It would help me if anyone can help solve this problem.

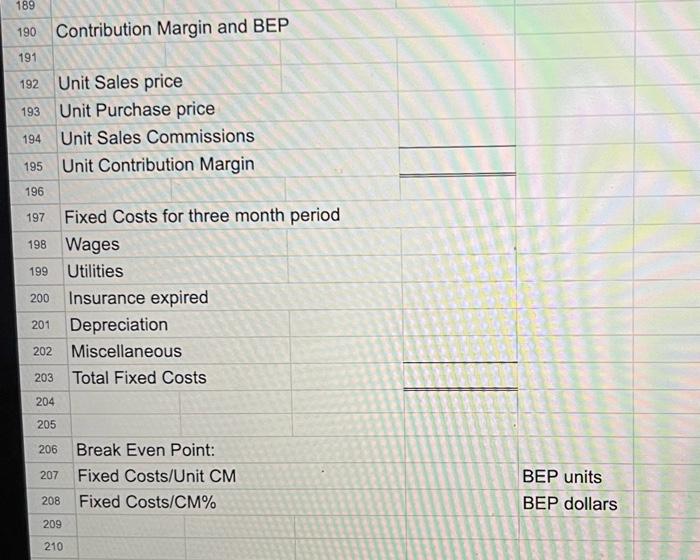

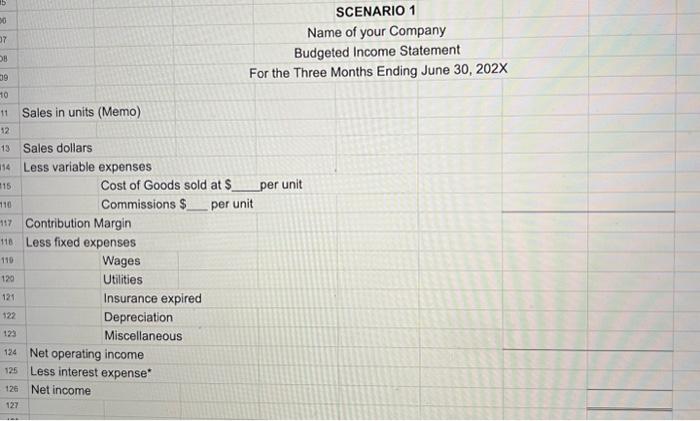

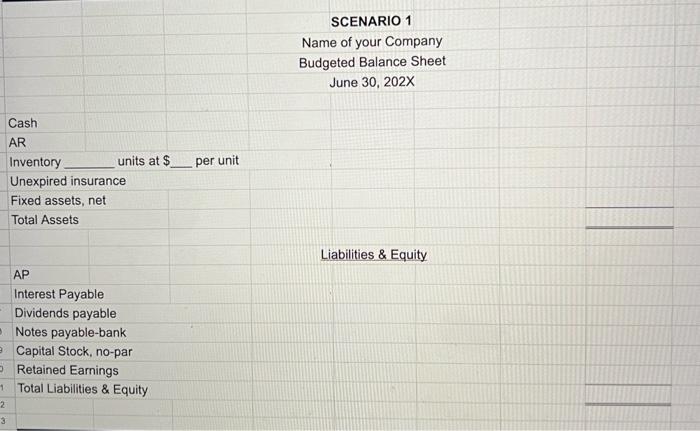

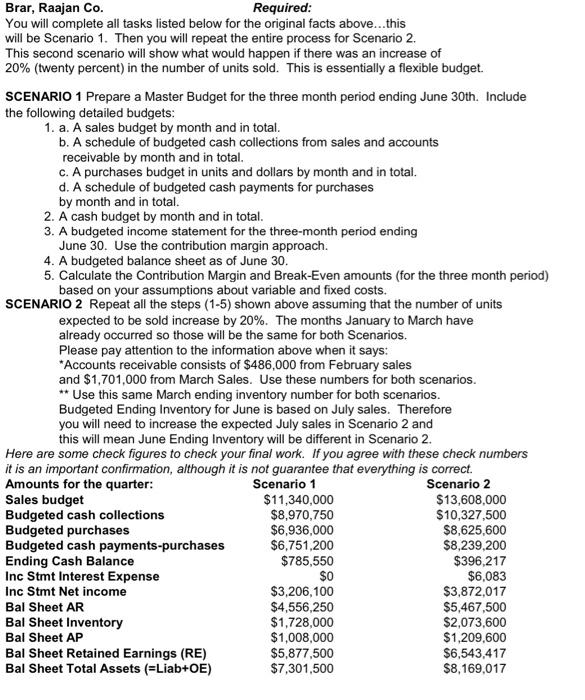

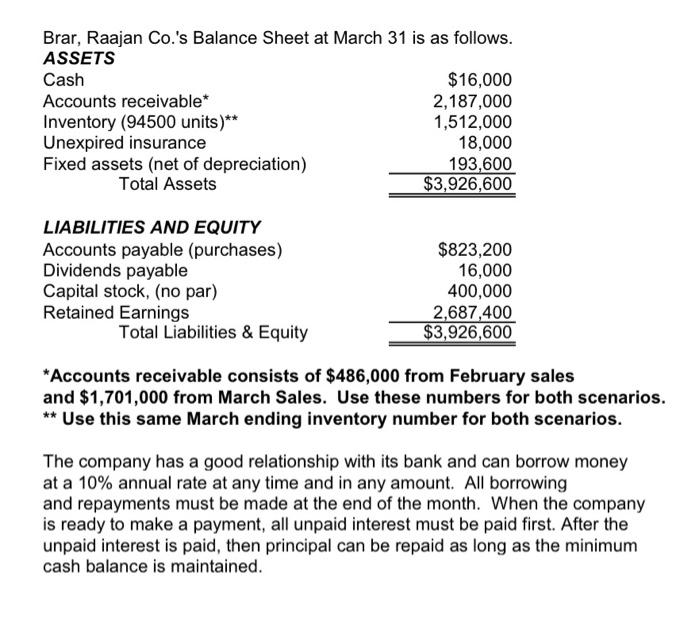

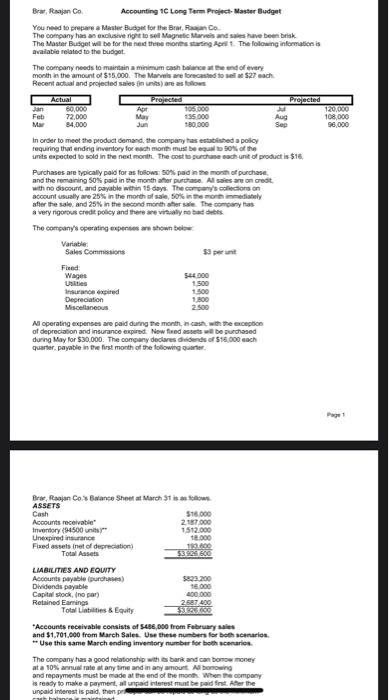

\begin{tabular}{|l|l|l|} \hline 190 & Contribution Margin and BEP \\ \hline 191 & & \\ \hline 192 & Unit Sales price \\ \hline 193 & Unit Purchase price \\ \hline 194 & Unit Sales Commissions \\ \hline 195 & Unit Contribution Margin \\ \hline 196 & & \\ \hline 197 & Fixed Costs for three month period \\ \hline 198 & Wages \\ \hline 199 & Utilities \\ \hline 200 & Insurance expired \\ \hline 201 & Depreciation \\ \hline 202 & Miscellaneous \\ \hline 203 & Total Fixed Costs \\ \hline 204 & & \\ \hline 205 & \\ \hline 206 & Break Even Point: \\ \hline 207 & Fixed Costs/Unit CM \\ \hline 208 & Fixed Costs/CM\% \\ \hline 209 & BEP units \\ \hline 210 & BEP dollars \\ \hline \end{tabular} SCENARIO 1 Name of your Company Budgeted Income Statement For the Three Months Ending June 30, 202X Sales in units (Memo) Sales dollars Less variable expenses Cost of Goods sold at $ per unit Commissions \$ per unit Contribution Margin Less fixed expenses Wages Utilities Insurance expired Depreciation Miscellaneous Net operating income Less interest expense* Net income SCENARIO 1 Name of your Company Budgeted Balance Sheet June 30,202X Cash AR Inventory units at $ per unit Unexpired insurance Fixed assets, net Total Assets AP Liabilities \& Equity Interest Payable Dividends payable Notes payable-bank Capital Stock, no-par Retained Earnings Total Liabilities \& Equity Brar, Raajan Co. Required: You will complete all tasks listed below for the original facts above...this will be Scenario 1. Then you will repeat the entire process for Scenario 2. This second scenario will show what would happen if there was an increase of 20% (twenty percent) in the number of units sold. This is essentially a flexible budget. Brar. Raaian Co.'s Balance Sheet at March 31 is as follows. *Accounts receivable consists of $486,000 from February sales and $1,701,000 from March Sales. Use these numbers for both scenarios. The company has a good relationship with its bank and can borrow money at a 10% annual rate at any time and in any amount. All