Question

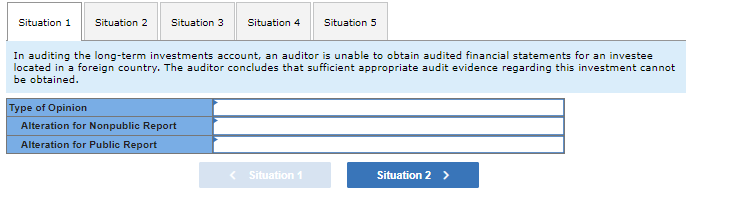

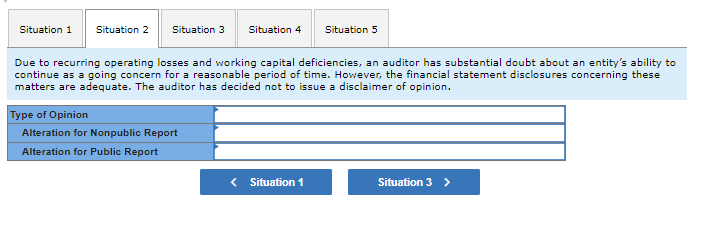

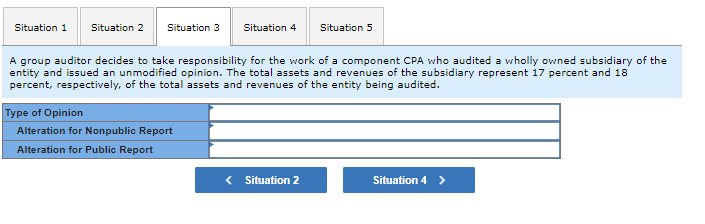

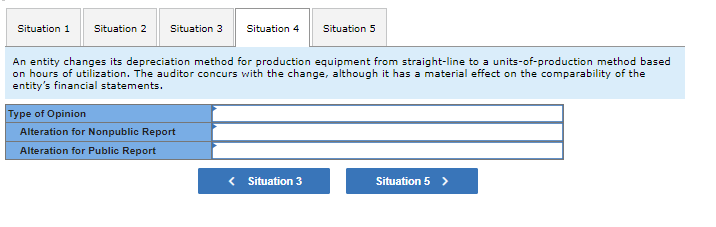

Items 1 through 5 present various independent factual situations an auditor might encounter in conducting an audit of a nonpublic company. For each situation, assume:

Items 1 through 5 present various independent factual situations an auditor might encounter in conducting an audit of a nonpublic company. For each situation, assume:

The auditor is independent.

The auditor previously expressed an unmodified opinion on the prior years financial statements.

The nonpublic audit client is presenting single-year (not comparative) financial statements.

The conditions for an unmodified opinion exist unless contradicted in the factual situations.

The conditions stated in the factual situations are material.

No report modifications are to be made except in response to the factual situation.

The Report Alteration part of the problem only addresses the need to add an additional section or a paragraph to an existing section. Other parts of the audit report may be affected that are not examined in this question.

Required:

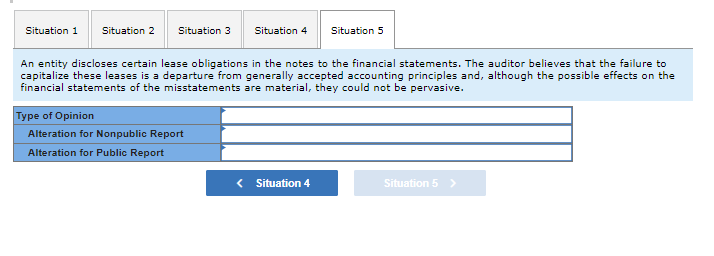

Below are the types of opinions the auditor ordinarily would issue and report modifications (if any) relating to an additional paragraph or section that would be necessary. Select as the best answer for each situation (items 1 through 5) the type of opinion and alterations, if any, the auditor would normally select. For each situation (items 1 through 5) also provide the report alteration under PCAOB standards for audits of public companies.

| Types of Opinions | Report Alteration | ||

|---|---|---|---|

| A. | Unmodified | H. | Add a section preceding the Opinion section. |

| B. | Qualified | I. | Add a section immediately following the Opinion section. |

| C. | Adverse | J. | Add a section at a point following the Basis for Opinion section. |

| D. | Disclaimer | K. | Add a paragraph to the Opinion section. |

| E. | Qualified or adverse | L. | Add a paragraph to the Basis for Opinion section. |

| F. | Qualified or disclaimer | M. | Issue unmodified report without alteration. |

| G. | Disclaimer or adverse | ||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started