Its a super clear picture just zoom in

Its a super clear picture just zoom in

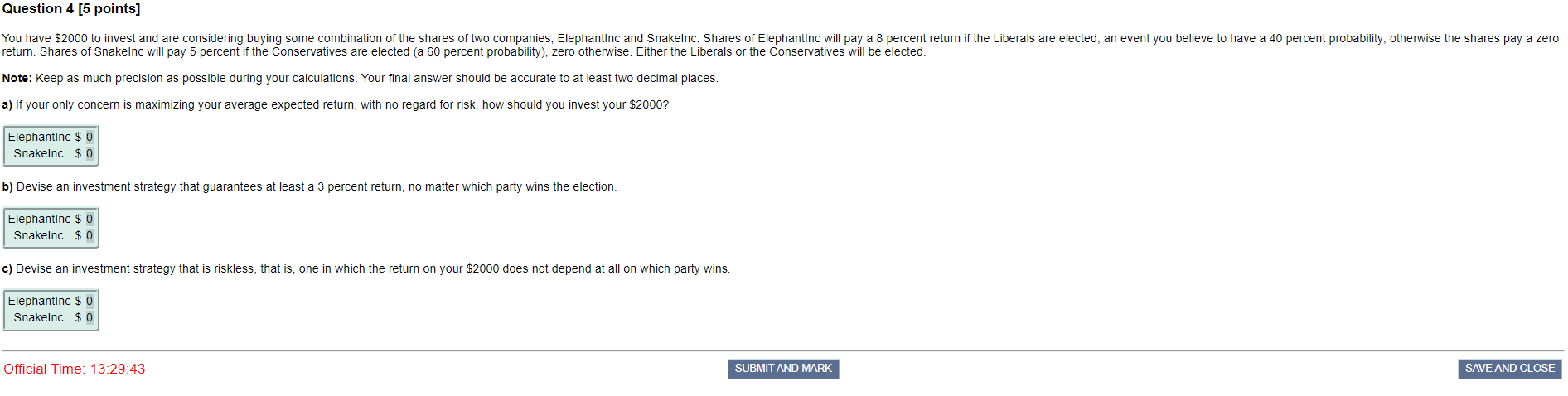

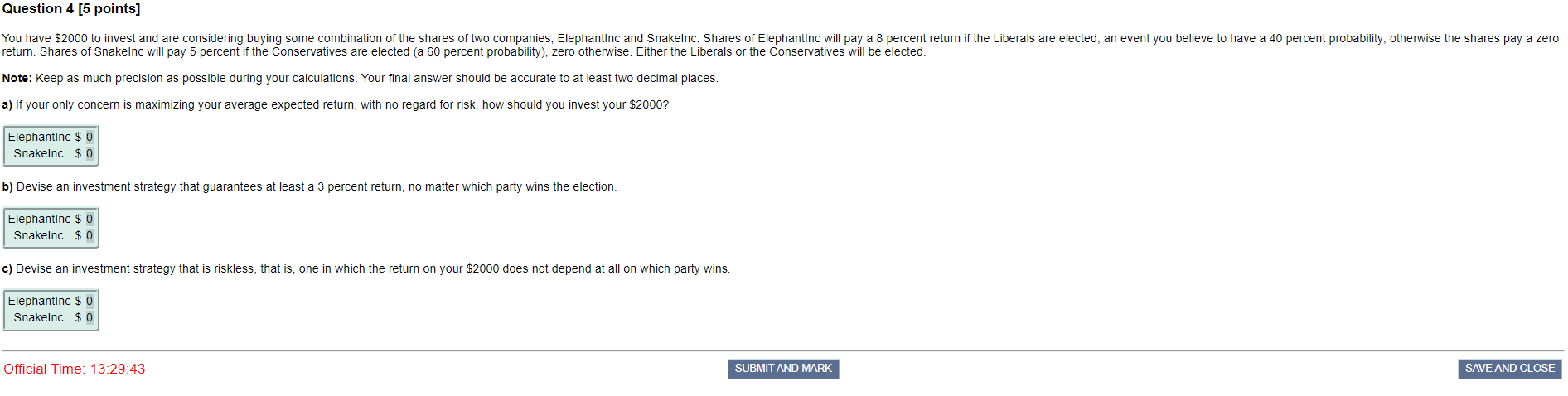

Question 4 [5 points] You have $2000 to invest and are considering buying some combination of the shares of two companies, Elephantinc and Snakelnc. Shares of Elephantinc will pay a 8 percent return if the Liberals are elected, an event you believe to have a 40 percent probability, otherwise the shares pay a zero return. Shares of Snakelnc will pay 5 percent if the Conservatives are elected (a 60 percent probability), zero otherwise. Either the Liberals or the Conservatives will be elected. Note: Keep as much precision as possible during your calculations. Your final answer should be accurate to at least two decimal places. a) If your only concern is maximizing your average expected return, with no regard for risk, how should you invest your $2000? Elephantinc $ 0 Snakelnc $0 b) Devise an investment strategy that guarantees at least a 3 percent return, no matter which party wins the election. Elephantinc $ 0 Snakelnc $0 c) Devise an investment strategy that is riskless, that is, one in which the return on your $2000 does not depend at all on which party wins. Elephantinc $ 0 Snakelnc $ 0 Official Time: 13:29:43 SUBMIT AND MARK SAVE AND CLOSE Question 4 [5 points] You have $2000 to invest and are considering buying some combination of the shares of two companies, Elephantinc and Snakelnc. Shares of Elephantinc will pay a 8 percent return if the Liberals are elected, an event you believe to have a 40 percent probability, otherwise the shares pay a zero return. Shares of Snakelnc will pay 5 percent if the Conservatives are elected (a 60 percent probability), zero otherwise. Either the Liberals or the Conservatives will be elected. Note: Keep as much precision as possible during your calculations. Your final answer should be accurate to at least two decimal places. a) If your only concern is maximizing your average expected return, with no regard for risk, how should you invest your $2000? Elephantinc $ 0 Snakelnc $0 b) Devise an investment strategy that guarantees at least a 3 percent return, no matter which party wins the election. Elephantinc $ 0 Snakelnc $0 c) Devise an investment strategy that is riskless, that is, one in which the return on your $2000 does not depend at all on which party wins. Elephantinc $ 0 Snakelnc $ 0 Official Time: 13:29:43 SUBMIT AND MARK SAVE AND CLOSE

Its a super clear picture just zoom in

Its a super clear picture just zoom in