Answered step by step

Verified Expert Solution

Question

1 Approved Answer

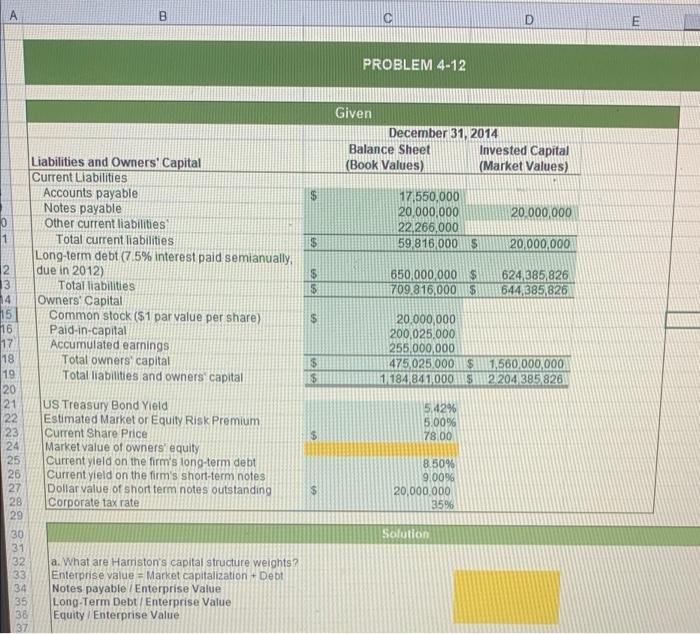

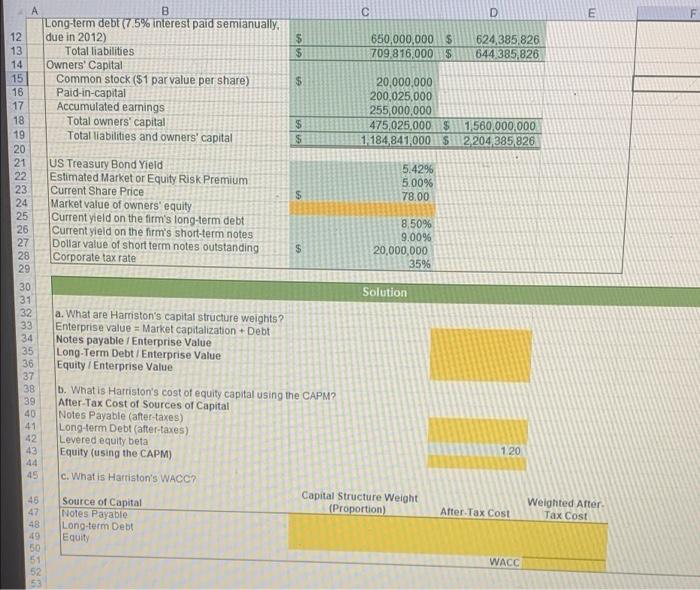

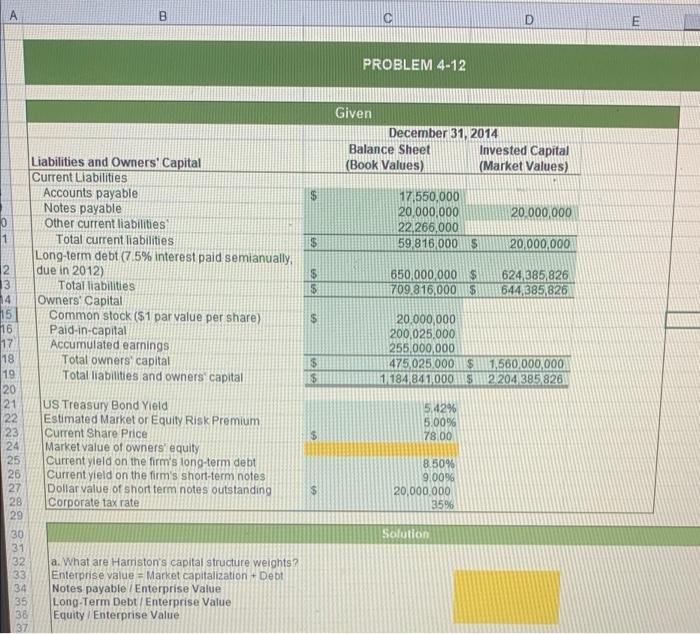

