Answered step by step

Verified Expert Solution

Question

1 Approved Answer

it's a complete question please do it A Ltd and B Ltd acquired their shareholdings of 60% of B Ltd and 100% of C Ltd

it's a complete question please do it

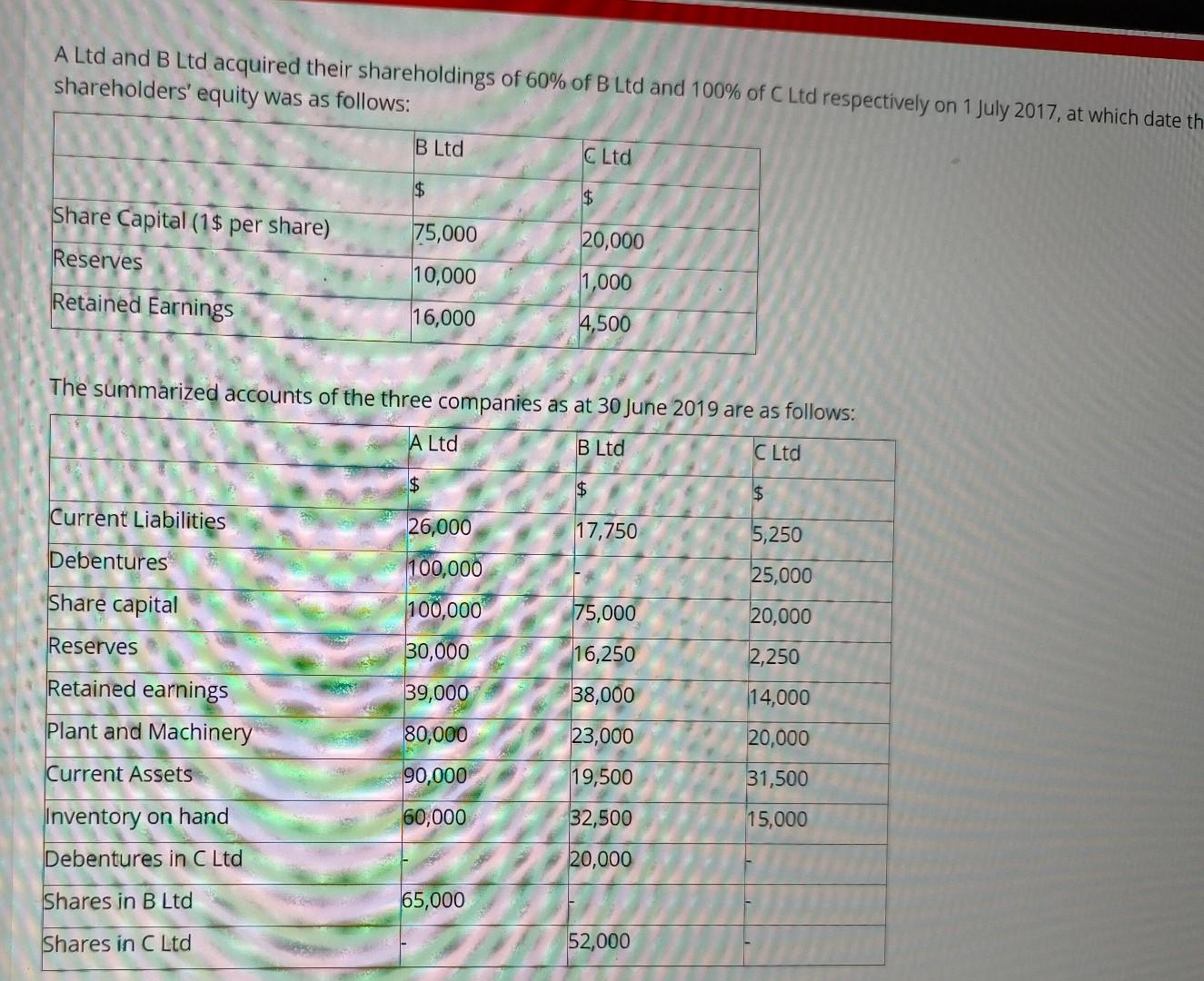

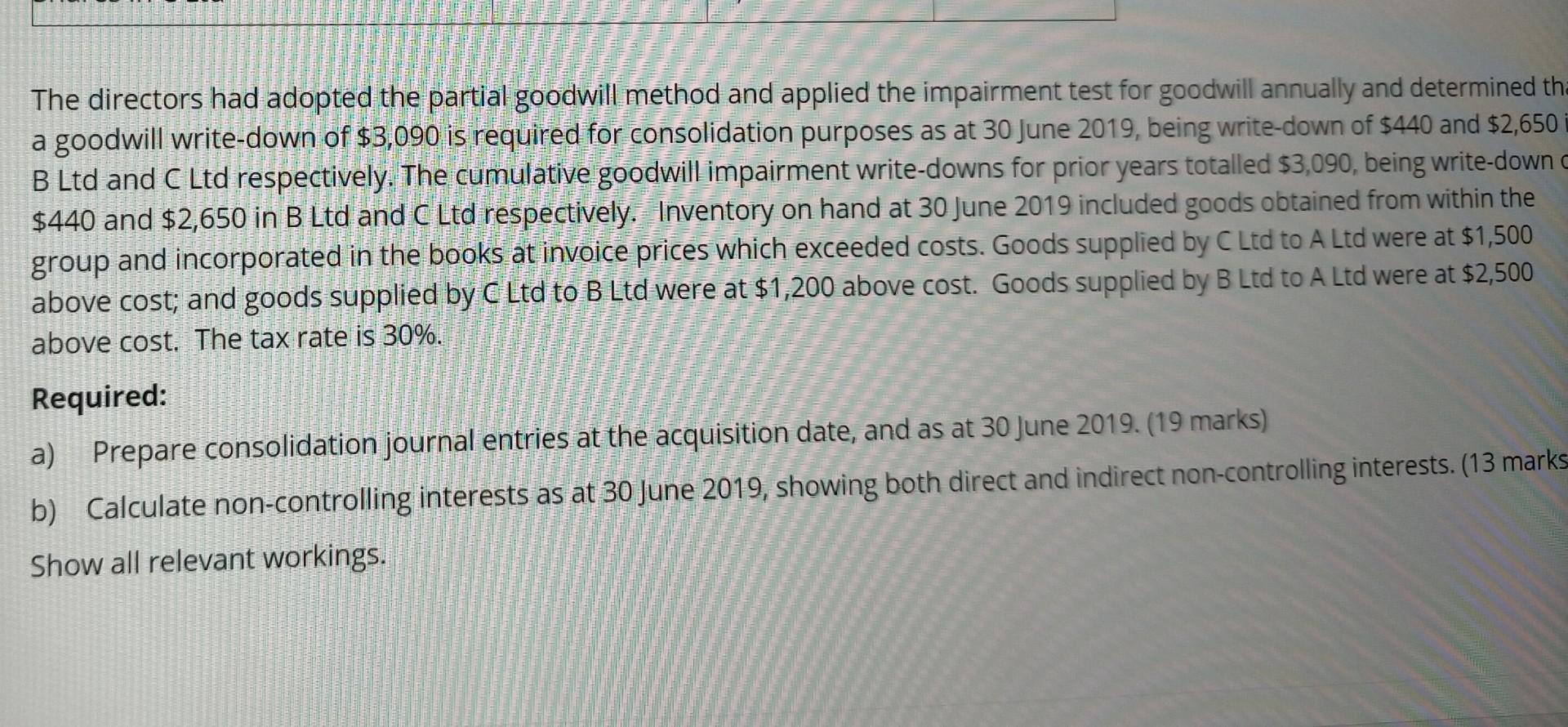

A Ltd and B Ltd acquired their shareholdings of 60% of B Ltd and 100% of C Ltd respectively on 1 July 2017, at which date th shareholders' equity was as follows: B Ltd C Ltd A 75,000 20,000 Share Capital (1$ per share) Reserves Retained Earnings 10,000 1,000 16,000 4,500 The summarized accounts of the three companies as at 30 June 2019 are as follows: A Ltd B Ltd C Ltd $ $ Current Liabilities 26,000 17,750 5,250 Debentures 100,000 25,000 Share capital 100,000 75,000 20,000 Reserves 30,000 2,250 16,250 38,000 39,000 14,000 Retained earnings Plant and Machinery 80,000 23,000 20,000 Current Assets 90,000 19,500 31,500 Inventory on hand 60,000 32,500 15,000 Debentures in C Ltd 20,000 Shares in B Ltd 65,000 Shares in C Ltd 52,000 The directors had adopted the partial goodwill method and applied the impairment test for goodwill annually and determined tha a goodwill write-down of $3,090 is required for consolidation purposes as at 30 June 2019, being write-down of $440 and $2,650 B Ltd and