Question

Its been half a year and Lidias business has really taken off. She secured her loan and has started accepting more clients, which in turn

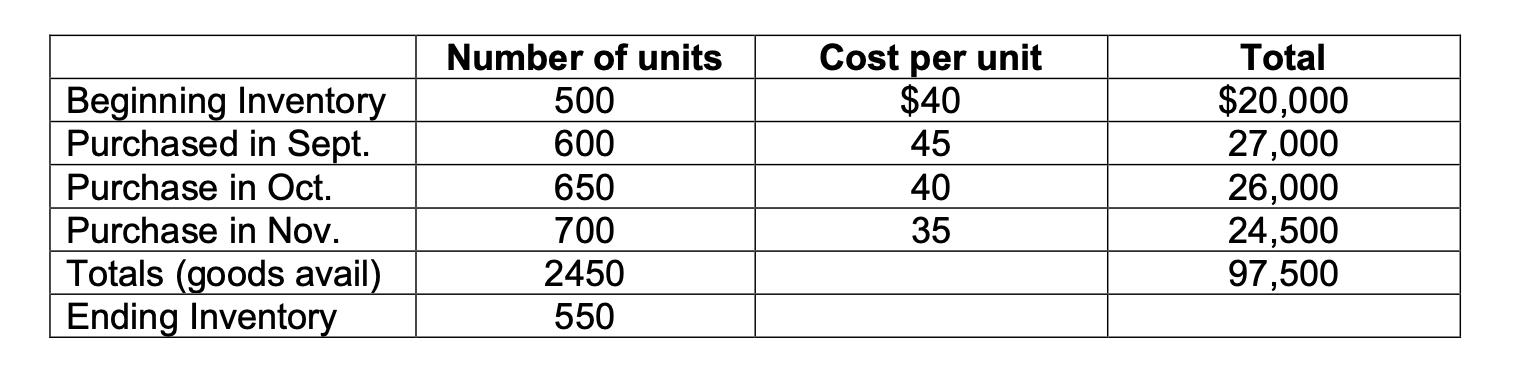

It’s been half a year and Lidia’s business has really taken off. She secured her loan and has started accepting more clients, which in turn means more sales. To help with organization, she’s started selling a lot more containers and baskets. Lidia has a large inventory of baskets that are all different sizes, but each unit is very similar in nature. She’d like to determine a better way to cost her basket inventory because her current method is causing too much loss and she cannot afford to continue down this path. She has provided you with the information below and would like for you to calculate the cost of goods sold and ending inventory using all three cost allocation methods (FIFO, LIFO, and Weighted Average). Use the periodic method and be sure to show all of your work to ensure Lidia can make the best decision.

Beginning Inventory Purchased in Sept. Purchase in Oct. Purchase in Nov. Totals (goods avail) Ending Inventory Number of units 500 600 650 700 2450 550 Cost per unit $40 45 40 35 Total $20,000 27,000 26,000 24,500 97,500

Step by Step Solution

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started