Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Its a question from ACCT1116 course about product line analysis. Its due tomorrow so i would be glad if you could somehow give me the

Its a question from ACCT1116 course about product line analysis. Its due tomorrow so i would be glad if you could somehow give me the answer. thanks

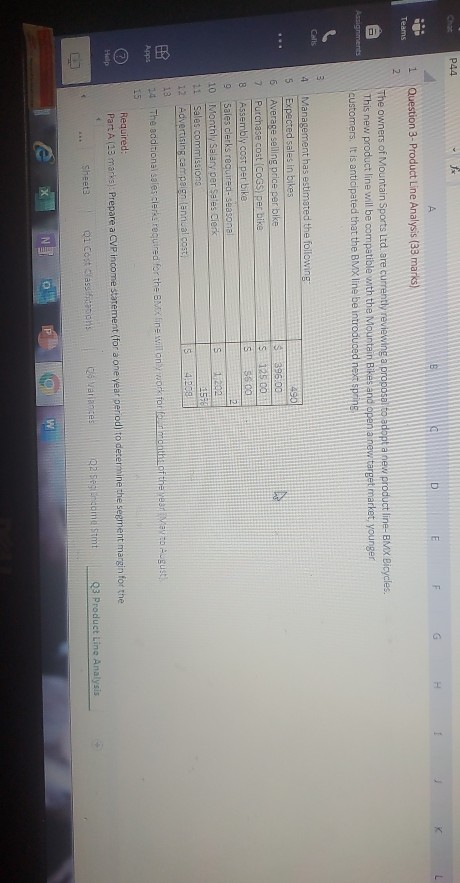

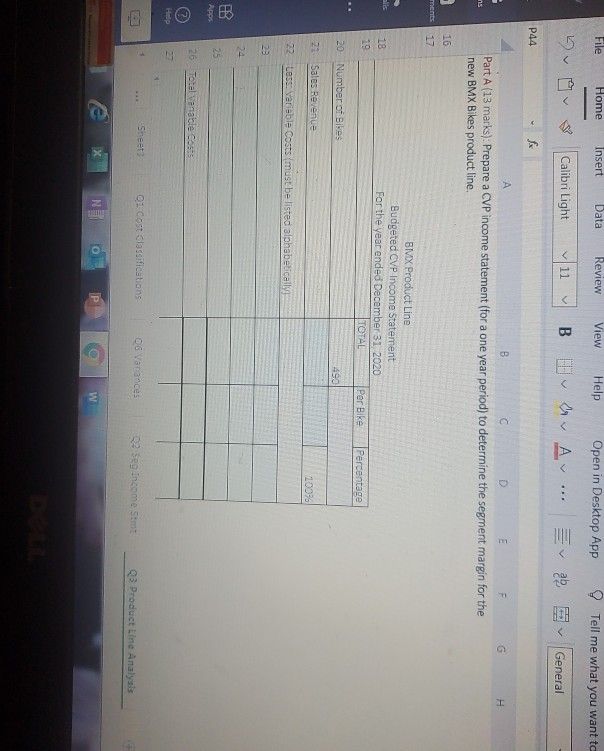

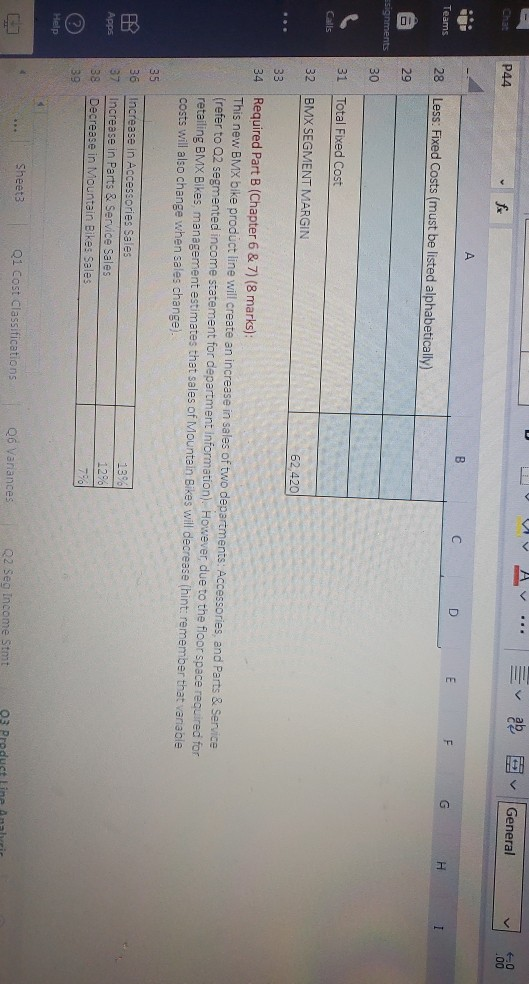

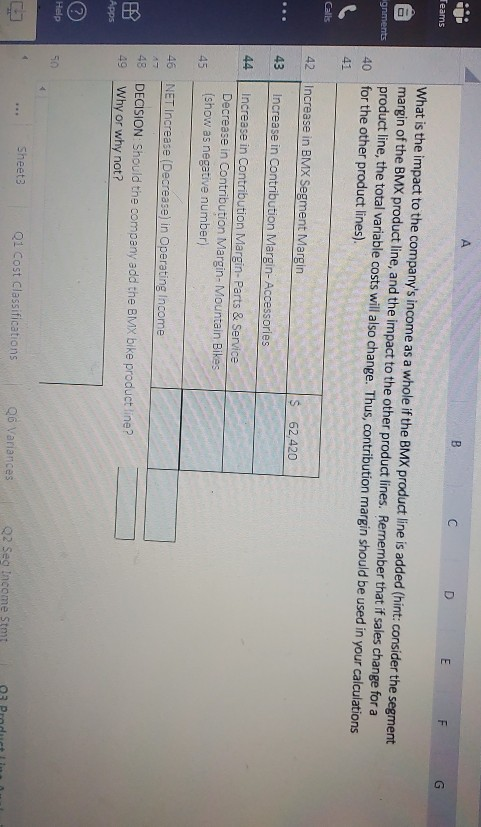

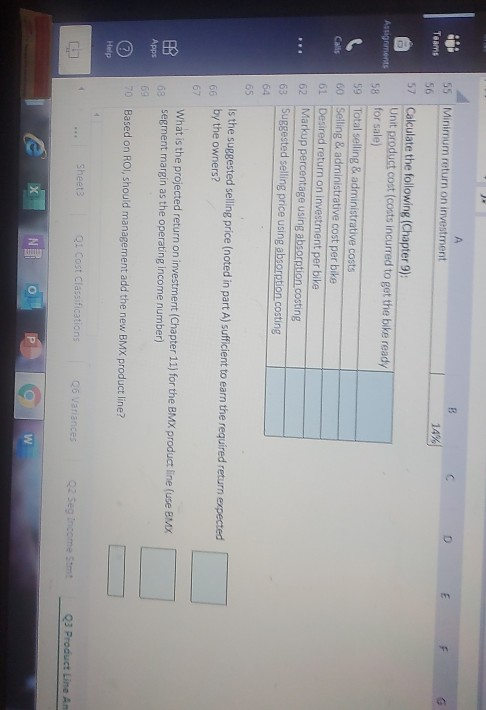

1 Question 3- Product Line Analysis (33 marks) Teams The owners of Mountain Sports Ltd. are currently reviewing a proposal to adopt a new product line-BMX Bicycles. This new product line will be compatible with the Mountain Bikes and open a new target market younger customers. It is anticipated that the BMX line be introduced next spring Assignments 396.08 125.00 4 Management has estimated the following 5 Expected sales in bikes 6 Average selling price per bike 7 Purchase cost Cos) per bike 8 Assembly cost per bike 9 Sales Clerks required-seasonal 10 Monthly Salary per Sales Clerk 11 Sales commissions 12 Advertising campaign annual cost S 1 202 S months of the year Agust 14 The saditional sales clerk required for the BMX line will only work for Required: Part A (13 marks): Prepare a CVP Income statement (for a one year period to determine the segment margin for the Sheet 01 Cost Cassifications Vatices dommt 3 Product Line Analysis File Home Insert Data Calibri Light fx Review vu View B Help O Open in Desktop App A ... 2 Tell me what you want to General P44 Part A (13 marks): Prepare a CVP income statement (for a one year period) to determine the segment margin for the new BMX Bikes product line. BMX Product Line Budgeted CVP Income Statement For the year ended December 31, 2020 TOTAL Per Bike Percentage 