutions) oll willpany BP just reported earnings

It will be grateful by providing assistance to question 2 and 5 from the image above (with worked solutions)

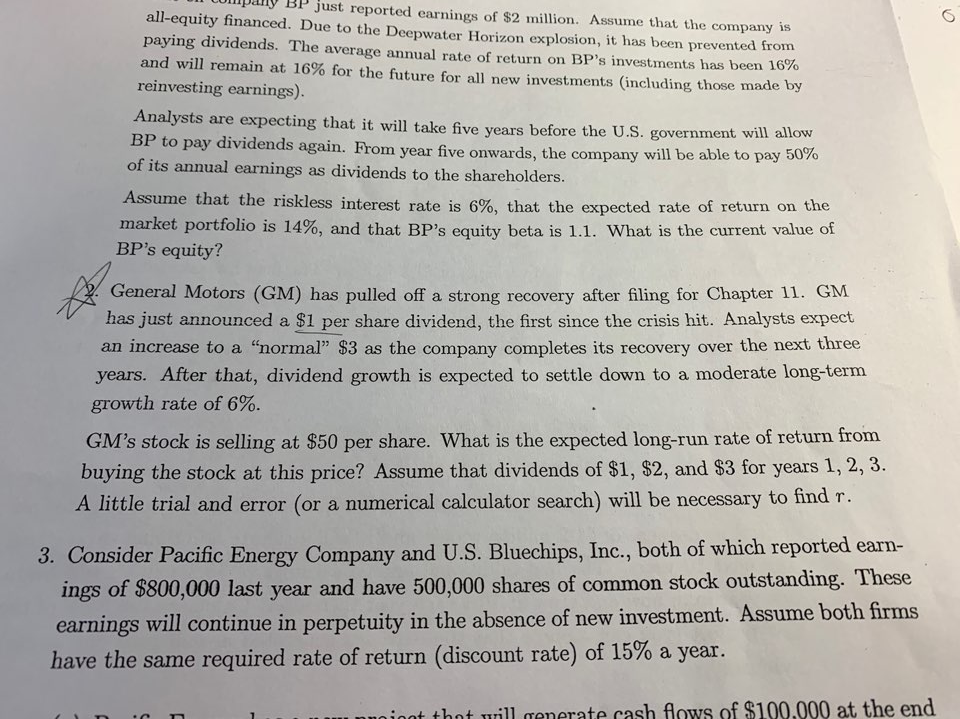

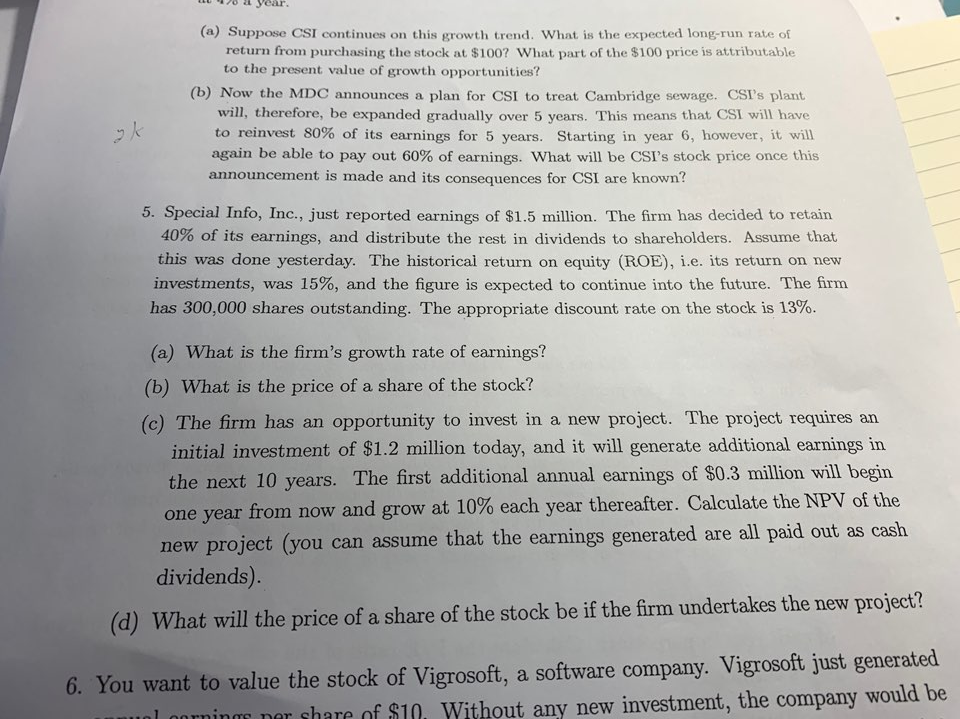

oll willpany BP just reported earnings of $2 million. Assume that the company is all-equity financed. Due to the Deepwater Horizon explosion, it has been prevented from paying dividends. The average annual rate of return on BP's investments has been 16% and will remain at 16% for the future for all new investments (including those made by reinvesting earnings). Analysts are expecting that it will take five years before the U.S. government will allow BP to pay dividends again. From year five onwards, the company will be able to pay 50% of its annual earnings as dividends to the shareholders. Assume that the riskless interest rate is 6%, that the expected rate of return on the market portfolio is 14%, and that BP's equity beta is 1.1. What is the current value of BP's equity? General Motors (GM) has pulled off a strong recovery after filing for Chapter 11. GM has just announced a $1 per share dividend, the first since the crisis hit. Analysts expect an increase to a "normal" $3 as the company completes its recovery over the next three years. After that, dividend growth is expected to settle down to a moderate long-term growth rate of 6%. GM's stock is selling at $50 per share. What is the expected long-run rate of return from buying the stock at this price? Assume that dividends of $1, $2, and $3 for years 1, 2, 3. A little trial and error (or a numerical calculator search) will be necessary to find r. 3. Consider Pacific Energy Company and U.S. Bluechips, Inc., both of which reported earn- ings of $800,000 last year and have 500,000 shares of common stock outstanding. These earnings will continue in perpetuity in the absence of new investment. Assume both firms have the same required rate of return (discount