Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Smithfield Company manufactures widgets. Smithfield's sales budget shows monthly sales for the upcoming quarter as follows: July August September October 10,000 units 8,000 units

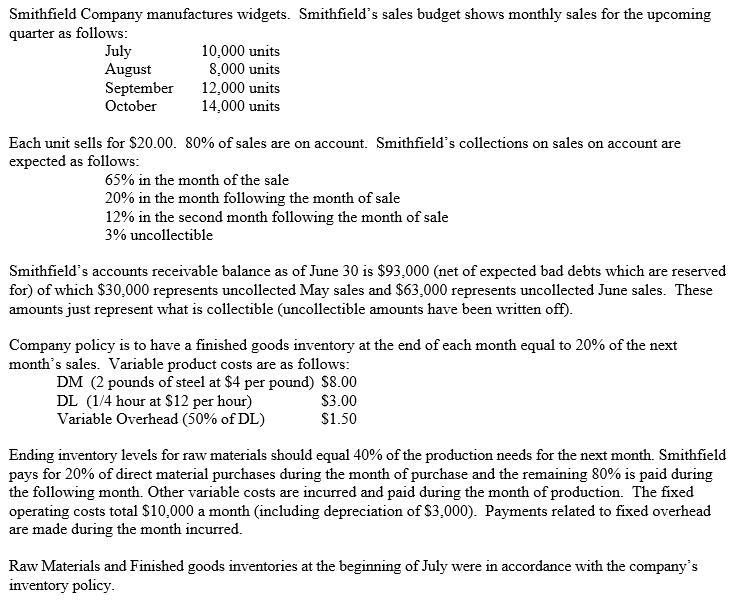

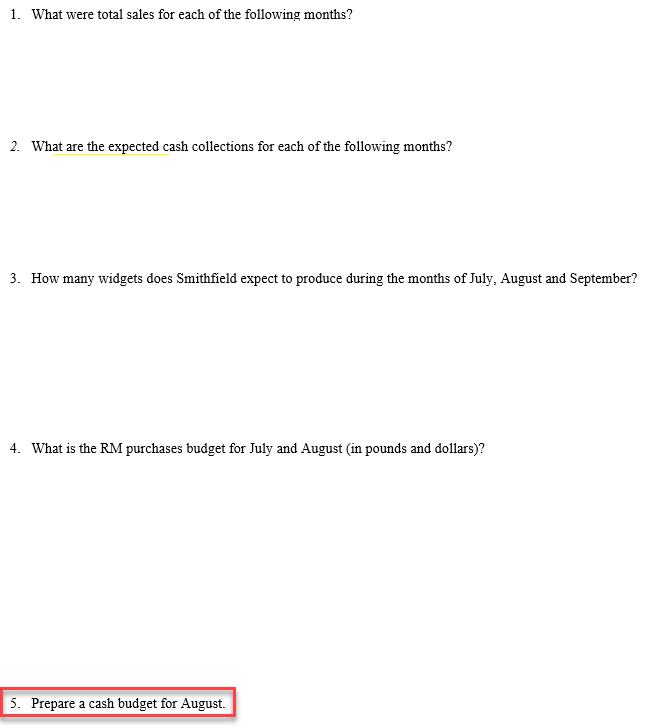

Smithfield Company manufactures widgets. Smithfield's sales budget shows monthly sales for the upcoming quarter as follows: July August September October 10,000 units 8,000 units 12,000 units 14,000 units Each unit sells for $20.00. 80% of sales are on account. Smithfield's collections on sales on account are expected as follows: 65% in the month of the sale 20% in the month following the month of sale 12% in the second month following the month of sale 3% uncollectible Smithfield's accounts receivable balance as of June 30 is $93,000 (net of expected bad debts which are reserved for) of which $30,000 represents uncollected May sales and $63,000 represents uncollected June sales. These amounts just represent what is collectible (uncollectible amounts have been written off). Company policy is to have a finished goods inventory at the end of each month equal to 20% of the next month's sales. Variable product costs are as follows: DM (2 pounds of steel at $4 per pound) $8.00 DL (1/4 hour at $12 per hour) $3.00 $1.50 Variable Overhead (50% of DL) Ending inventory levels for raw materials should equal 40% of the production needs for the next month. Smithfield pays for 20% of direct material purchases during the month of purchase and the remaining 80% is paid during the following month. Other variable costs are incurred and paid during the month of production. The fixed operating costs total $10,000 a month (including depreciation of $3,000). Payments related to fixed overhead are made during the month incurred. Raw Materials and Finished goods inventories at the beginning of July were in accordance with the company's inventory policy. 1. What were total sales for each of the following months? 2. What are the expected cash collections for each of the following months? 3. How many widgets does Smithfield expect to produce during the months of July, August and September? 4. What is the RM purchases budget for July and August (in pounds and dollars)? 5. Prepare a cash budget for August.

Step by Step Solution

★★★★★

3.28 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 Total sales for each of the following months are July 10000 units x 2000 200000 August 8000 units x 2000 160000 September 12000 units x 2000 240000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started