20 Number of Bikes Sales Revenue 22 Less: Variable Costs must be listed alphabetically Total vanable costs 5 Sheet Qi Cost Classifications 06 Variances 02 Seg Income Stmt Q3 Product Line Analysis 10 W A. Chat P44 General Teams 28 Less: Fixed Costs (must be listed alphabetically) Esignments 31 Total Fixed Cost Calls 32 BMX SEGMENT MARGIN 62 420 34 Required Part B (Chapter 6 & 7) (8 marks): This new BMX bike product line will create an increase in sales of two departments Accessories, and Parts & Service (refer to a2 segmented income statement for department information). However due to the floor space required for retailing BMX Bikes management estimates that sales of Mountain Bikes will decrease (hint: remember that enable costs will also change when sales change). 1396 36 37 38 39 Increase in Accessories Sales Increase in Parts & Service Sales Decrease in Mountain Bikes Sales 796 ... Sheet3 Q1 Cost Classifications Q6 Variances Q2 Seg Income Stmt 93 Product Line Anal Teams What is the impact to the company's income as a whole if the BMX product line is added (hint: consider the segment margin of the BMX product line, and the impact to the other product lines. Remember that if sales change for a product line, the total variable costs will also change. Thus, contribution margin should be used in your calculations for the other product lines). ignments 40 Calls 42 Increase in BMX Segment Margin US 62,420 Increase in Contribution Margin-Accessories Increase in Contribution Margin-Parts & Service Decrease in Contribution Margin-Mountain Bikes (show as negative number) NET Increase (Decrease) in Operating Income DECISION: Should the company add the BMX bike product line? Why or why not? Apps Help Sheet3 Q1 Cost Classifications Q6 Variances Q2 Seg Income Smt Product line out C D eams E F G 48 DECISION: Should the company add the BMX bike product