Answered step by step

Verified Expert Solution

Question

1 Approved Answer

It would be greatly appreciated the support on this questions Consolidation subsequent to date of acquisition-upstream intercompany inventory sale-tquity method with noncontrolling interest, AAP, and

It would be greatly appreciated the support on this questions

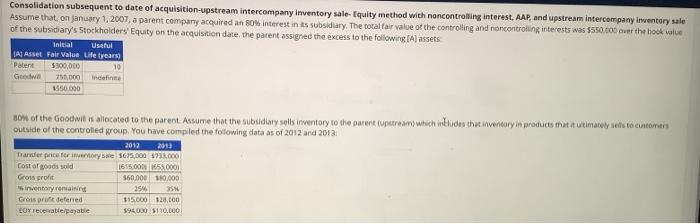

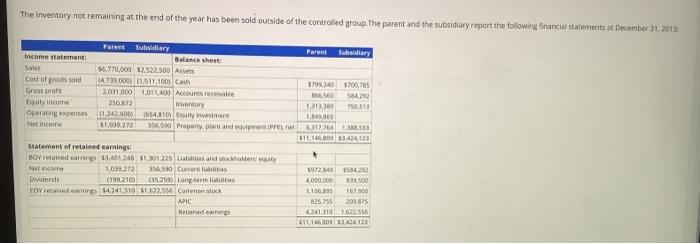

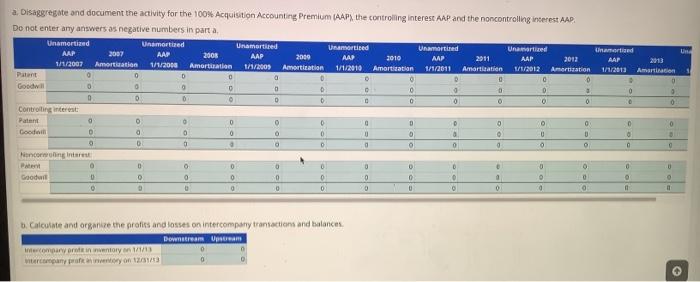

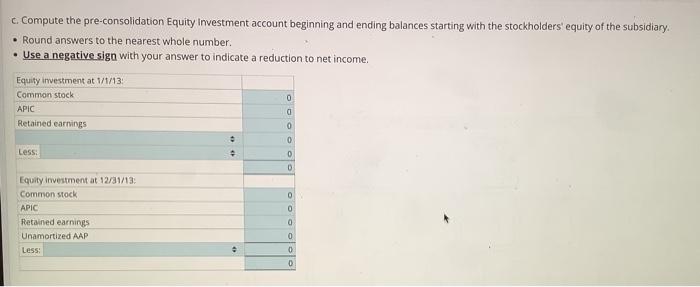

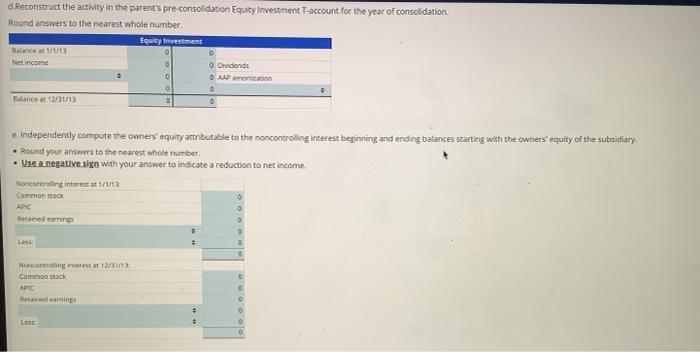

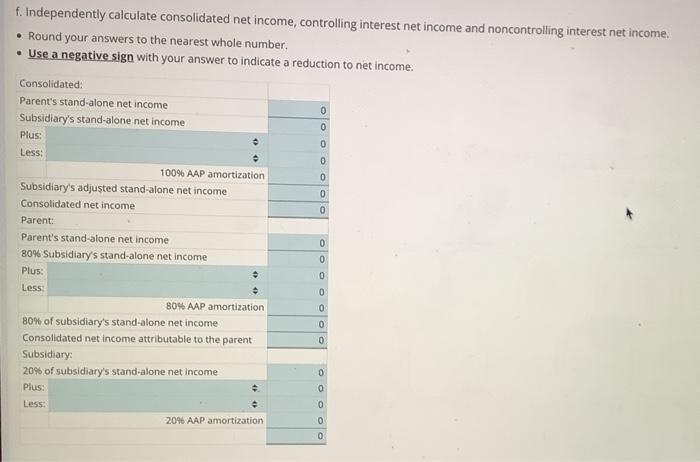

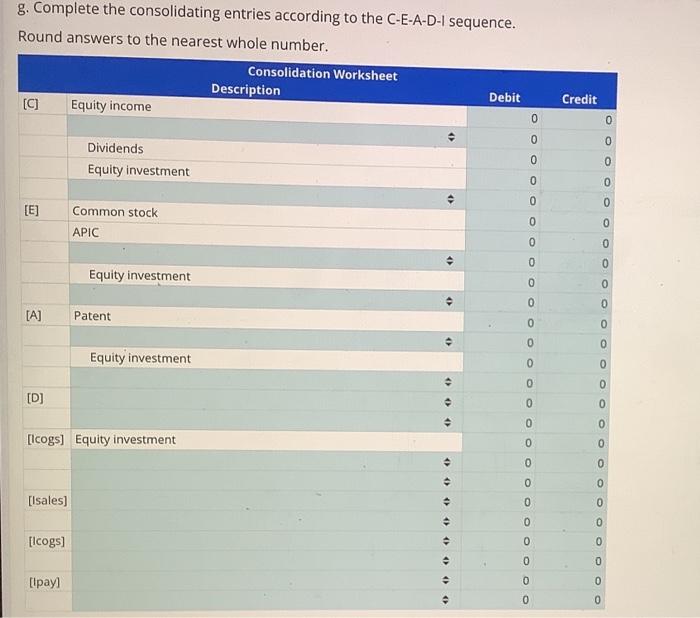

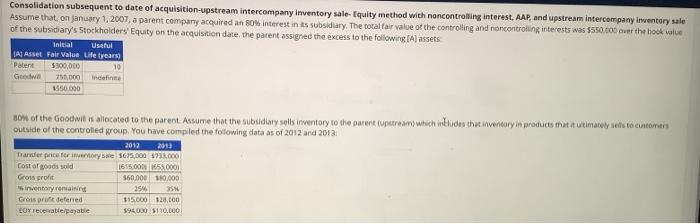

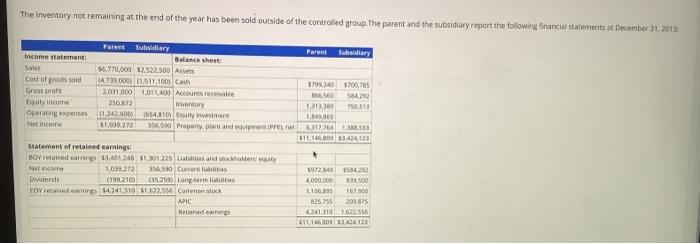

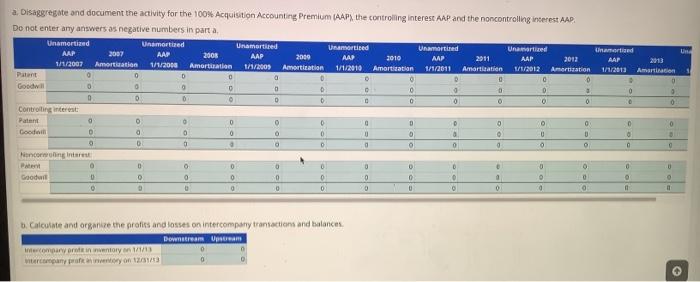

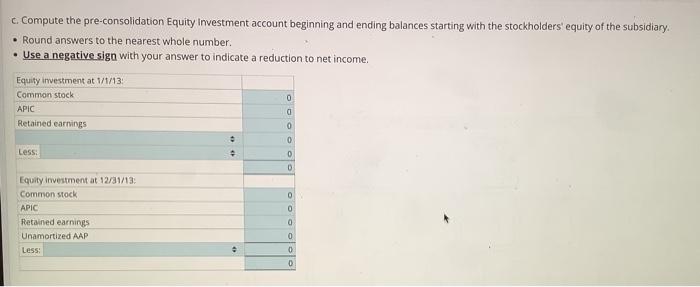

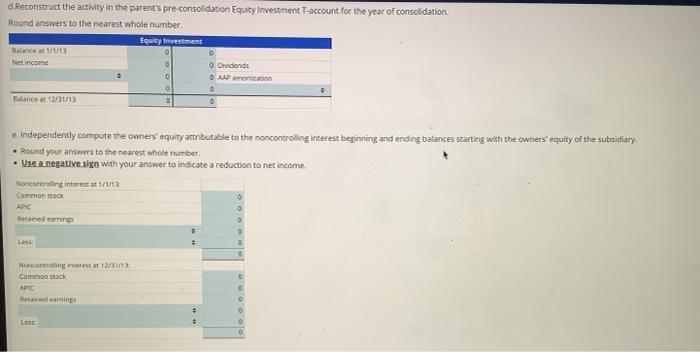

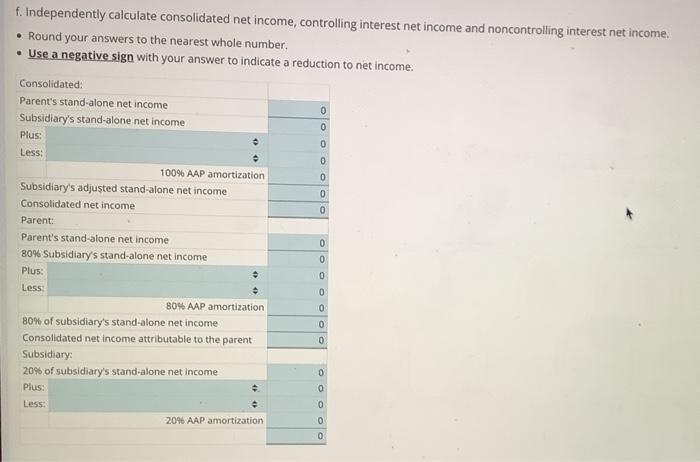

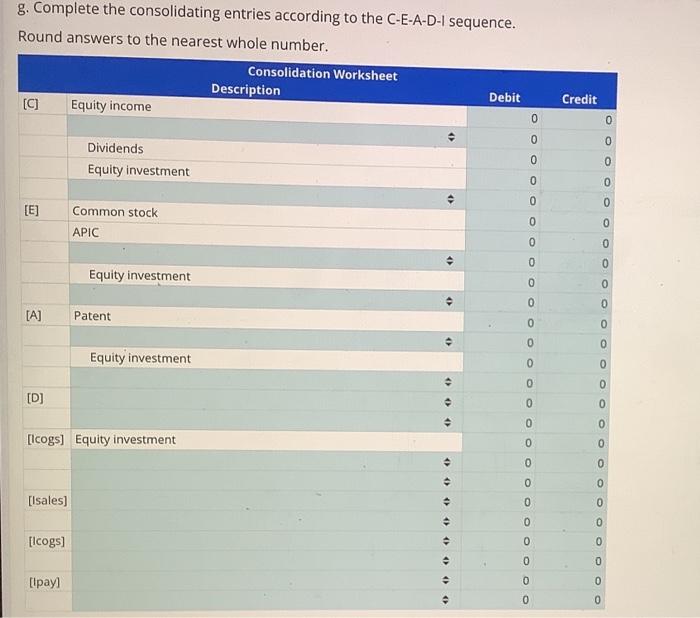

Consolidation subsequent to date of acquisition-upstream intercompany inventory sale-tquity method with noncontrolling interest, AAP, and upstream intercompany inventory se Assume that on jansary 1, 2007, a parent company acquired an 80% interest in is subsidary. The corat fair value ot the controlling and noncontroaing interests was 5550 .cos orer the hook igite of the subsidiary's