Answered step by step

Verified Expert Solution

Question

1 Approved Answer

its 2012 and 2011 on financial statement is written 2010 which is 2011 and for 2011 is 2012. this is the question from the book.

its 2012 and 2011

on financial statement is written 2010 which is 2011 and for 2011 is 2012.

this is the question from the book. and it's a clear question

no changes in the question. solve as it is

solve qn 3

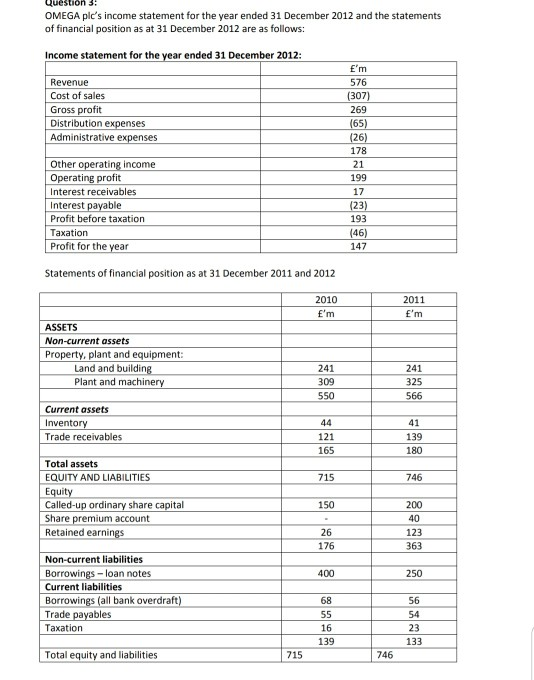

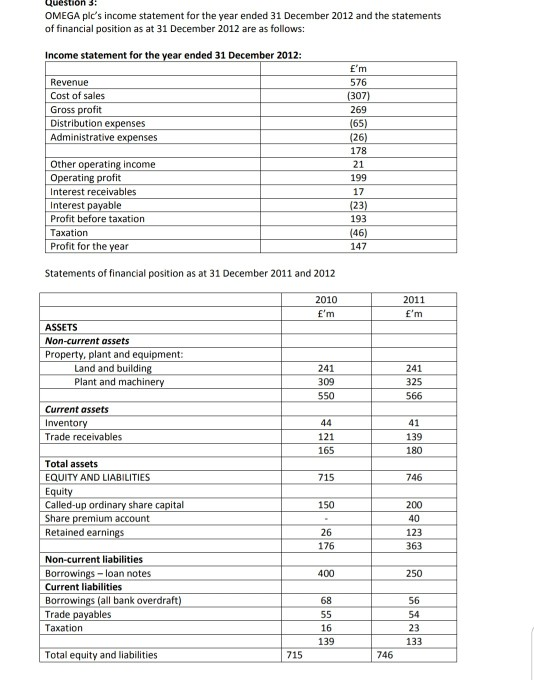

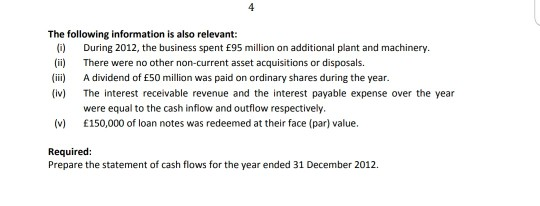

Question 3 OMEGA plc's income statement for the year ended 31 December 2012 and the statements of financial position as at 31 December 2012 are as follows: Income statement for the year ended 31 December 2012 Revenue Cost of sales Gross profit Distribution expenses Administrative e E m 576 (307) 269 65 178 21 199 17 Other operating income Operating profit Interest receivables Interest payable Profit before taxation Taxation Profit for the year 193 46) 147 Statements of financial position as at 31 December 2011 and 2012 2010 2011 E'm E'm ASSETS Non-current assets Property, plant and equipment Land and build Plant and machin 241 309 550 241 325 566 Current assets nventor Trade receivables 121 165 139 180 Total assets EQUITY AND LIABILITIES Equi Called-up ordinary share capital Share premium account Retained e 715 150 26 746 200 40 123 363 176 Non-current liabilities Borrowines-loan notes Current liabilities Borrowings (all bank overdraft) Trade payables Taxation 400 250 68 56 54 23 133 16 139 Total equty dliabilities 715 746 Question 3 OMEGA plc's income statement for the year ended 31 December 2012 and the statements of financial position as at 31 December 2012 are as follows: Income statement for the year ended 31 December 2012 Revenue Cost of sales Gross profit Distribution expenses Administrative e E m 576 (307) 269 65 178 21 199 17 Other operating income Operating profit Interest receivables Interest payable Profit before taxation Taxation Profit for the year 193 46) 147 Statements of financial position as at 31 December 2011 and 2012 2010 2011 E'm E'm ASSETS Non-current assets Property, plant and equipment Land and build Plant and machin 241 309 550 241 325 566 Current assets nventor Trade receivables 121 165 139 180 Total assets EQUITY AND LIABILITIES Equi Called-up ordinary share capital Share premium account Retained e 715 150 26 746 200 40 123 363 176 Non-current liabilities Borrowines-loan notes Current liabilities Borrowings (all bank overdraft) Trade payables Taxation 400 250 68 56 54 23 133 16 139 Total equty dliabilities 715 746 The following information is also relevant (i) (ii) There were no other non-current asset acquisitions or disposals. (iv) The interest receivable revenue and the interest payable expense over the year () 150,000 of loan notes was redeemed at their face (par) value During 2012, the business spent E95 million on additional plant and machinery. A dividend of 50 million was paid on ordinary shares during the year. were equal to the cash inflow and outflow respectively. Required Prepare the statement of cash flows for the year ended 31 December 2012

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started