Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Item 1 - Megan's Income Megan earns a salary of $ 6 5 0 , 0 0 0 per annum from Starlight Films. In the

Item Megan's Income

Megan earns a salary of $ per annum from Starlight Films. In the income year, Megan received an Academy Award Oscar from the American Film Academy for her work in producing a film. She received a gold statue worth $ She had to sign a contract agreeing not to sell the statue.

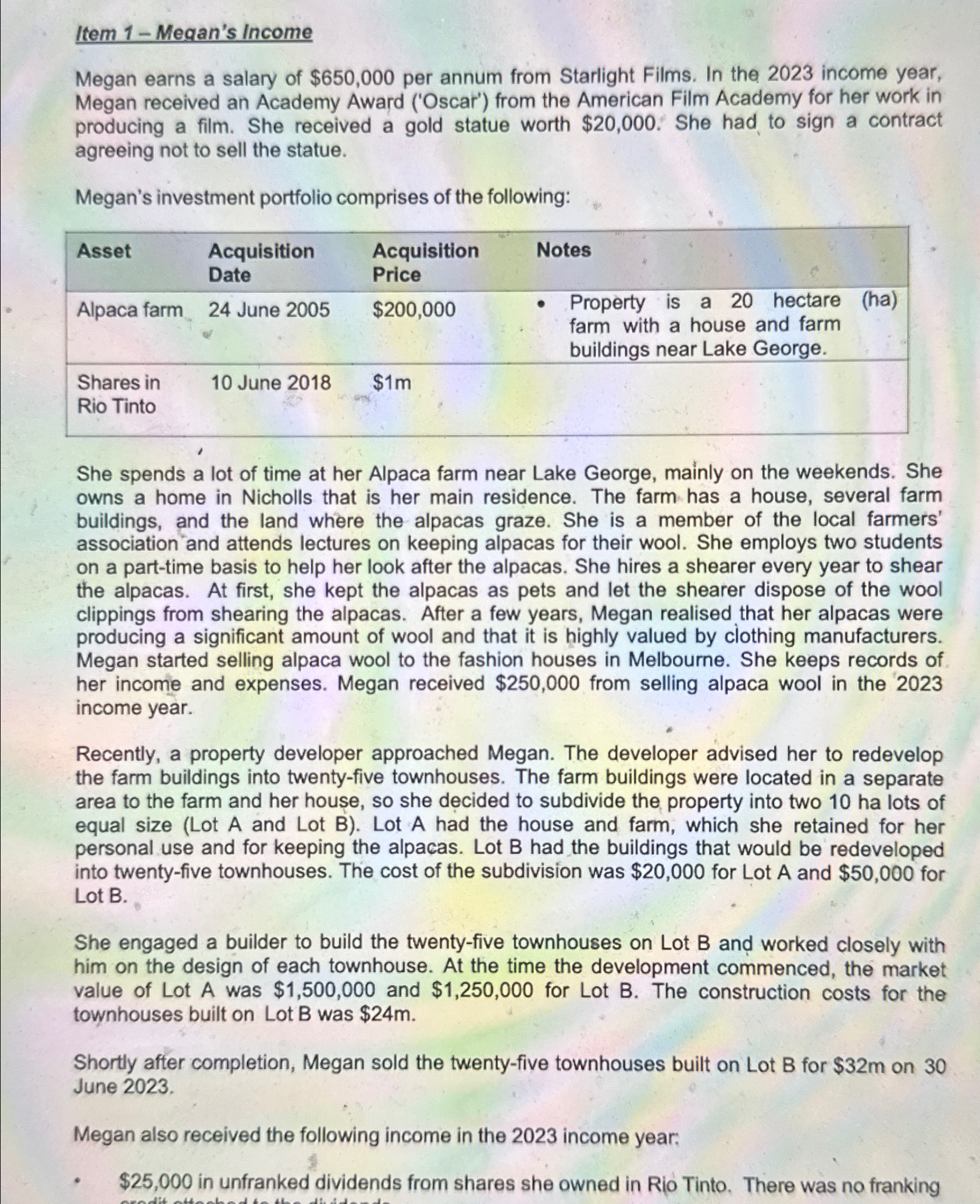

Megan's investment portfolio comprises of the following:

tableAssettableAcquisitionDatetableAcquisitionPriceNotesAlpaca farm, June $tableProperty is a hectare hafarm with a house and farmbuildings near Lake George.tableShares inRio Tinto June $

She spends a lot of time at her Alpaca farm near Lake George, mainly on the weekends. She owns a home in Nicholls that is her main residence. The farm has a house, several farm buildings, and the land where the alpacas graze. She is a member of the local farmers' association and attends lectures on keeping alpacas for their wool. She employs two students on a parttime basis to help her look after the alpacas. She hires a shearer every year to shear the alpacas. At first, she kept the alpacas as pets and let the shearer dispose of the wool clippings from shearing the alpacas. After a few years, Megan realised that her alpacas were producing a significant amount of wool and that it is highly valued by clothing manufacturers. Megan started selling alpaca wool to the fashion houses in Melbourne. She keeps records of her income and expenses. Megan received $ from selling alpaca wool in the income year.

Recently, a property developer approached Megan. The developer advised her to redevelop the farm buildings into twentyfive townhouses. The farm buildings were located in a separate area to the farm and her house, so she decided to subdivide the property into two ha lots of equal size Lot A and Lot Lot A had the house and farm, which she retained for her personal use and for keeping the alpacas. Lot had the buildings that would be redeveloped into twentyfive townhouses. The cost of the subdivision was $ for Lot A and $ for Lot B

She engaged a builder to build the twentyfive townhouses on Lot B and worked closely with him on the design of each townhouse. At the time the development commenced, the market value of Lot A was $ and $ for Lot The construction costs for the townhouses built on Lot B was $

Shortly after completion, Megan sold the twentyfive townhouses built on Lot B for $ on June

Megan also received the following income in the income year:

$ in unfranked dividends from shares she owned in Rio Tinto. There was no franking credit attached to the dividends. Megan incurs the following expenditure during the income year:

She pays $ for alpaca food.

She pays for the alpaca food using her credit card. She pays $ in interest to the

credit card company for the purchase.

She receives an $ speeding fine on the way to Melbourne to attend a fashion show

where the models were wearing clothing made from the wool of Megans alpacas. Megan

has a stall at the fashion show where she displayed the alpaca wool from her farm.

On May she buys a laptop, costing $ The Commissioner states that the

laptop has an effective life of three years. She uses the laptop for her job and the rest

of the time for streaming Netflix.

She travels from her home at Nicholls to the farm at Lake George on Friday

afternoons, returning on the following Sunday night, by taxi, at an annual cost of

$

Megan employs two students to work in the farm, paying a total of $ in wages

per year.

She pays the shearer $ each year to shear the alpacas. He is not an employee.

Megan pays $ per year to attend lectures at the local farmers association.

QUESTION:

Calculate Megans taxable income and income tax payable for the income year. Use legislation to explain your calculation. If you need to make certain assumptions in performing the calculation, state them in your answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started