line? 49 Why or why not? gnments Required Part C: Pricing (12 marks) Assume management has decided to go ahead with offering the BMX product line. The owners of Mountain Sports are concerned about the ability of BMX to cover its fixed costs and provide a good return on investment (ROI). An investment is required for the necessary fixtures, display racks, and inventory. The owners have provided the minimum return on investment below. Use the cost information and unit sales provided in part A above to answer the questions below. Required investment in assets Minimum return on investment S 201 000 - 57 Calculate the following (Chapter 9): Unit product cost costs incurred to get the bike ready sheets Cost Classifications Qovarances 02 Seo Income simt 9 5 Product Line Analysis X NI P W 55 Minimum return on investment Teams 14% 57. Calculate the following (Chapter 9); Unit product cost (costs incurred to get the bike ready 58 for sale) 59 Total selling & administrative costs Selling & administrative cost per bike Desired return on investment per bike Markup percentage using absorption costing Suggested selling price using absorption costing Is the suggested selling price (noted in part A) sufficient to earn the required return expected by the owners? What is the projected return on investment (Chapter 11) for the BMX product line (use BMX segment margin as the operating income number) 70 Based on ROI should management add the new BMX product line? ... Sheet3 Q1 Cost Classifications 06 Variances 02 Seg income simt 03 Product Line A eams C D 70 Based on ROI, should management add the new BMX product line? E F 71 Why or why not? ignments N M Are there any other considerations management should take into account before adding the product line? i O cost clafati var . Seg Income Stmt Q 3 ProductStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started