Question: Its for filling out a pretend 1040, schedule 3, schedule 8812, form 8863, and a schedule EIC. Filing as Head of Household with one dependant.

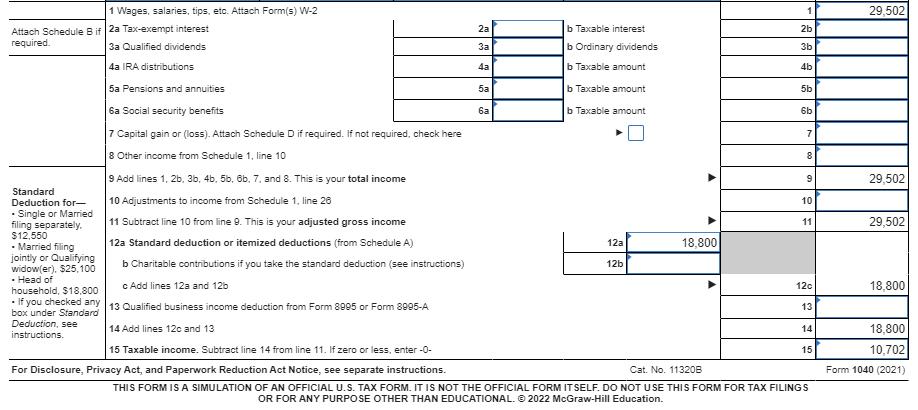

Its for filling out a pretend 1040, schedule 3, schedule 8812, form 8863, and a schedule EIC. Filing as Head of Household with one dependant. Everything I have filled in so far is marked as correct, I need help with lines, 22, 27a, 34, and 35a, on the 1040 file. Can I please get assistance with this?

Image transcription text

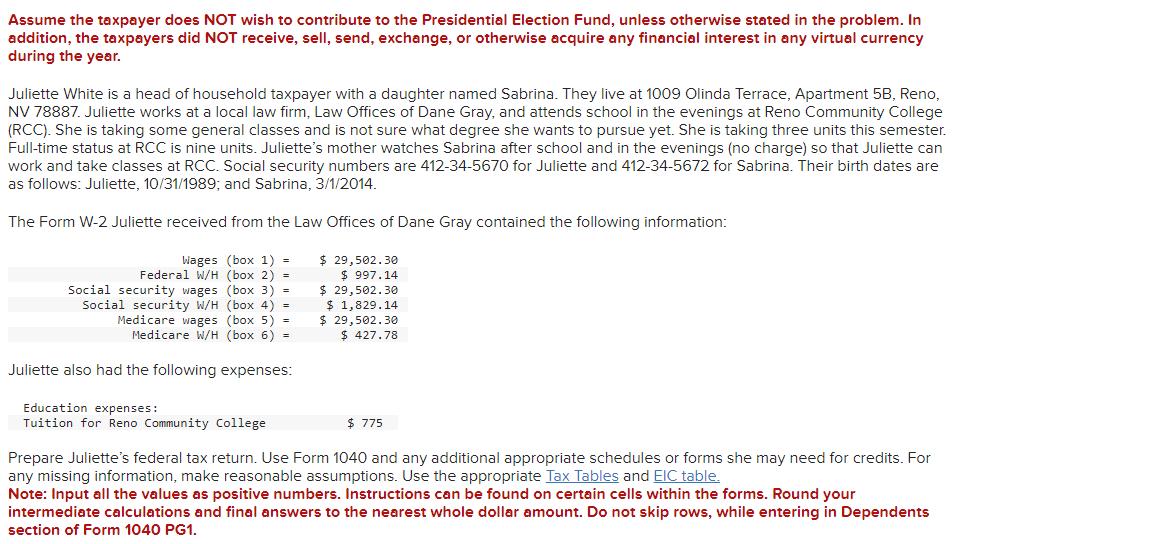

Assume the taxpayer does NOT wish to contribute to the Presidential Election Fund, unless otherwise stated in the problem. In addition. the taxpayers did NOT receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency during the year. Juliette White is a head of household taxpayer with a daughter named Sabrina. They live at 1009 Olinda Terrace, Apartment 5E5, Reno, NV 78887. Juliette works at a local law firm, Law Offices of Dane Gray. and attends school in the evenings at Reno Community College (RCC). She is taking some general classes and is not sure what degree she wants to pursue yet. She is taking three units this semester. Full-time status at RCC is nine units. Juliette's mother watches Sabrina after school and in the evenings (no charge) so that Juliette can work and take classes at RCC. Social security numbers are 412—34—5670 for Juliette and 412—34—5672 for Sabrina. Their birth dates are as follows: Juliette, 10.-'31.-'1989: and Sabrina, 3i'1i'2014. The Form W—2 Juliette received from the Law Offices of Dane Gray contained the following information: Hages {box 1) = $ 29,502.39 Federal NIH {box 2) = $ 997.14 Social security wages {box 3) = $ 29,502.39 Social security NIH {box 4) = $ 1,829.14 Medicare wages {box 5) = $ 29,502.39 Medicare NIH {box 6) = $ 427.78 Juliette also had the following expenses: Education expenses: Tuition for Reno Community College $ 775 Prepare Juliette's federal tax return. Use Form 1040 and any additional appropriate schedules or forms she may need for credits. For any missing information. make reasonable assumptions. Use the appropriate Tax Tables and EIC table. Note: Input all the values as positive numbers. Instructions can be found on certain cells within the forms. Round your intermediate calculations and final answers to the nearest whole dollar amount. Do not skip rows, while entering in Dependents section of Form 1040 PG1.

