Answered step by step

Verified Expert Solution

Question

1 Approved Answer

It's all one task, please, do it full. thanks A U.S. company is considering entering into a currency swap transaction in which the company pays

It's all one task, please, do it full. thanks

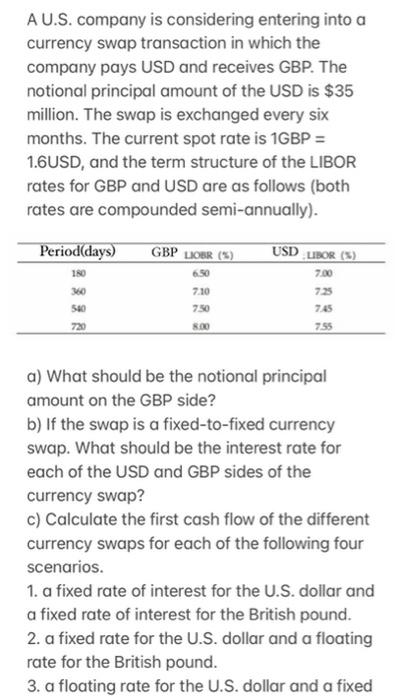

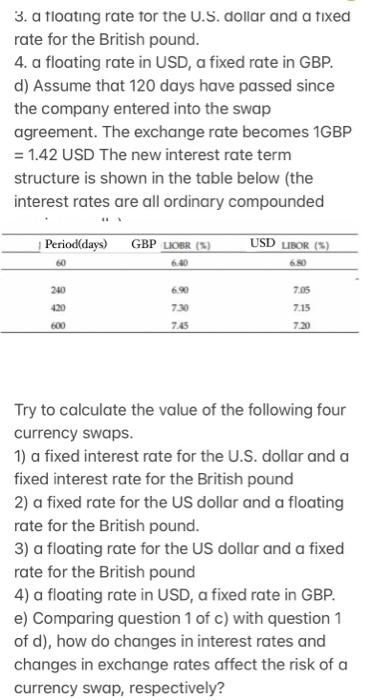

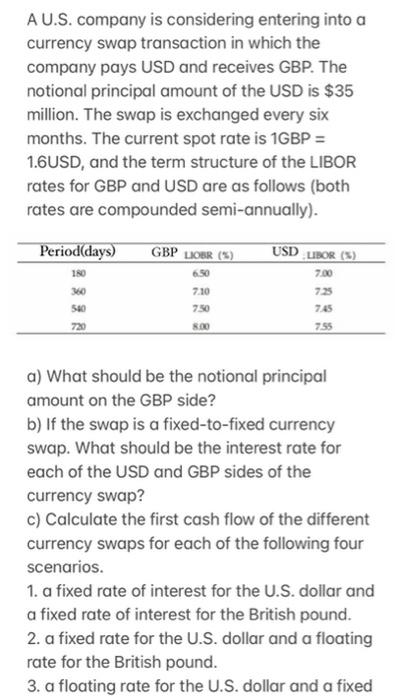

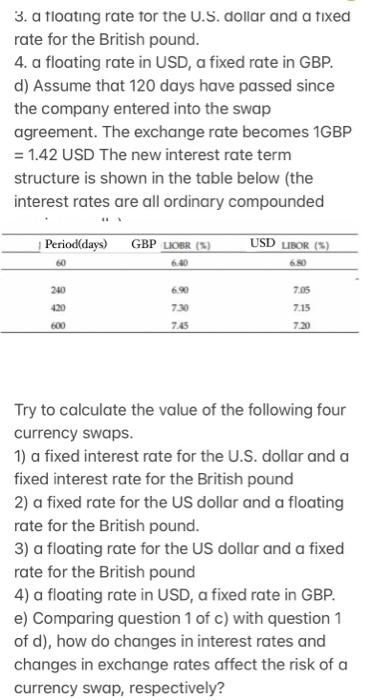

A U.S. company is considering entering into a currency swap transaction in which the company pays USD and receives GBP. The notional principal amount of the USD is $35 million. The swap is exchanged every six months. The current spot rate is 1GBP= 1.6USD, and the term structure of the LIBOR rates for GBP and USD are as follows (both rates are compounded semi-annually). a) What should be the notional principal amount on the GBP side? b) If the swap is a fixed-to-fixed currency swap. What should be the interest rate for each of the USD and GBP sides of the currency swap? c) Calculate the first cash flow of the different currency swaps for each of the following four scenarios. 1. a fixed rate of interest for the U.S. dollar and a fixed rate of interest for the British pound. 2. a fixed rate for the U.S. dollar and a floating rate for the British pound. 3. a floating rate for the U.S. dollar and a fixed 3. a tloating rate tor the U.S. dollar and a tixed rate for the British pound. 4. a floating rate in USD, a fixed rate in GBP. d) Assume that 120 days have passed since the company entered into the swap agreement. The exchange rate becomes 1GBP =1.42 USD The new interest rate term structure is shown in the table below (the interest rates are all ordinary compounded Try to calculate the value of the following four currency swaps. 1) a fixed interest rate for the U.S. dollar and a fixed interest rate for the British pound 2) a fixed rate for the US dollar and a floating rate for the British pound. 3) a floating rate for the US dollar and a fixed rate for the British pound 4) a floating rate in USD, a fixed rate in GBP. e) Comparing question 1 of c) with question 1 of d), how do changes in interest rates and changes in exchange rates affect the risk of a currency swap, respectively? A U.S. company is considering entering into a currency swap transaction in which the company pays USD and receives GBP. The notional principal amount of the USD is $35 million. The swap is exchanged every six months. The current spot rate is 1GBP= 1.6USD, and the term structure of the LIBOR rates for GBP and USD are as follows (both rates are compounded semi-annually). a) What should be the notional principal amount on the GBP side? b) If the swap is a fixed-to-fixed currency swap. What should be the interest rate for each of the USD and GBP sides of the currency swap? c) Calculate the first cash flow of the different currency swaps for each of the following four scenarios. 1. a fixed rate of interest for the U.S. dollar and a fixed rate of interest for the British pound. 2. a fixed rate for the U.S. dollar and a floating rate for the British pound. 3. a floating rate for the U.S. dollar and a fixed 3. a tloating rate tor the U.S. dollar and a tixed rate for the British pound. 4. a floating rate in USD, a fixed rate in GBP. d) Assume that 120 days have passed since the company entered into the swap agreement. The exchange rate becomes 1GBP =1.42 USD The new interest rate term structure is shown in the table below (the interest rates are all ordinary compounded Try to calculate the value of the following four currency swaps. 1) a fixed interest rate for the U.S. dollar and a fixed interest rate for the British pound 2) a fixed rate for the US dollar and a floating rate for the British pound. 3) a floating rate for the US dollar and a fixed rate for the British pound 4) a floating rate in USD, a fixed rate in GBP. e) Comparing question 1 of c) with question 1 of d), how do changes in interest rates and changes in exchange rates affect the risk of a currency swap, respectively

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started