Stockholders' Equity on the acquistion date, the parent assigned the excess to the following [A] assets: outside of the controlied groep. You have compiled the folowing data as of 2012 and 2013 . The inventocy not remaining at the end of the year has beeo sold outside of the controlled group. The parent and the subsidiaryraport the following finarkiat statements at December 3t, aolz. a. Oisaggregate and document the activity for the 100\% Acquisitgn Accounting Premium (AAP) the controling interest AAP and the noncontrolling inserest AAD? Do not enter any answers as negative numbers in part a, b. Calcukate and organize the profiss and losses on intercompary transacticns and balances. c. Compute the pre-consolidation Equity Investment account beginning and ending balances starting with the stockholders' equity of the subsidiary. - Round answers to the nearest whole number. - Use a negativesign with your answer to indicate a reduction to net income. d. Reconstruct the activity in the parent's pre-consol dation Equity Investment T-account for the year of consolidation. Round ansaers to the nearest whole nimmber. 2. Independently compute the owners' equity atmibutable to the nonconcroling interest beginning and ending balances starting with the owners' equity of the subsidiary: - Round your answers to the nearest whole number. - Use anegative sign with your ansiwer to indicate a reduction to net income f. Independently calculate consolidated net income, controlling interest net income and noncontrolling interest net income - Round your answers to the nearest whole number. - Use a negative sign with your answer to indicate a reduction to net income. g. Complete the consolidating entries according to the C-E-A-D-I canuanro Consolidation subsequent to date of acquisition-upstream intercompany inventory sale-tquity method with noncontrolling interest, AAP, and upstream intercompany inventory se Assume that on jansary 1, 2007, a parent company acquired an 80% interest in is subsidary. The corat fair value ot the controlling and noncontroaing interests was 5550 .cos orer the hook igite of the subsidiary's Stockholders' Equity on the acquistion date, the parent assigned the excess to the following [A] assets: outside of the controlied groep. You have compiled the folowing data as of 2012 and 2013 . The inventocy not remaining at the end of the year has beeo sold outside of the controlled group. The parent and the subsidiaryraport the following finarkiat statements at December 3t, aolz. a. Oisaggregate and document the activity for the 100\% Acquisitgn Accounting Premium (AAP) the controling interest AAP and the noncontrolling inserest AAD? Do not enter any answers as negative numbers in part a, b. Calcukate and organize the profiss and losses on intercompary transacticns and balances. c. Compute the pre-consolidation Equity Investment account beginning and ending balances starting with the stockholders' equity of the subsidiary. - Round answers to the nearest whole number. - Use a negativesign with your answer to indicate a reduction to net income. d. Reconstruct the activity in the parent's pre-consol dation Equity Investment T-account for the year of consolidation. Round ansaers to the nearest whole nimmber. 2. Independently compute the owners' equity atmibutable to the nonconcroling interest beginning and ending balances starting with the owners' equity of the subsidiary: - Round your answers to the nearest whole number. - Use anegative sign with your ansiwer to indicate a reduction to net income f. Independently calculate consolidated net income, controlling interest net income and noncontrolling interest net income - Round your answers to the nearest whole number. - Use a negative sign with your answer to indicate a reduction to net income. g. Complete the consolidating entries according to the C-E-A-D-I canuanro

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started