borrowing and repayments must be made at the end of the month. When the company is ready to make a payment, all unpaid interest must be paid first. After the unpaid interest is paid, then principal can be repaid as long as the minimum cash balance is maintained. Braw, Maajon Co. Accounting 1e Long Term Frojech- Master Budget You neve to prepare a Masiler Buboer for the Brar, Rawan Co. The company has as ewolustive nolit to sell Magnefic Marveis and sules have been briak. The Masher Busget wil be for the need theoe morese trarting Agrit. 1 . The following infermation is avalabie relatod to the budpot. The company neods to maintain a minimum cash balarce at the end of every month in the amount of 515,000 . The Marves are formoushed to sell at 527 each. Recent actual and projected sales (n unts) are as follows In order to meet the product demand, the company tas estublished a policy fequing that ending inventory for nuch month thust be equal botiot the units eapected to sold in the neet month. The cost to gurchase wach unt of product is $15. Purchases are typicaly paid for as follows: sos pad in the month of purchase. and the remaining 50N paid in the month aher puethase. Al saies are on oredt. wth no discourt, and payable wethin 15 doyt. The conctiy's collectors on adocunt isualy are 25% in the morth of sale, sots in the morth immediathly after the sale, and 25% in the second monath aher sale. The company has a very rigorows erede policy and there are vithatly no bat dibes. The eompany's operating expentes are shown telow: M coperating expenses are paid durng the month, in cash. w th the exception of depreciobon and insurance eupired. New fted assets will be purchased during May for $30.000. The compuny dedures dibends of $15,000 each quarter, payable in the first month of the lollowing ouicter. "Accounts receivable consists of se96, 600 from Febluary aules and \$1.701.600 from March Salet. Use these numbers for besh scenarios. Use this same March ending imventory number for beth acenariea. The company has a good relationship with is bark and can bomoe money at a 10\% annual rale of any time and in any anourt. A1 bonowing and repayments must be made at the end of the month. When the compony is ready to make a parment, all unpaid interest mant be pad fret. Aher the uncaid inferest is paid, then prot