Answered step by step

Verified Expert Solution

Question

1 Approved Answer

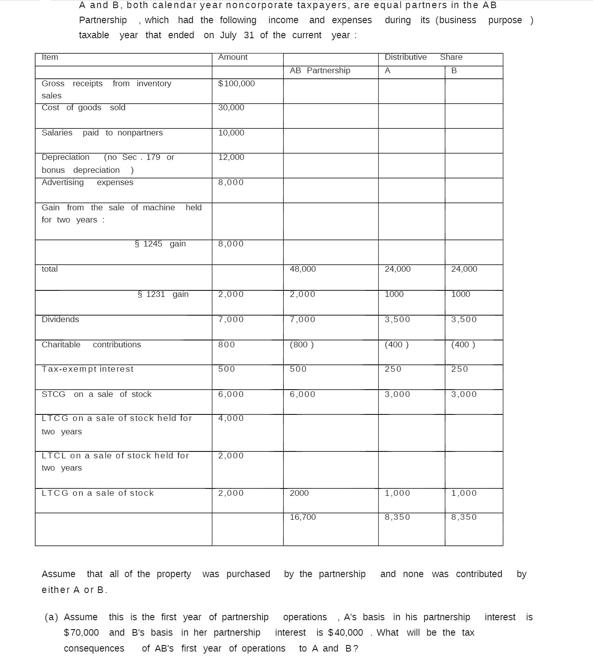

Item A and B, both calendar year noncorporate taxpayers, are equal partners in the AB Partnership which had the following income and expenses during

Item A and B, both calendar year noncorporate taxpayers, are equal partners in the AB Partnership which had the following income and expenses during its (business purpose) taxable year that ended on July 31 of the current year Gross receipts from inventory sales Cost of goods sold Salaries paid to nonpartners Depreciation (no Sec 179 of bonus depreciation) Advertising expenses Gain from the sale of machine held for two years: total Dividends Charitable contributions Tax-exempt interest 1245 gain 51231 gain STCG on a sale of stock LTCG on a sale of stock held for two years LTCL on a sale of stock held for two years LTCG on a sale of stock Amount $100,000 30,000 10,000 12,000 8,000 8,000 2,000 7,000 800 500 6,000 4,000 2,000 2,000 AB Partnership 48,000 2,000 7,000 (800) 500 6,000 2000 16,700 Distributive A 24,000 1000 3,500 (400) 250 3,000 1,000 8,350 Share B 24,000 1000 3,500 (400) 250 3,000 1,000 8,350 Assume that all of the property was purchased by the partnership and none was contributed by either A or B. (a) Assume this is the first year of partnership operations A's basis in his partnership interest is $70,000 and B's basis in her partnership interest is $40,000 What will be the tax consequences of AB's first year of operations to A and B?

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

As Taxable Income Gross Receipts Cost of Goods Sold Salaries Depreciation A...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started