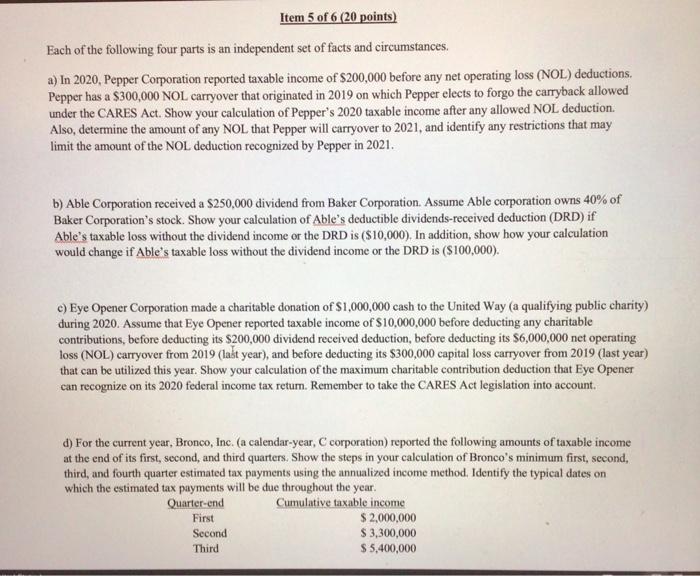

Item 5 of 6 (20 points) Each of the following four parts is an independent set of facts and circumstances. a) In 2020, Pepper Corporation reported taxable income of $200,000 before any net operating loss (NOL) deductions Pepper has a $300,000 NOL carryover that originated in 2019 on which Pepper elects to forgo the carryback allowed under the CARES Act. Show your calculation of Pepper's 2020 taxable income after any allowed NOL deduction. Also, determine the amount of any NOL that Pepper will carryover to 2021, and identify any restrictions that may limit the amount of the NOL deduction recognized by Pepper in 2021. b) Able Corporation received a $250,000 dividend from Baker Corporation. Assume Able corporation owns 40% of Baker Corporation's stock. Show your calculation of Able's deductible dividends-received deduction (DRD) if Able's taxable loss without the dividend income or the DRD is ($10,000). In addition, show how your calculation would change if Able's taxable loss without the dividend income or the DRD is ($100,000). c) Eye Opener Corporation made a charitable donation of $1,000,000 cash to the United Way (a qualifying public charity) during 2020. Assume that Eye Opener reported taxable income of $10,000,000 before deducting any charitable contributions, before deducting its $200,000 dividend received deduction, before deducting its $6,000,000 net operating loss (NOL) carryover from 2019 (lalt year), and before deducting its $300,000 capital loss carryover from 2019 (last year) that can be utilized this year. Show your calculation of the maximum charitable contribution deduction that Eye Opener can recognize on its 2020 federal income tax return. Remember to take the CARES Act legislation into account. d) For the current year, Bronco, Inc. (a calendar-year, C corporation) reported the following amounts of taxable income at the end of its first , second, and third quarters, Show the steps in your calculation of Bronco's minimum first, second, third, and fourth quarter estimated tax payments using the annualized income method. Identify the typical dates on which the estimated tax payments will be due throughout the year Quarter-end Cumulative taxable income $ 2,000,000 $ 3,300,000 Third $5,400,000 First Second Item 5 of 6 (20 points) Each of the following four parts is an independent set of facts and circumstances. a) In 2020, Pepper Corporation reported taxable income of $200,000 before any net operating loss (NOL) deductions Pepper has a $300,000 NOL carryover that originated in 2019 on which Pepper elects to forgo the carryback allowed under the CARES Act. Show your calculation of Pepper's 2020 taxable income after any allowed NOL deduction. Also, determine the amount of any NOL that Pepper will carryover to 2021, and identify any restrictions that may limit the amount of the NOL deduction recognized by Pepper in 2021. b) Able Corporation received a $250,000 dividend from Baker Corporation. Assume Able corporation owns 40% of Baker Corporation's stock. Show your calculation of Able's deductible dividends-received deduction (DRD) if Able's taxable loss without the dividend income or the DRD is ($10,000). In addition, show how your calculation would change if Able's taxable loss without the dividend income or the DRD is ($100,000). c) Eye Opener Corporation made a charitable donation of $1,000,000 cash to the United Way (a qualifying public charity) during 2020. Assume that Eye Opener reported taxable income of $10,000,000 before deducting any charitable contributions, before deducting its $200,000 dividend received deduction, before deducting its $6,000,000 net operating loss (NOL) carryover from 2019 (lalt year), and before deducting its $300,000 capital loss carryover from 2019 (last year) that can be utilized this year. Show your calculation of the maximum charitable contribution deduction that Eye Opener can recognize on its 2020 federal income tax return. Remember to take the CARES Act legislation into account. d) For the current year, Bronco, Inc. (a calendar-year, C corporation) reported the following amounts of taxable income at the end of its first , second, and third quarters, Show the steps in your calculation of Bronco's minimum first, second, third, and fourth quarter estimated tax payments using the annualized income method. Identify the typical dates on which the estimated tax payments will be due throughout the year Quarter-end Cumulative taxable income $ 2,000,000 $ 3,300,000 Third $5,400,000 First Second