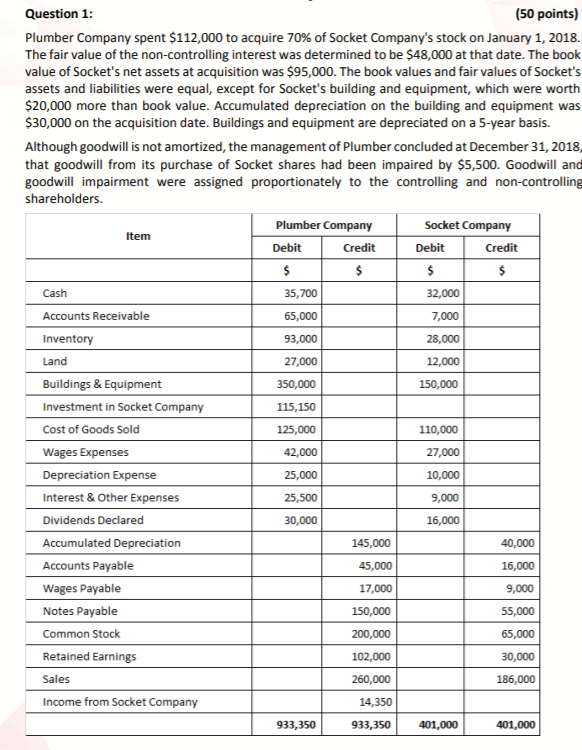

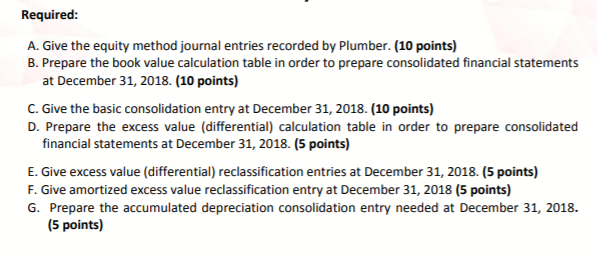

Item Question 1: (50 points) Plumber Company spent $112,000 to acquire 70% of Socket Company's stock on January 1, 2018. The fair value of the non-controlling interest was determined to be $48,000 at that date. The book value of Socket's net assets at acquisition was $95,000. The book values and fair values of Socket's assets and liabilities were equal, except for Socket's building and equipment, which were worth $20,000 more than book value. Accumulated depreciation on the building and equipment was $30,000 on the acquisition date. Buildings and equipment are depreciated on a 5-year basis. Although goodwill is not amortized, the management of Plumber concluded at December 31, 2018, that goodwill from its purchase of Socket shares had been impaired by $5,500. Goodwill and goodwill impairment were assigned proportionately to the controlling and non-controlling shareholders. Plumber Company Socket Company Debit Credit Debit Credit $ $ $ Cash 35,700 32,000 Accounts Receivable 65,000 7,000 Inventory 93,000 28,000 Land 27,000 12,000 Buildings & Equipment 350,000 150,000 Investment in Socket Company 115,150 Cost of Goods Sold 125,000 110,000 Wages Expenses 42,000 27,000 Depreciation Expense 25,000 10,000 Interest & Other Expenses 25,500 9,000 Dividends Declared 30,000 16,000 Accumulated Depreciation 145,000 40,000 Accounts Payable 45,000 16,000 Wages Payable 17,000 9,000 Notes Payable 150,000 55,000 Common Stock 200,000 65,000 Retained Earnings 102,000 30,000 Sales 260,000 186,000 Income from Socket Company 14,350 933,350 933,350 401,000 401,000 Required: A. Give the equity method journal entries recorded by Plumber. (10 points) B. Prepare the book value calculation table in order to prepare consolidated financial statements at December 31, 2018. (10 points) C. Give the basic consolidation entry at December 31, 2018. (10 points) D. Prepare the excess value (differential) calculation table in order to prepare consolidated financial statements at December 31, 2018. (5 points) E. Give excess value (differential) reclassification entries at December 31, 2018. (5 points) F. Give amortized excess value reclassification entry at December 31, 2018 (5 points) G. Prepare the accumulated depreciation consolidation entry needed at December 31, 2018. (5 points) Item Question 1: (50 points) Plumber Company spent $112,000 to acquire 70% of Socket Company's stock on January 1, 2018. The fair value of the non-controlling interest was determined to be $48,000 at that date. The book value of Socket's net assets at acquisition was $95,000. The book values and fair values of Socket's assets and liabilities were equal, except for Socket's building and equipment, which were worth $20,000 more than book value. Accumulated depreciation on the building and equipment was $30,000 on the acquisition date. Buildings and equipment are depreciated on a 5-year basis. Although goodwill is not amortized, the management of Plumber concluded at December 31, 2018, that goodwill from its purchase of Socket shares had been impaired by $5,500. Goodwill and goodwill impairment were assigned proportionately to the controlling and non-controlling shareholders. Plumber Company Socket Company Debit Credit Debit Credit $ $ $ Cash 35,700 32,000 Accounts Receivable 65,000 7,000 Inventory 93,000 28,000 Land 27,000 12,000 Buildings & Equipment 350,000 150,000 Investment in Socket Company 115,150 Cost of Goods Sold 125,000 110,000 Wages Expenses 42,000 27,000 Depreciation Expense 25,000 10,000 Interest & Other Expenses 25,500 9,000 Dividends Declared 30,000 16,000 Accumulated Depreciation 145,000 40,000 Accounts Payable 45,000 16,000 Wages Payable 17,000 9,000 Notes Payable 150,000 55,000 Common Stock 200,000 65,000 Retained Earnings 102,000 30,000 Sales 260,000 186,000 Income from Socket Company 14,350 933,350 933,350 401,000 401,000 Required: A. Give the equity method journal entries recorded by Plumber. (10 points) B. Prepare the book value calculation table in order to prepare consolidated financial statements at December 31, 2018. (10 points) C. Give the basic consolidation entry at December 31, 2018. (10 points) D. Prepare the excess value (differential) calculation table in order to prepare consolidated financial statements at December 31, 2018. (5 points) E. Give excess value (differential) reclassification entries at December 31, 2018. (5 points) F. Give amortized excess value reclassification entry at December 31, 2018 (5 points) G. Prepare the accumulated depreciation consolidation entry needed at December 31, 2018. (5 points)