Question

Items 1 through 10 in the left-hand column represent various transactions pertaining to a municipality that uses encumbrance accounting. Items 11 through 20, also listed

Items 1 through 10 in the left-hand column represent various transactions pertaining to a municipality that uses encumbrance accounting. Items 11 through 20, also listed in the left-hand column, represent the funds and accounts used by the municipality. To the right of these items is a list of possible accounting and reporting methods.

Required:

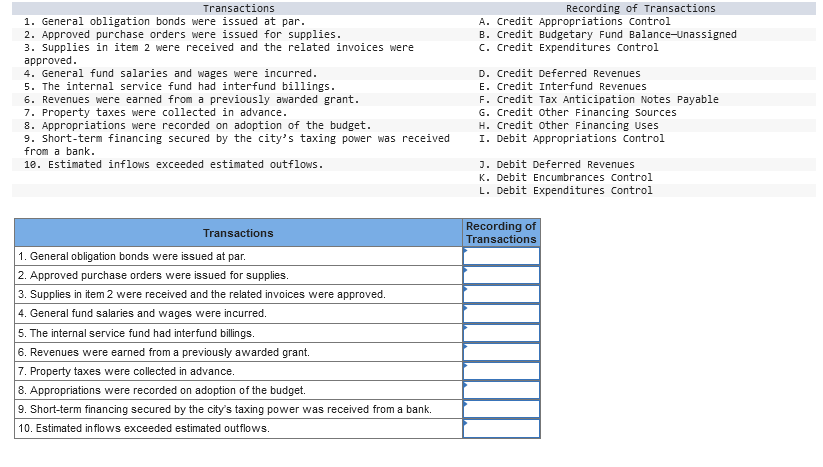

For the municipality, select the appropriate method to record each transaction (items 1 through 10). A method of recording the transactions may be selected once, more than once, or not at all.

4

Item 2

Items 1 through 10 in the left-hand column represent various transactions pertaining to a municipality that uses encumbrance accounting. Items 11 through 20, also listed in the left-hand column, represent the funds and accounts used by the municipality. To the right of these items is a list of possible accounting and reporting methods.

Required:

For the municipality, select the appropriate method to record each transaction (items 1 through 10). A method of recording the transactions may be selected once, more than once, or not at all.

| Transactions | Recording of Transactions |

|---|---|

| 1. General obligation bonds were issued at par. | A. Credit Appropriations Control |

| 2. Approved purchase orders were issued for supplies. | B. Credit Budgetary Fund BalanceUnassigned |

| 3. Supplies in item 2 were received and the related invoices were approved. | C. Credit Expenditures Control |

| 4. General fund salaries and wages were incurred. | D. Credit Deferred Revenues |

| 5. The internal service fund had interfund billings. | E. Credit Interfund Revenues |

| 6. Revenues were earned from a previously awarded grant. | F. Credit Tax Anticipation Notes Payable |

| 7. Property taxes were collected in advance. | G. Credit Other Financing Sources |

| 8. Appropriations were recorded on adoption of the budget. | H. Credit Other Financing Uses |

| 9. Short-term financing secured by the citys taxing power was received from a bank. | I. Debit Appropriations Control |

| 10. Estimated inflows exceeded estimated outflows. | J. Debit Deferred Revenues |

| K. Debit Encumbrances Control | |

| L. Debit Expenditures Control |

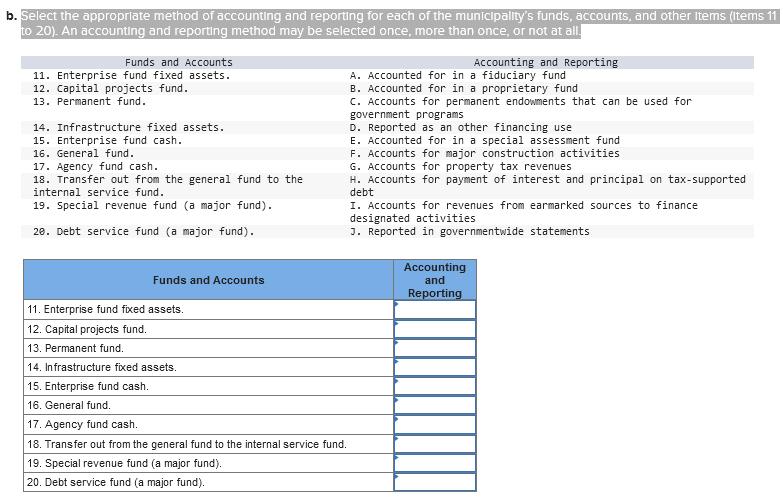

Select the appropriate method of accounting and reporting for each of the municipalitys funds, accounts, and other items (items 11 to 20). An accounting and reporting method may be selected once, more than once, or not at all.

