its 100,00 thanks!

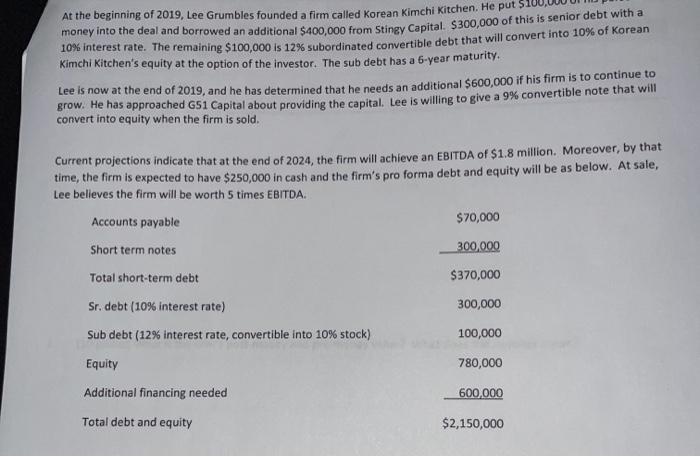

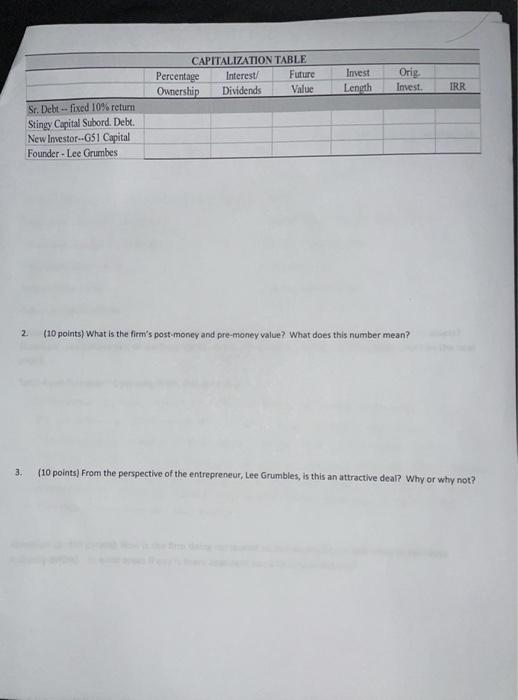

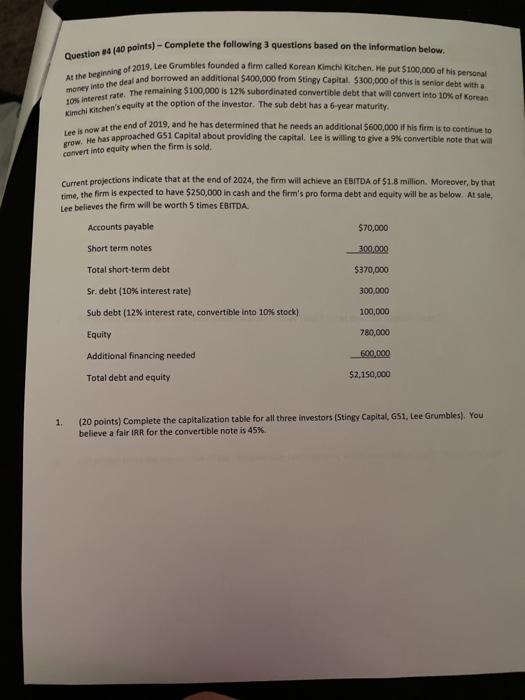

At the beginning of 2019, Lee Grumbles founded a firm called Korean Kimchi Kitchen. He puts money into the deal and borrowed an additional $400,000 from Stingy Capital. $300,000 of this is senior debt with a 10% interest rate. The remaining $100,000 is 12% subordinated convertible debt that will convert into 10% of Korean Kimchi Kitchen's equity at the option of the investor. The sub debt has a 6-year maturity. Lee is now at the end of 2019, and he has determined that he needs an additional $600,000 if his firm is to continue to grow. He has approached G51 Capital about providing the capital. Lee is willing to give a 9% convertible note that will convert into equity when the firm is sold. Current projections indicate that at the end of 2024, the firm will achieve an EBITDA of $1.8 million. Moreover, by that time, the firm is expected to have $250,000 in cash and the firm's pro forma debt and equity will be as below. At sale, Lee believes the firm will be worth 5 times EBITDA. Accounts payable $70,000 Short term notes 300,000 $370,000 Total short-term debt Sr. debt (10% interest rate) Sub debt (12% interest rate, convertible into 10% stock) 300,000 100,000 780,000 Equity Additional financing needed 600,000 Total debt and equity $2,150,000 CAPITALIZATION TABLE Percentage Interest/ Future Ownership Dividends Value Invest Length Orig Invest. IRR Sr. Debt-fixed 10% return Stingy Capital Subord. Debt. New Investor--G51 Capital Founder - Lee Grumbes 2 (10 points) What is the firm's post money and pre-money value? What does this number mean? 3. (10 points) From the perspective of the entrepreneur, Lee Grumbles, is this an attractive deal? Why or why not? At the beginning of 2019, Lee Grumbles founded a firm called Korean Kimchi Kitchen. He puts money into the deal and borrowed an additional $400,000 from Stingy Capital. $300,000 of this is senior debt with a 10% interest rate. The remaining $100,000 is 12% subordinated convertible debt that will convert into 10% of Korean Kimchi Kitchen's equity at the option of the investor. The sub debt has a 6-year maturity. Lee is now at the end of 2019, and he has determined that he needs an additional $600,000 if his firm is to continue to grow. He has approached G51 Capital about providing the capital. Lee is willing to give a 9% convertible note that will convert into equity when the firm is sold. Current projections indicate that at the end of 2024, the firm will achieve an EBITDA of $1.8 million. Moreover, by that time, the firm is expected to have $250,000 in cash and the firm's pro forma debt and equity will be as below. At sale, Lee believes the firm will be worth 5 times EBITDA. Accounts payable $70,000 Short term notes 300,000 $370,000 Total short-term debt Sr. debt (10% interest rate) Sub debt (12% interest rate, convertible into 10% stock) 300,000 100,000 780,000 Equity Additional financing needed 600,000 Total debt and equity $2,150,000 CAPITALIZATION TABLE Percentage Interest/ Future Ownership Dividends Value Invest Length Orig Invest. IRR Sr. Debt-fixed 10% return Stingy Capital Subord. Debt. New Investor--G51 Capital Founder - Lee Grumbes 2 (10 points) What is the firm's post money and pre-money value? What does this number mean? 3. (10 points) From the perspective of the entrepreneur, Lee Grumbles, is this an attractive deal? Why or why not