Answered step by step

Verified Expert Solution

Question

1 Approved Answer

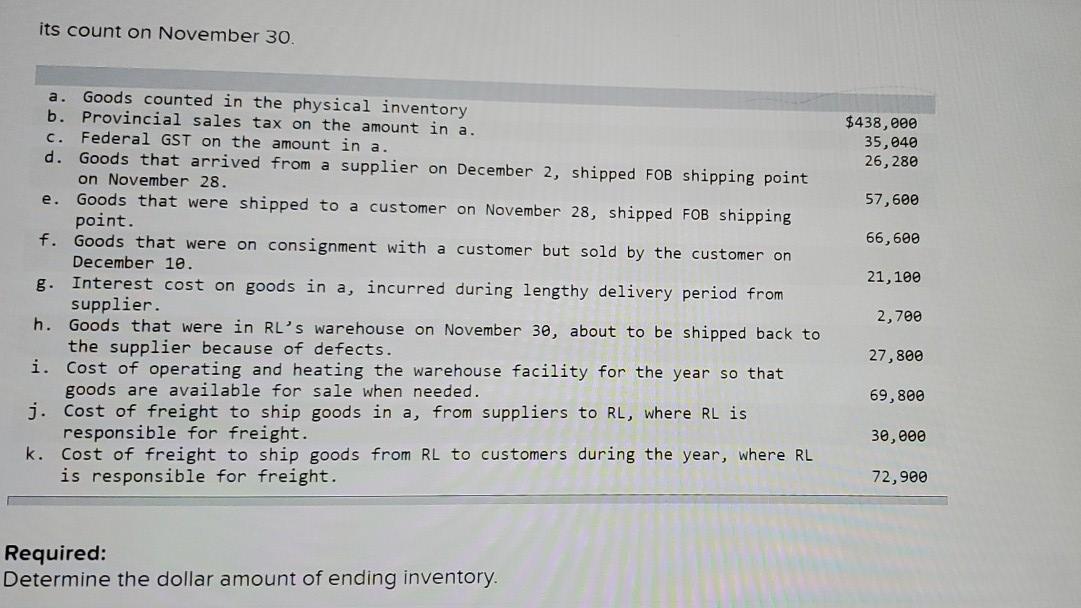

its count on November 30. C. $438,000 35, 040 26,280 57,600 66,600 21,100 a. Goods counted in the physical inventory b. Provincial sales tax on

its count on November 30. C. $438,000 35, 040 26,280 57,600 66,600 21,100 a. Goods counted in the physical inventory b. Provincial sales tax on the amount in a. Federal GST on the amount in a. d. Goods that arrived from a supplier on December 2, shipped FOB shipping point on November 28. e. Goods that were shipped to a customer on November 28, shipped FOB shipping point. f. Goods that were on consignment with a customer but sold by the customer on December 10. Interest cost on goods in a, incurred during lengthy delivery period from supplier. h. Goods that were in RL's warehouse on November 30, about to be shipped back to the supplier because of defects. i. Cost of operating and heating the warehouse facility for the year so that goods are available for sale when needed. j. Cost of freight to ship goods in a, from suppliers to RL, where RL is responsible for freight. k. Cost of freight to ship goods from RL to customers during the year, where RL is responsible for freight. 2,700 27,800 69,800 30,000 72,900 Required: Determine the dollar amount of ending inventory

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started