Answered step by step

Verified Expert Solution

Question

1 Approved Answer

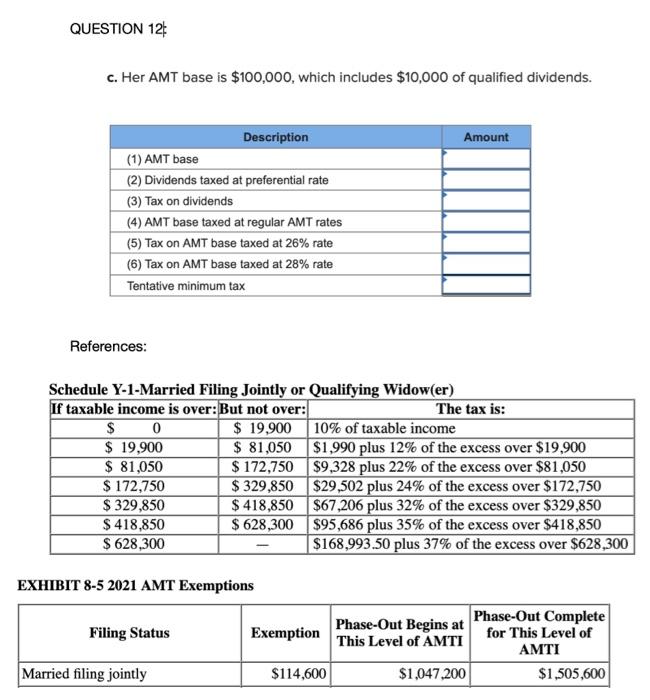

its 2021, as made clear by the references i attached. QUESTION 12 C. Her AMT base is $100,000, which includes $10,000 of qualified dividends. Amount

its 2021, as made clear by the references i attached.

QUESTION 12 C. Her AMT base is $100,000, which includes $10,000 of qualified dividends. Amount Description (1) AMT base (2) Dividends taxed at preferential rate (3) Tax on dividends (4) AMT base taxed at regular AMT rates (5) Tax on AMT base taxed at 26% rate (6) Tax on AMT base taxed at 28% rate Tentative minimum tax References: Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over: But not over: The tax is: $ 0 $ 19,900 10% of taxable income $ 19,900 $ 81,050 $1,990 plus 12% of the excess over $19,900 $ 81,050 $ 172,750 $9,328 plus 22% of the excess over $81,050 $ 172,750 $ 329,850 $29,502 plus 24% of the excess over $172,750 $ 329,850 $ 418,850 $67,206 plus 32% of the excess over $329,850 $ 418,850 $ 628,300 $95,686 plus 35% of the excess over $418,850 $ 628,300 $168.993.50 plus 37% of the excess over $628,300 EXHIBIT 8-5 2021 AMT Exemptions Filing Status Exemption Phase-Out Begins at Phase-Out Complete This Level of AMTI for This Level of AMTI $1,047,200 $1,505,600 Married filing jointly $114,600 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started