Answered step by step

Verified Expert Solution

Question

1 Approved Answer

its a mistake when i was typing the question. its Orange instead of varsity 2. Orange Company owns 90% of the voting stock of Purple,

its a mistake when i was typing the question. its Orange instead of varsity

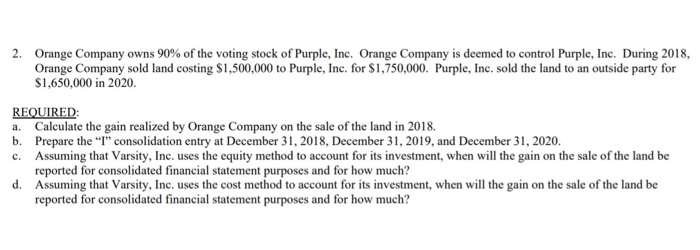

2. Orange Company owns 90% of the voting stock of Purple, Inc. Orange Company is deemed to control Purple, Inc. During 2018, Orange Company sold land costing $1,500,000 to Purple, Inc. for $1,750,000. Purple, Inc. sold the land to an outside party for $1,650,000 in 2020. REQUIRED: a. Calculate the gain realized by Orange Company on the sale of the land in 2018. b. Prepare the "I" consolidation entry at December 31, 2018, December 31, 2019, and December 31, 2020. c. Assuming that Varsity, Inc. uses the equity method to account for its investment, when will the gain on the sale of the land be reported for consolidated financial statement purposes and for how much? d. Assuming that Varsity, Inc. uses the cost method to account for its investment, when will the gain on the sale of the land be reported for consolidated financial statement purposes and for how much Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started