Answered step by step

Verified Expert Solution

Question

1 Approved Answer

it's a business law course Rachel is keen to purchase a new formal dress for her university ball. She finds a suitable black dress known

it's a business law course

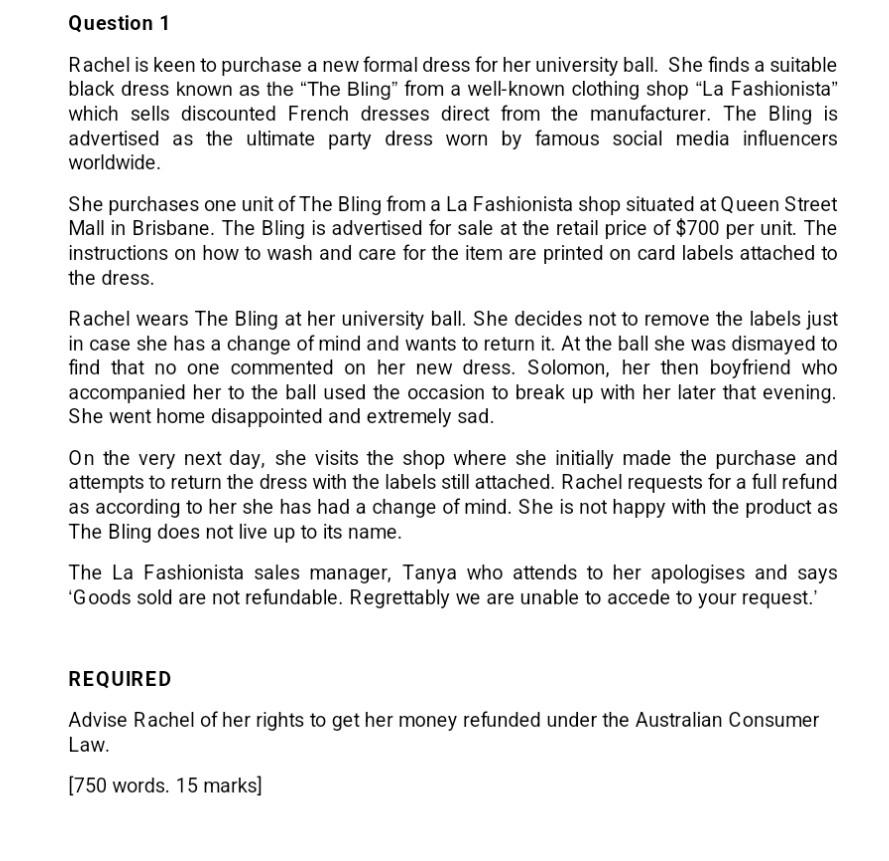

Rachel is keen to purchase a new formal dress for her university ball. She finds a suitable black dress known as the "The Bling" from a well-known clothing shop "La Fashionista" which sells discounted French dresses direct from the manufacturer. The Bling is advertised as the ultimate party dress worn by famous social media influencers worldwide. She purchases one unit of The Bling from a La Fashionista shop situated at Queen Street Mall in Brisbane. The Bling is advertised for sale at the retail price of $700 per unit. The instructions on how to wash and care for the item are printed on card labels attached to the dress. Rachel wears The Bling at her university ball. She decides not to remove the labels just in case she has a change of mind and wants to return it. At the ball she was dismayed to find that no one commented on her new dress. Solomon, her then boyfriend who accompanied her to the ball used the occasion to break up with her later that evening. She went home disappointed and extremely sad. On the very next day, she visits the shop where she initially made the purchase and attempts to return the dress with the labels still attached. Rachel requests for a full refund as according to her she has had a change of mind. She is not happy with the product as The Bling does not live up to its name. The La Fashionista sales manager, Tanya who attends to her apologises and says 'Goods sold are not refundable. Regrettably we are unable to accede to your request.' REQUIRED Advise Rachel of her rights to get her money refunded under the Australian Consumer Law. [750 words. 15 marks]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started