Answered step by step

Verified Expert Solution

Question

1 Approved Answer

it's answered at the end Prepare the Manufacturing Overhead Budget assuming: 1. The supervisor salaries are $42,000 per quarter. 2. The indirect material is expected

it's answered at the end

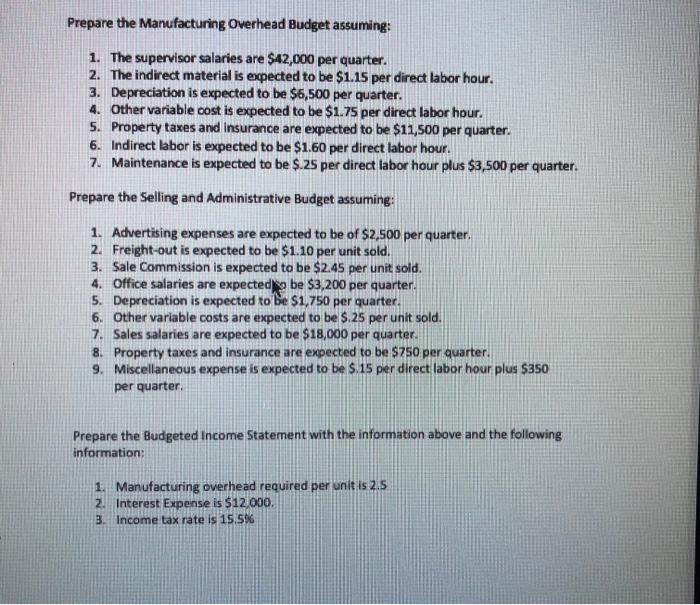

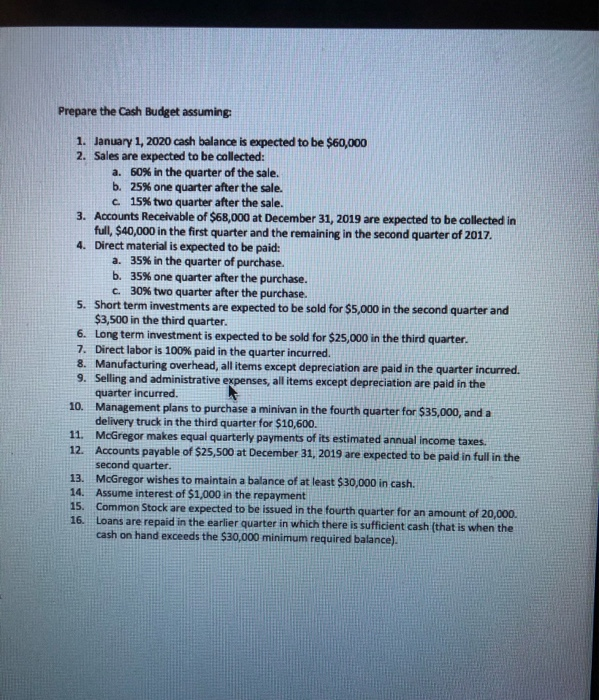

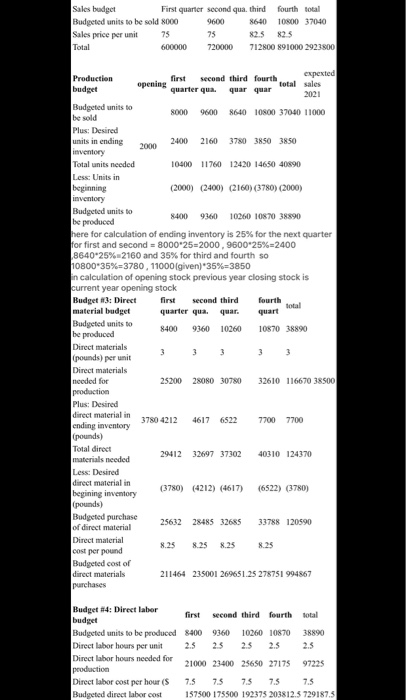

Prepare the Manufacturing Overhead Budget assuming: 1. The supervisor salaries are $42,000 per quarter. 2. The indirect material is expected to be $1.15 per direct labor hour. 3. Depreciation is expected to be $6,500 per quarter. 4. Other variable cost is expected to be $1.75 per direct labor hour. 5. Property taxes and insurance are expected to be $11,500 per quarter. 6. Indirect labor is expected to be $1.60 per direct labor hour. 7. Maintenance is expected to be $.25 per direct labor hour plus $3,500 per quarter. Prepare the Selling and Administrative Budget assuming: 1. Advertising expenses are expected to be of $2,500 per quarter. 2. Freight-out is expected to be $1.10 per unit sold. 3. Sale Commission is expected to be $2.45 per unit sold. 4. Office salaries are expected to be $3,200 per quarter. 5. Depreciation is expected to be $1,750 per quarter. 6. Other variable costs are expected to be $.25 per unit sold. 7. Sales salaries are expected to be $18,000 per quarter. 8. Property taxes and insurance are expected to be $750 per quarter. 9. Miscellaneous expense is expected to be 5.15 per direct labor hour plus $350 per quarter. Prepare the Budgeted Income Statement with the information above and the following information: 1. Manufacturing overhead required per unit is 2.5 2. Interest Expense is $12.000. 3. Income tax rate is 15.5% Prepare the Cash Budget assuming 1. January 1, 2020 cash balance is expected to be $60,000 2. Sales are expected to be collected: a. 60% in the quarter of the sale. b. 25% one quarter after the sale. c. 15% two quarter after the sale. 3. Accounts Receivable of $68,000 at December 31, 2019 are expected to be collected in full, $40,000 in the first quarter and the remaining in the second quarter of 2017. 4. Direct material is expected to be paid: a. 35% in the quarter of purchase. b. 35% one quarter after the purchase. c. 30% two quarter after the purchase. 5. Short term investments are expected to be sold for $5,000 in the second quarter and $3,500 in the third quarter. 6. Long term investment is expected to be sold for $25,000 in the third quarter. 7. Direct labor is 100% paid in the quarter incurred. 8. Manufacturing overhead, all items except depreciation are paid in the quarter incurred. 9. Selling and administrative expenses, all items except depreciation are paid in the quarter incurred. 10. Management plans to purchase a minivan in the fourth quarter for $35,000, and a delivery truck in the third quarter for $10,600. 11. McGregor makes equal quarterly payments of its estimated annual income taxes. 12. Accounts payable of $25,500 at December 31, 2019 are expected to be paid in full in the second quarter. 13. McGregor wishes to maintain a balance of at least $30,000 in cash. 14. Assume interest of $1,000 in the repayment 15. Common Stock are expected to be issued in the fourth quarter for an amount of 20,000. 