C Ltd respectively. The cumulative goodwill impairment write-downs for prior years totalled $3,090, being write-down $440 and $2,650 in B Ltd and C Ltd respectively. Inventory on hand at 30 June 2019 included goods obtained from within the group and incorporated in the books at invoice prices which exceeded costs. Goods supplied by C Ltd to A Ltd were at $1,500 above cost; and goods supplied by C Ltd to B Ltd were at $1,200 above cost. Goods supplied by B Ltd to A Ltd were at $2,500 above cost. The tax rate is 30%. Required: a) Prepare consolidation journal entries at the acquisition date, and as at 30 June 2019. (19 marks) b) Calculate non-controlling interests as at 30 June 2019, showing both direct and indirect non-controlling interests. (13 marks Show all relevant workings. A Ltd and B Ltd acquired their shareholdings of 60% of B Ltd and 100% of C Ltd respectively on 1 July 2017, at which date th shareholders' equity was as follows: B Ltd C Ltd A 75,000 20,000 Share Capital (1$ per share) Reserves Retained Earnings 10,000 1,000 16,000 4,500 The summarized accounts of the three companies as at 30 June 2019 are as follows: A Ltd B Ltd C Ltd $ $ Current Liabilities 26,000 17,750 5,250 Debentures 100,000 25,000 Share capital 100,000 75,000 20,000 Reserves 30,000 2,250 16,250 38,000 39,000 14,000 Retained earnings Plant and Machinery 80,000 23,000 20,000 Current Assets 90,000 19,500 31,500 Inventory on hand 60,000 32,500 15,000 Debentures in C Ltd 20,000 Shares in B Ltd 65,000 Shares in C Ltd 52,000 The directors had adopted the partial goodwill method and applied the impairment test for goodwill annually and determined tha a goodwill write-down of $3,090 is required for consolidation purposes as at 30 June 2019, being write-down of $440 and $2,650 B Ltd and C Ltd respectively. The cumulative goodwill impairment write-downs for prior years totalled $3,090, being write-down $440 and $2,650 in B Ltd and C Ltd respectively. Inventory on hand at 30 June 2019 included goods obtained from within the group and incorporated in the books at invoice prices which exceeded costs. Goods supplied by C Ltd to A Ltd were at $1,500 above cost; and goods supplied by C Ltd to B Ltd were at $1,200 above cost. Goods supplied by B Ltd to A Ltd were at $2,500 above cost. The tax rate is 30%. Required: a) Prepare consolidation journal entries at the acquisition date, and as at 30 June 2019. (19 marks) b) Calculate non-controlling interests as at 30 June 2019, showing both direct and indirect non-controlling interests. (13 marks Show all relevant workingsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started