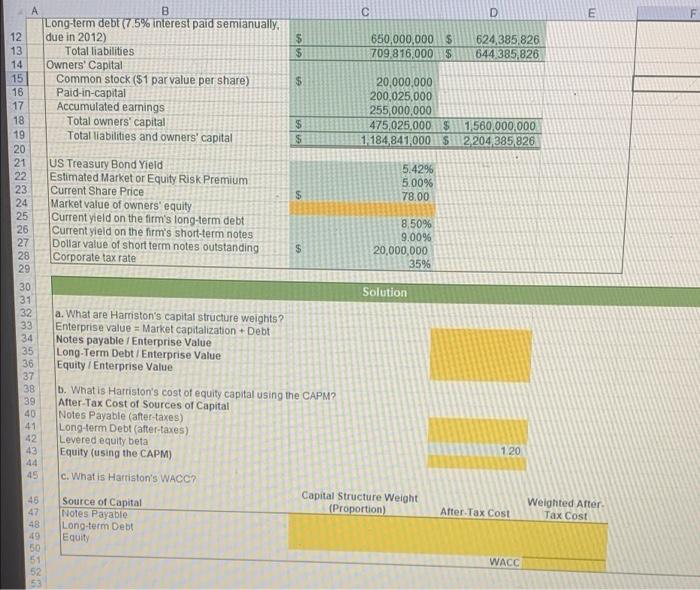

Please help me complete all parts, thank you in advance! A 1 2 13 14 15 16 17 18 1.9 20 21 22 23 24

Please help me complete all parts, thank you in advance!

