Answered step by step

Verified Expert Solution

Question

1 Approved Answer

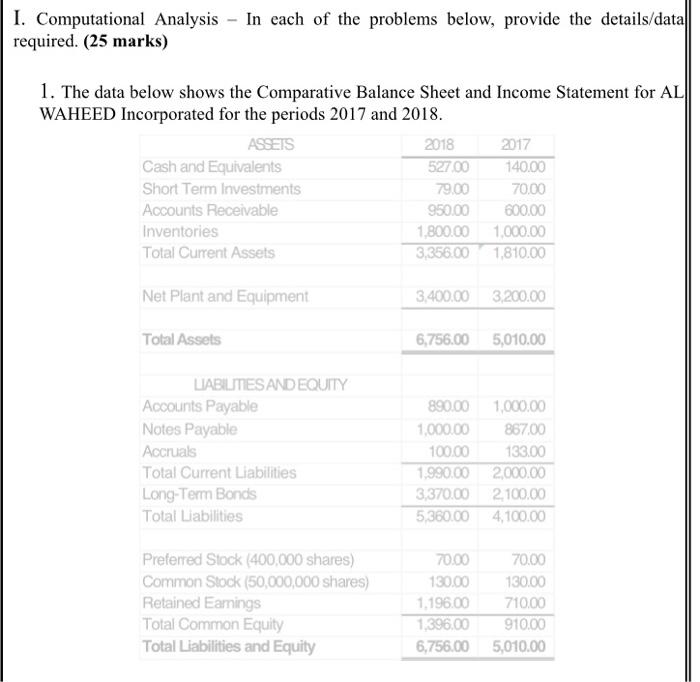

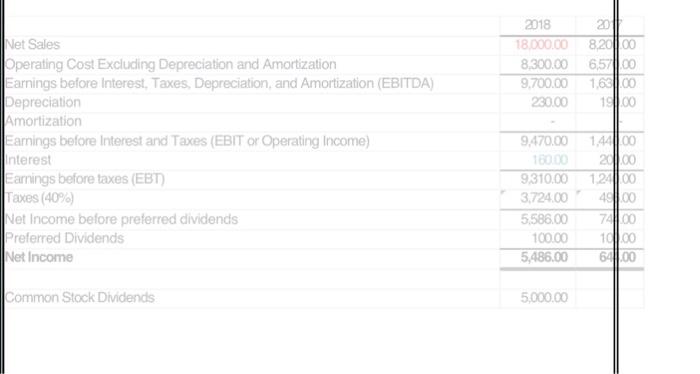

its clear. I. Computational Analysis - In each of the problems below, provide the details/data|| required. (25 marks) 1. The data below shows the Comparative

its clear.

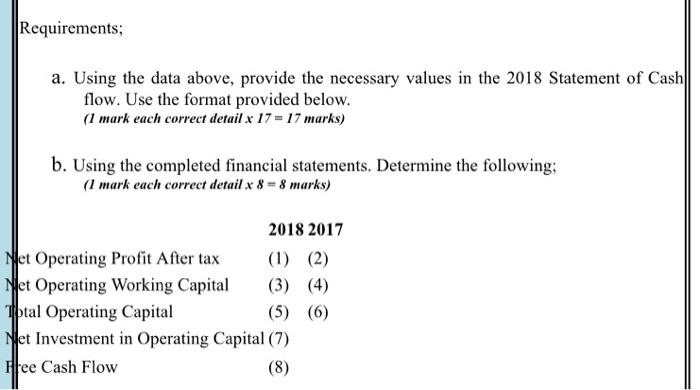

I. Computational Analysis - In each of the problems below, provide the details/data|| required. (25 marks) 1. The data below shows the Comparative Balance Sheet and Income Statement for AL WAHEED Incorporated for the periods 2017 and 2018. ASSETS 2018 2017 Cash and Equivalents 527.00 140.00 Short Term Investments 79.00 70.00 Accounts Receivable 950.00 600.00 Inventories 1,800.00 1,000.00 Total Current Assets 3,356.00 1,810.00 Net Plant and Equipment 3,400.00 3,200.00 Total Assets 6,756.00 5,010.00 LIABILITIES AND EQUITY Accounts Payable Notes Payable Accruals Total Current Liabilities Long-Term Bonds Total Liabilities 890.00 1,000.00 1,000.00 867.00 100.00 133.00 1,990.00 2,000.00 3,370.00 2,100.00 5,360.00 4,100.00 Preferred Stock (400,000 shares) Common Stock (50,000,000 shares) Retained Eamings Total Common Equity Total Liabilities and Equity 70.00 130.00 1.196.00 1.396.00 6,756.00 70.00 130.00 710.00 910.00 5,010.00 2018 18.000.00 8,300.00 9.700.00 230.00 8.2000 6,500 1.600 1600 Net Sales Operating Cost Excluding Depreciation and Amortization Earnings before Interest, Taxes, Depreciation, and Amortization (EBITDA) Pepreciation Amortization Earnings before Interest and Taxes (EBIT or Operating Income) Interest Earnings before taxes (EBT) Taxes (40%) Net Income before preferred dividends Preferred Dividends Net Income 9.470.00 160.00 9310.00 3,724.00 5,586.00 100.00 5,486.00 1.4 100 2011.00 1200 4511.00 74100 1000 64.00 Common Stock Dividends 5,000.00 Requirements; a. Using the data above, provide the necessary values in the 2018 Statement of Cash flow. Use the format provided below. (1 mark each correct detail x 17 = 17 marks) b. Using the completed financial statements. Determine the following: (1 mark each correct detail x 8 = 8 marks) 2018 2017 Net Operating Profit After tax (1) (2) Net Operating Working Capital (3) (4) Total Operating Capital (5) (6) Net Investment in Operating Capital (7) Hee Cash Flow (8) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started