16. Loans are repaid in the earlier quarter in which there is sufficient cash (that is when the cash on hand exceeds the $30,000 minimum required balance). Sales budget First quarter second qua third fourth total Budgeted units to be sold 8000 9600 8640 10800 37040 Sales price per unit 75 75 82.5 825 Total 600000 720000 712800 891000 2923800 Production first second third fourth experted budget opening quaret qua. total sales quar quar 2021 Budgeted units to 8000 9600 be sold 8640 10800 37040 11000 Plus: Desired units in ending 2000 2400 2160 3780 3850 3850 inventory Total units needed 10400 11760 12420 14650 40890 Less: Units in beginning (2000) (2400) (2160)(3780) (2000) inventory Budgeted units to 8400 9360 10260 10870 38890 be produced here for calculation of ending inventory is 25% for the next quarter for first and second = 8000'25=2000, 9600'25%=2400 8640-25% 2160 and 35% for third and fourth so 10800-35%=3780, 11000 (given) 35%=3850 in calculation of opening stock previous year closing stock is current year opening stock Budget 3: Direct first second third fourth material budget quarter quaquar. quart Budgeted units to be produced 8400 9360 10260 10870 38890 Direct materials (pounds) per unit Direct materials needed for 25200 28080 30780 32610 116670 38500 production Plus: Desired direct material in 3780 4212 4617 6522 7700 7700 ending inventory (pounds) Total direct materials needed 2941232697 37302 40310 124370 Less: Desired direct material in begining inventory (3780) (4212) (4617) (6522) (3780) (pounds) Budgeted purchase 25632 28485 32685 of direct material 33788 120590 Direct material 8.25 8.25 8.25 8.25 cost per pound Budgeted cost of direct materials 211464 235001 269651.25 278751 994867 purchases Budget #4: Direct laber first second third fourth total budget Budgeted units to be produced 8400 9360 10260 10870 38890 Direct labor hours per unit 2.5 25 2.5 2.5 Direct labor hours needed for 21000 23400 25650 2717597225 production Direct labor cost per hour (S 7.5 7.5 7.5 7.5 7.5 Budgeted direct labor cost 157500 175500 192375 203812.5 729187.5 Prepare the Manufacturing Overhead Budget assuming: 1. The supervisor salaries are $42,000 per quarter. 2. The indirect material is expected to be $1.15 per direct labor hour. 3. Depreciation is expected to be $6,500 per quarter. 4. Other variable cost is expected to be $1.75 per direct labor hour. 5. Property taxes and insurance are expected to be $11,500 per quarter. 6. Indirect labor is expected to be $1.60 per direct labor hour. 7. Maintenance is expected to be $.25 per direct labor hour plus $3,500 per quarter. Prepare the Selling and Administrative Budget assuming: 1. Advertising expenses are expected to be of $2,500 per quarter. 2. Freight-out is expected to be $1.10 per unit sold. 3. Sale Commission is expected to be $2.45 per unit sold. 4. Office salaries are expected to be $3,200 per quarter. 5. Depreciation is expected to be $1,750 per quarter. 6. Other variable costs are expected to be $.25 per unit sold. 7. Sales salaries are expected to be $18,000 per quarter. 8. Property taxes and insurance are expected to be $750 per quarter. 9. Miscellaneous expense is expected to be 5.15 per direct labor hour plus $350 per quarter. Prepare the Budgeted Income Statement with the information above and the following information: 1. Manufacturing overhead required per unit is 2.5 2. Interest Expense is $12.000. 3. Income tax rate is 15.5% Prepare the Cash Budget assuming 1. January 1, 2020 cash balance is expected to be $60,000 2. Sales are expected to be collected: a. 60% in the quarter of the sale. b. 25% one quarter after the sale. c. 15% two quarter after the sale. 3. Accounts Receivable of $68,000 at December 31, 2019 are expected to be collected in full, $40,000 in the first quarter and the remaining in the second quarter of 2017. 