It's a Acf2100 financial accounting Subject.

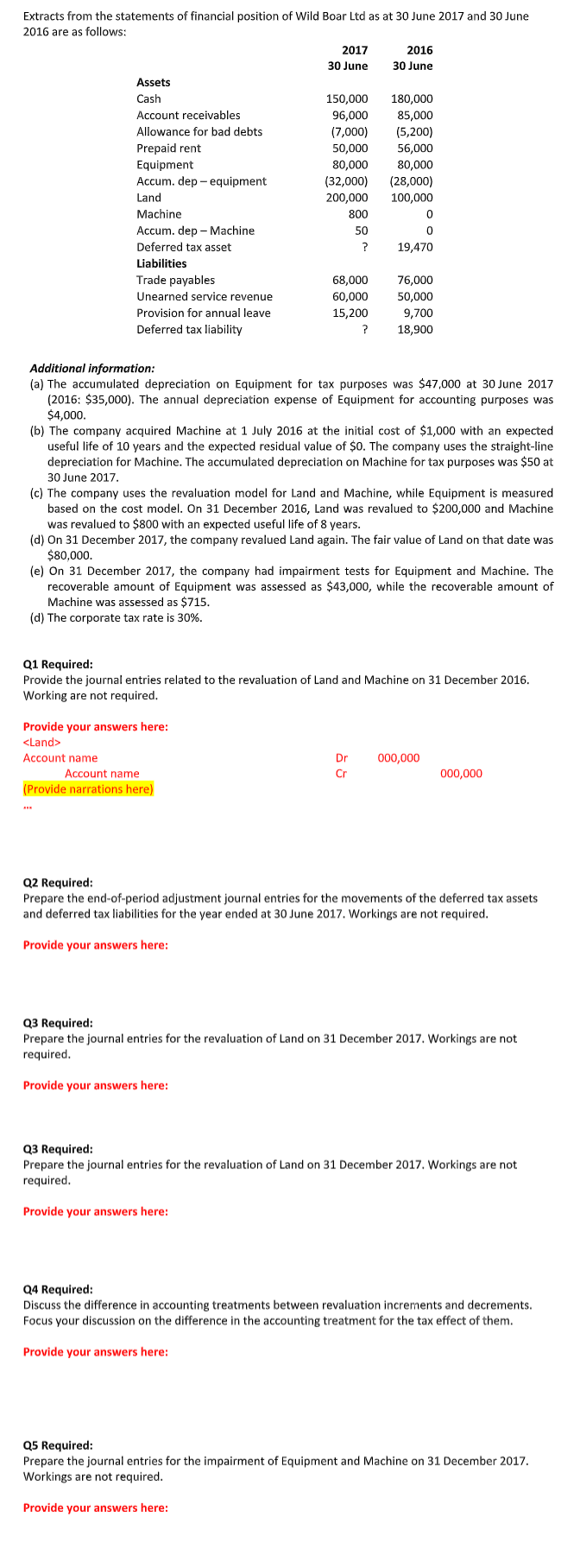

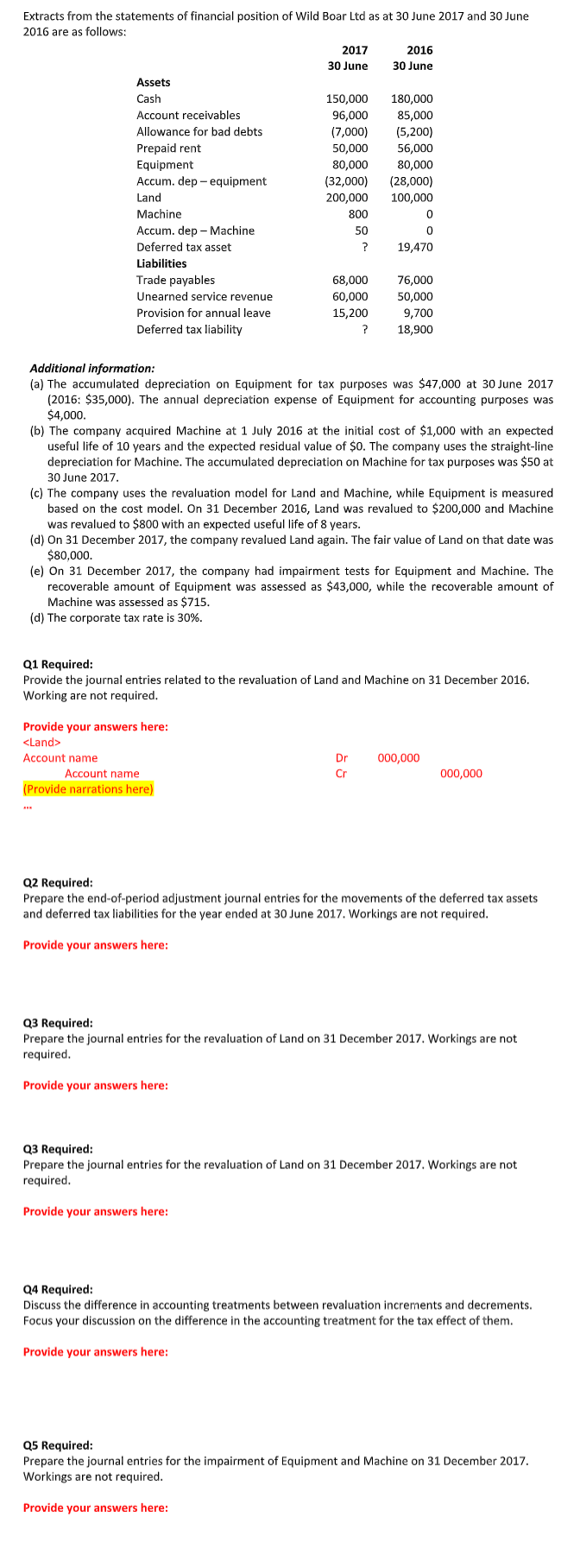

Extracts from the statements of financial position of Wild Boar Ltd as at 30 June 2017 and 30 June 2016 are as follows: 2017 2016 30 June 30 June Assets Cash 150,000 180,000 Account receivables 96,000 85,000 Allowance for bad debts (7,000) (5,200) Prepaid rent 50,000 56,000 Equipment 80,000 80,000 Accum. dep-equipment (32,000) (28,000) Land 200,000 100,000 Machine 800 0 Accum. dep - Machine 50 0 Deferred tax asset ? 19,470 Liabilities Trade payables 68,000 76,000 Unearned service revenue 60,000 50,000 Provision for annual leave 15,200 9,700 Deferred tax liability ? 18,900 Additional information: (a) The accumulated depreciation on Equipment for tax purposes was $47,000 at 30 June 2017 (2016: $35,000). The annual depreciation expense of Equipment for accounting purposes was $4,000. (b) The company acquired Machine at 1 July 2016 at the initial cost of $1,000 with an expected useful life of 10 years and the expected residual value of $0. The company uses the straight-line depreciation for Machine. The accumulated depreciation on Machine for tax purposes was $50 at 30 June 2017 (c) The company uses the revaluation model for Land and Machine, while Equipment is measured based on the cost model. On 31 December 2016, Land was revalued to $200,000 and Machine was revalued to $800 with an expected useful life of 8 years. (d) On 31 December 2017, the company revalued Land again. The fair value of Land on that date was $80,000. (e) On 31 December 2017, the company had impairment tests for Equipment and Machine. The recoverable amount of Equipment was assessed as $43,000, while the recoverable amount of Machine was assessed as $715. (d) The corporate tax rate is 30%. Q1 Required: Provide the journal entries related to the revaluation of Land and Machine on 31 December 2016. Working are not required. Provide your answers here:

Account name Account name (Provide narrations here) Dr Cr 000,000 000,000 Q2 Required: Prepare the end-of-period adjustment journal entries for the movements of the deferred tax assets and deferred tax liabilities for the year ended at 30 June 2017. Workings are not required. Provide your answers here: Q3 Required: Prepare the journal entries for the revaluation of Land on 31 December 2017. Workings are not required. Provide your answers here: Q3 Required: Prepare the journal entries for the revaluation of Land on 31 December 2017. Workings are not required. Provide your answers here: Q4 Required: Discuss the difference in accounting treatments between revaluation increments and decrements. Focus your discussion on the difference in the accounting treatment for the tax effect of them. Provide your answers here: Q5 Required: Prepare the journal entries for the impairment of Equipment and Machine on 31 December 2017. Workings are not required. Provide your answers here