Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Its 1 question only, so need complete answer. Please solve the question if you are completely sure about the solution, otherwise I will downvote it.

Its 1 question only, so need complete answer.

Please solve the question if you are completely sure about the solution, otherwise I will downvote it.

Thanks.

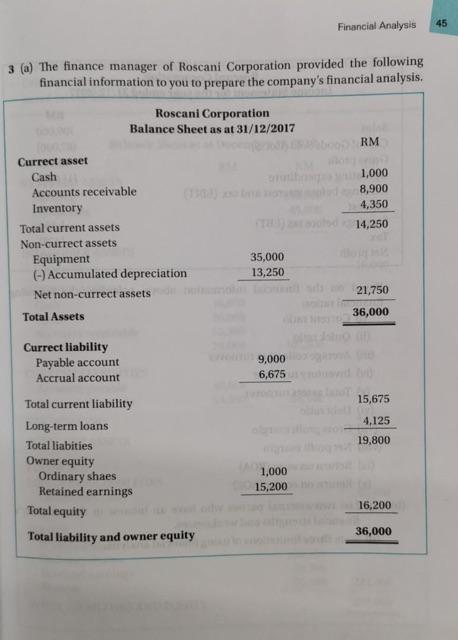

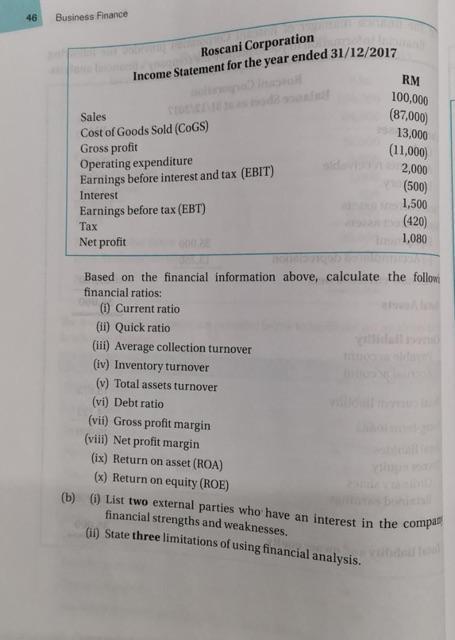

Financial Analysis 45 3 (a) The finance manager of Roscani Corporation provided the following financial information to you to prepare the company's financial analysis. Roscani Corporation Balance Sheet as at 31/12/2017 RM Currect asset Cash 1,000 8,900 4,350 14,250 21,750 36,000 15,675 4,125 19,800 16,200 36,000 Accounts receivable Inventory Total current assets Non-currect assets Equipment (-) Accumulated depreciation Net non-currect assets Total Assets Currect liability Payable account Accrual account Total current liability Long-term loans Total liabities Owner equity Ordinary shaes Retained earnings Total equity Total liability and owner equity arutham 35,000 13,250 9,000 6,675 1,000 15,200 46 Business Finance Sales Cost of Goods Sold (COGS) Gross profit Operating expenditure Earnings before interest and tax (EBIT) (500) Interest 1,500 Earnings before tax (EBT) (420) Tax 1,080 Net profit Based on the financial information above, calculate the follow financial ratios: (i) Current ratio (ii) Quick ratio (iii) Average collection turnover (iv) Inventory turnover (v) Total assets turnover (vi) Debt ratio (vii) Gross profit margin (viii) Net profit margin (ix) Return on asset (ROA) (x) Return on equity (ROE) (b) (i) List two external parties who have an interest in the compa financial strengths and weaknesses. (ii) State three limitations of using financial analysis. of lopment Roscani Corporation Income Statement for the year ended 31/12/2017 RM 100,000 (87,000) 13,000 (11,000) 2,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started