rate) of 15% a year. nuninnt that will generate cash flows of $100.000 at the end . a year. (a) Suppose CSI continues on this growth trend. What is the expected long-run rate of return from purchasing the stock at $100? What part of the $100 price is attributable to the present value of growth opportunities? (b) Now the MDC announces a plan for CSI to treat Cambridge sewage. CSI's plant will, therefore, be expanded gradually over 5 years. This means that CSI will have to reinvest 80% of its earnings for 5 years. Starting in year 6, however, it will again be able to pay out 60% of earnings. What will be CSI's stock price once this announcement is made and its consequences for CSI are known? 5. Special Info, Inc., just reported earnings of $1.5 million. The firm has decided to retain 40% of its earnings, and distribute the rest in dividends to shareholders. Assume that this was done yesterday. The historical return on equity (ROE), i.e. its return on new investments, was 15%, and the figure is expected to continue into the future. The firm has 300,000 shares outstanding. The appropriate discount rate on the stock is 13%. (a) What is the firm's growth rate of earnings? (b) What is the price of a share of the stock? (c) The firm has an opportunity to invest in a new project. The project requires an initial investment of $1.2 million today, and it will generate additional earnings in the next 10 years. The first additional annual earnings of $0.3 million will begin one year from now and grow at 10% each year thereafter. Calculate the NPV of the new project (you can assume that the earnings generated are all paid out as cash dividends). d) What will the price of a share of the stock be if the firm undertakes the new project? 6. You want to value the stock of Vigrosoft, a software company. Vigrosoft just generated morning nar share of $10. Without any new investment, the company would beStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started