\begin{tabular}{ll} Transactions & \multicolumn{1}{c}{ Recording of Transactions } \\ 1. General obligation bonds were issued at par. & A. Credit Appropriations Control \\ 2. Approved purchase orders were issued for supplies. & B. Credit Budgetary Fund Balance-Unassigned \\ 3. Supplies in item 2 were received and the related invoices were & C. Credit Expenditures control \\ approved. & D. Credit Deferred Revenues \\ 4. General fund salaries and wages were incurred. & E. Credit Interfund Revenues \\ 5. The internal service fund had interfund billings. & F. Credit Tax Anticipation Notes Payable \\ 6. Revenues were earned from a previously awarded grant. & G. Credit other Financing Sources \\ 7. Property taxes were collected in advance. & H. Credit other Financing Uses \\ 8. Appropriations were recorded on adoption of the budget. & I. Debit Appropriations Control \\ 9. Short-term financing secured by the city's taxing power was received & \\ from a bank. & J. Debit Deferred Revenues \\ 10. Estimated inflows exceeded estimated outflows. & K. Debit Encumbrances Control \\ & L. Debit Expenditures Control \end{tabular} \begin{tabular}{|l|l|} \hline \multicolumn{1}{|c|}{ Transactions } & \begin{tabular}{l} Recording of \\ Transactions \end{tabular} \\ \hline 1. General obligation bonds were issued at par. & \\ \hline 2. Approved purchase orders were issued for supplies. & \\ \hline 3. Supplies in item 2 were received and the related invoices were approved. \\ \hline 4. General fund salaries and wages were incurred. \\ \hline 5. The internal service fund had interfund billings. \\ \hline 6. Revenues were earned from a previously awarded grant. \\ \hline 7. Property taxes were collected in advance. \\ \hline 8. Appropriations were recorded on adoption of the budget. \\ \hline 9. Short-term financing secured by the city's taxing power was received from a bank. \\ \hline 10. Estimated inflows exceeded estimated outflows. \\ \hline \end{tabular} b. Select the appropriate method of accounting and reporting for each of the municlpality's funds, accounts, and other Items (Items 11 to 20). An accounting and reporting method may be selected once, more than once, or not at all. Funds and Accounts 11. Enterprise fund fixed assets. 12. Capital projects fund. 13. Permanent fund. 14. Infrastructure fixed assets. 15. Enterprise fund cash. 16. General fund. 17. Agency fund cash. 18. Transfer out from the general fund to the internal service fund. 19. Special revenue fund (a major fund). 20. Debt service fund (a major fund). Accounting and Reporting A. Accounted for in a fiduciary fund B. Accounted for in a proprietary fund C. Accounts for permanent endowments that can be used for government programs D. Reported as an other financing use E. Accounted for in a special assessment fund F. Accounts for major construction activities G. Accounts for property tax revenues H. Accounts for payment of interest and principal on tax-supported debt I. Accounts for revenues from earmarked sources to finance designated activities J. Reported in governmentwide statements \begin{tabular}{|l|l|} \hline \multicolumn{1}{|c|}{ Funds and Accounts } & \begin{tabular}{c} Accounting \\ and \\ Reporting \end{tabular} \\ \hline 11. Enterprise fund fixed assets. \\ \hline 12. Capital projects fund. \\ \hline 13. Permanent fund. \\ \hline 14. Infrastructure fixed assets. \\ \hline 15. Enterprise fund cash. \\ \hline 16. General fund. \\ \hline 17. Agency fund cash. \\ \hline 18. Transfer out from the general fund to the internal service fund. \\ \hline 19. Special revenue fund (a major fund). \\ \hline 20. Debt service fund (a major fund). \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started