A 1 2 13 14 15 16 17 18 1.9 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 B Liabilities and Owners' Capital Current Liabilities Accounts payable Notes payable Other current liabilities" Total current liabilities Long-term debt (7.5% interest paid semianually, due in 2012) Total liabilities Owners' Capital Common stock ($1 par value per share) Paid-in-capital Accumulated earnings Total owners' capital Total liabilities and owners' capital US Treasury Bond Yield Estimated Market or Equity Risk Premium Current Share Price: Market value of owners' equity Current yield on the firm's long-term debt Current yield on the firm's short-term notes Dollar value of short term notes outstanding Corporate tax rate a. What are Harriston's capital structure weights? Enterprise value = Market capitalization + Debt Notes payable / Enterprise Value Long-Term Debt / Enterprise Value Equity/Enterprise Value $ 1919 $ IA $ $ C PROBLEM 4-12 Given December 31, 2014 Balance Sheet (Book Values) 17,550,000 20,000,000 22,266,000 59,816,000 $ 650,000,000 $ 709.816,000 $ 5,42% 5.00% 78.00 Invested Capital (Market Values) 8.50% 9.00% 20,000,000 35% D Solution 20,000,000 20,000,000 200,025,000 255,000,000 475,025.000 $ 1,560,000,000 1,184,841,000 $ 2204 385,826 20,000,000 624.385,826 644.385.826 E 12 13 171 15 16 17 18 19 20 21 22 23 A 24 25 14 Owners' Capital 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 45 46 03286656 B Long-term debt (7.5% interest paid semianually. due in 2012) 49 Total liabilities Common stock ($1 par value per share) Paid-in-capital Accumulated earnings Total owners' capital Total liabilities and owners' capital US Treasury Bond Yield Estimated Market or Equity Risk Premium Current Share Price Market value of owners' equity Current yield on the firm's long-term debt Current yield on the firm's short-term notes Dollar value of short term notes outstanding Corporate tax rate a. What are Harriston's capital structure weights? Enterprise value = Market capitalization + Debt Notes payable / Enterprise Value Long-Term Debt / Enterprise Value Equity / Enterprise Value $ Source of Capital Notes Payable Long-term Debt Equity $ $ $ $ $ $ b. What is Harriston's cost of equity capital using the CAPM? After-Tax Cost of Sources of Capital Notes Payable (after-taxes) Long-term Debt (after-taxes) Levered equity beta Equity (using the CAPM) c. What is Harriston's WACC? C 650,000,000 $ 709,816,000 $ 5.42% 5.00% 78.00 20,000,000 200,025,000 255,000,000 475,025,000 $1,560,000,000 1.184,841,000 $ 2,204,385,826 8,50% 9.00% 20,000,000 35% Solution D Capital Structure Weight (Proportion) 624,385,826 644 385,826 1.20 After-Tax Cost WACC E Weighted After. Tax Cost A 1 2 13 14 15 16 17 18 1.9 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 B Liabilities and Owners' Capital Current Liabilities Accounts payable Notes payable Other current liabilities" Total current liabilities Long-term debt (7.5% interest paid semianually, due in 2012) Total liabilities Owners' Capital Common stock ($1 par value per share) Paid-in-capital Accumulated earnings Total owners' capital Total liabilities and owners' capital US Treasury Bond Yield Estimated Market or Equity Risk Premium Current Share Price: Market value of owners' equity Current yield on the firm's long-term debt Current yield on the firm's short-term notes Dollar value of short term notes outstanding Corporate tax rate a. What are Harriston's capital structure weights? Enterprise value = Market capitalization + Debt Notes payable / Enterprise Value Long-Term Debt / Enterprise Value Equity/Enterprise Value $ 1919 $ IA $ $ C PROBLEM 4-12 Given December 31, 2014 Balance Sheet (Book Values) 17,550,000 20,000,000 22,266,000 59,816,000 $ 650,000,000 $ 709.816,000 $ 5,42% 5.00% 78.00 Invested Capital (Market Values) 8.50% 9.00% 20,000,000 35% D Solution 20,000,000 20,000,000 200,025,000 255,000,000 475,025.000 $ 1,560,000,000 1,184,841,000 $ 2204 385,826 20,000,000 624.385,826 644.385.826 E 12 13 171 15 16 17 18 19 20 21 22 23 A 24 25 14 Owners' Capital 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 45 46 03286656 B Long-term debt (7.5% interest paid semianually. due in 2012) 49 Total liabilities Common stock ($1 par value per share) Paid-in-capital Accumulated earnings Total owners' capital Total liabilities and owners' capital US Treasury Bond Yield Estimated Market or Equity Risk Premium Current Share Price Market value of owners' equity Current yield on the firm's long-term debt Current yield on the firm's short-term notes Dollar value of short term notes outstanding Corporate tax rate a. What are Harriston's capital structure weights? Enterprise value = Market capitalization + Debt Notes payable / Enterprise Value Long-Term Debt / Enterprise Value Equity / Enterprise Value $ Source of Capital Notes Payable Long-term Debt Equity $ $ $ $ $ $ b. What is Harriston's cost of equity capital using the CAPM? After-Tax Cost of Sources of Capital Notes Payable (after-taxes) Long-term Debt (after-taxes) Levered equity beta Equity (using the CAPM) c. What is Harriston's WACC? C 650,000,000 $ 709,816,000 $ 5.42% 5.00% 78.00 20,000,000 200,025,000 255,000,000 475,025,000 $1,560,000,000 1.184,841,000 $ 2,204,385,826 8,50% 9.00% 20,000,000 35% Solution D Capital Structure Weight (Proportion) 624,385,826 644 385,826 1.20 After-Tax Cost WACC E Weighted After. Tax Cost

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started