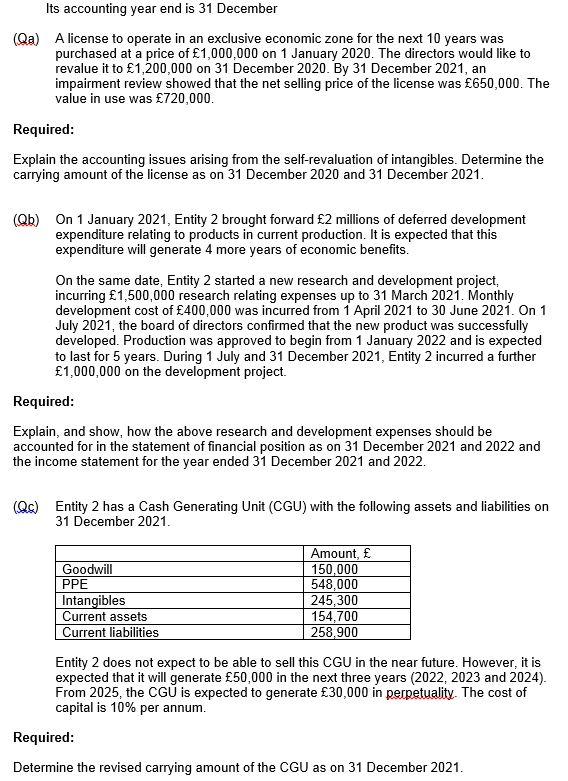

Its accounting year end is 31 December (Qa) A license to operate in an exclusive economic zone for the next 10 years was purchased at a price of 1,000,000 on 1 January 2020. The directors would like to revalue it to 1,200,000 on 31 December 2020. By 31 December 2021, an impairment review showed that the net selling price of the license was 650,000. The value in use was 720,000. Required: Explain the accounting issues arising from the self-revaluation of intangibles. Determine the carrying amount of the license as on 31 December 2020 and 31 December 2021. (Qb) On 1 January 2021, Entity 2 brought forward 2 millions of deferred development expenditure relating to products in current production. It is expected that this expenditure will generate 4 more years of economic benefits. On the same date, Entity 2 started a new research and development project, incurring 1,500,000 research relating expenses up to 31 March 2021. Monthly development cost of 400,000 was incurred from 1 April 2021 to 30 June 2021. On 1 July 2021, the board of directors confirmed that the new product was successfully developed. Production was approved to begin from 1 January 2022 and is expected to last for 5 years. During 1 July and 31 December 2021, Entity 2 incurred a further 1,000,000 on the development project. Required: Explain, and show, how the above research and development expenses should be accounted for in the statement of financial position as on 31 December 2021 and 2022 and the income statement for the year ended 31 December 2021 and 2022. (Qc) Entity 2 has a Cash Generating Unit (CGU) with the following assets and liabilities on 31 December 2021. Amount, 150,000 Goodwill PPE 548,000 245,300 Intangibles Current assets 154,700 Current liabilities 258,900 Entity 2 does not expect to be able to sell this CGU in the near future. However, it is expected that it will generate 50,000 in the next three years (2022, 2023 and 2024). From 2025, the CGU is expected to generate 30,000 in perpetuality. The cost of capital is 10% per annum. Required: Determine the revised carrying amount of the CGU as on 31 December 2021