4. Direct material is expected to be paid: a. 35% in the quarter of purchase. b. 35% one quarter after the purchase. c. 30% two quarter after the purchase. 5. Short term investments are expected to be sold for $5,000 in the second quarter and $3,500 in the third quarter. 6. Long term investment is expected to be sold for $25,000 in the third quarter. 7. Direct labor is 100% paid in the quarter incurred. 8. Manufacturing overhead, all items except depreciation are paid in the quarter incurred. 9. Selling and administrative expenses, all items except depreciation are paid in the quarter incurred. 10. Management plans to purchase a minivan in the fourth quarter for $35,000, and a delivery truck in the third quarter for $10,600. 11. McGregor makes equal quarterly payments of its estimated annual income taxes. 12. Accounts payable of $25,500 at December 31, 2019 are expected to be paid in full in the second quarter. 13. McGregor wishes to maintain a balance of at least $30,000 in cash. 14. Assume interest of $1,000 in the repayment 15. Common Stock are expected to be issued in the fourth quarter for an amount of 20,000. 16. Loans are repaid in the earlier quarter in which there is sufficient cash (that is when the cash on hand exceeds the $30,000 minimum required balance). Sales budget First quarter second qua third fourth total Budgeted units to be sold 8000 9600 8640 10800 37040 Sales price per unit 75 75 82.5 825 Total 600000 720000 712800 891000 2923800 Production first second third fourth experted budget opening quaret qua. total sales quar quar 2021 Budgeted units to 8000 9600 be sold 8640 10800 37040 11000 Plus: Desired units in ending 2000 2400 2160 3780 3850 3850 inventory Total units needed 10400 11760 12420 14650 40890 Less: Units in beginning (2000) (2400) (2160)(3780) (2000) inventory Budgeted units to 8400 9360 10260 10870 38890 be produced here for calculation of ending inventory is 25% for the next quarter for first and second = 8000'25=2000, 9600'25%=2400 8640-25% 2160 and 35% for third and fourth so 10800-35%=3780, 11000 (given) 35%=3850 in calculation of opening stock previous year closing stock is current year opening stock Budget 3: Direct first second third fourth material budget quarter quaquar. quart Budgeted units to be produced 8400 9360 10260 10870 38890 Direct materials (pounds) per unit Direct materials needed for 25200 28080 30780 32610 116670 38500 production Plus: Desired direct material in 3780 4212 4617 6522 7700 7700 ending inventory (pounds) Total direct materials needed 2941232697 37302 40310 124370 Less: Desired direct material in begining inventory (3780) (4212) (4617) (6522) (3780) (pounds) Budgeted purchase 25632 28485 32685 of direct material 33788 120590 Direct material 8.25 8.25 8.25 8.25 cost per pound Budgeted cost of direct materials 211464 235001 269651.25 278751 994867 purchases Budget #4: Direct laber first second third fourth total budget Budgeted units to be produced 8400 9360 10260 10870 38890 Direct labor hours per unit 2.5 25 2.5 2.5 Direct labor hours needed for 21000 23400 25650 2717597225 production Direct labor cost per hour (S 7.5 7.5 7.5 7.5 7.5 Budgeted direct labor cost 157500 175500 192375 203812.5 729187.5 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started