Image transcription text

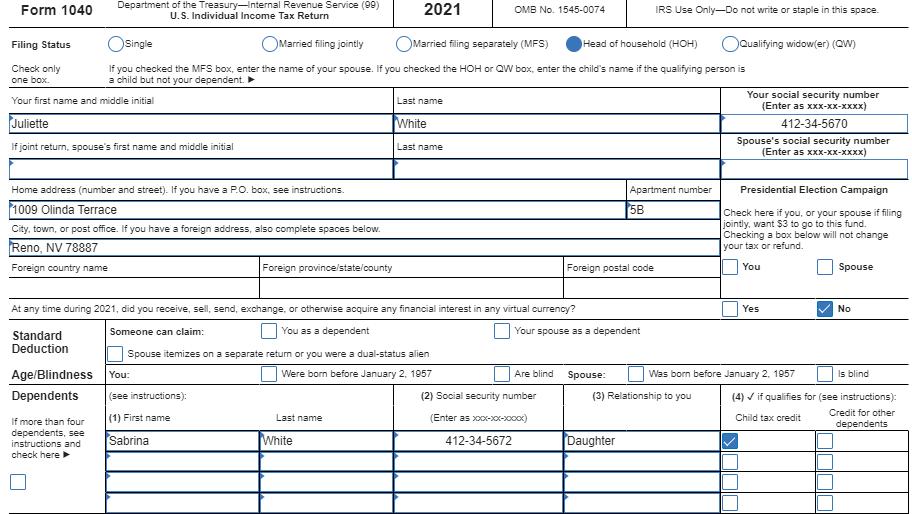

Form 1040 Department of the Treasury-Internal Revenue Service (90) U.S. Individual Income Tax Return 2021 OMB No. 1545-0074 IRS Use Only-Do not write or staple in this space. Filing Status Osingle OMarried filing jointly Married filing separately (MFS) Head of household (HOH) (Qualifying widow(er) (QW) Check only If you checked the MFS box, enter the name of your spouse. If you checked the HOH or QW box, enter the child's name if the qualifying person is one box. a child but not your dependent. Your social security number Your first name and middle initial Last name (Enter as xxx-xx-xxxx) Juliette White 412-34-5670 Spouse's social security number If joint return, spouse's first name and middle initial Last name (Enter as xxx-xx-xxxx Home address (number and street). If you have a P.O. box, see instructions. Apartment number Presidential Election Campaign 1009 Olinda Terrace 5B Check here if you, or your spouse if filing City, town, or post office. If you have a foreign address, also complete spaces below. jointly, want $3 to go to this fund. Checking a box below will not change Reno, NV 78887 your tax or refund. Foreign country name Foreign province/state/county Foreign postal code You Spouse At any time during 2021, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency? Yes No Standard Someone can claim: You as a dependent Your spouse as a dependent Deduction Spouse itemizes on a separate retum or you were a dual-status alien Age/Blindness You: Were born before January 2. 1957 Are blind Spouse: Was born before January 2, 1957 Is blind Dependents (see instructions): (2) Social security number (3) Relationship to you (4) v if qualifies for (see instructions): (1) First name Last name (Enter as xxx-xx-xxxx) Child tax credit Credit for other If more than four dependents dependents, see instructions and Sabrina White 412-34-5672 Daughter check here >

Image transcription text

1 Wages, salaries, tips, etc. Attach Form(s) W-2 29,502 Attach Schedule B if | 2a Tax-exempt interest 2a b Taxable interest 2b required. 3a Qualified dividends 33 b Ordinary dividends 3b 4a IRA distributions b Taxable amount 5a Pensions and annuities b Taxable amount 5b 6a Social security benefits b Taxable amount 7 Capital gain or (loss). Attach Schedule D if required. If not required, check here 8 Other income from Schedule 1, line 10 9 Add lines 1, 2b, 3b, 4b, 5b, 6b, 7, and 8. This is your total income 29,502 Standard Deduction for- 10 Adjustments to income from Schedule 1, line 26 . Single or Married filing separately. 11 Subtract line 10 from line 9. This is your adjusted gross income 11 29,502 $12,550 . Married filing 12a Standard deduction or itemized deductions (from Schedule A) 12z 18,800 jointly or Qualifying widow(er). $25,100 b Charitable contributions if you take the standard deduction (see instructions) 12b . Head of household, $18,800 c Add lines 12a and 12b 12c 18,800 . If you checked any 13 Qualified business income deduction from Form 8995 or Form 8995-A 13 box under Standard Deduction, see 14 Add lines 12c and 13 14 18,800 instructions. 15 Taxable income. Subtract line 14 from line 11. If zero or less, enter -0- 15 10,702 For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 113208 Form 1040 (2021) THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL. @ 2022 McGraw-Hill Education.

Image transcription text

Form 1040 (2021) Juliette White 412-34-5670 Page 2 16 Tax (see instructions). Check if any from Form(s): (1) 8814 (2) 4972 (3) 16 1,073 17 Amount from Schedule 2, line 3 17 0 18 Add lines 16 and 17 18 1,073 19 Nonrefundable child tax credit or credit for other dependents from Schedule 8812 19 3,000 20 Amount from Schedule 3, line 8 20 155 21 Add lines 19 and 20 21 3, 155 22 Subtract line 21 from line 18. If zero or less, enter -0- 22 23 Other taxes, including self-employment tax, from Schedule 2, line 21 23 24 Add lines 22 and 23. This is your total tax 25 Federal income tax withheld from: a Form(s) W-2 25 b Form(s) 1089 25b c Other forms (see instructions) 25c d Add lines 25a through 250 25d 997 26 2021 estimated tax payments and amount applied from 2020 return 26 If you have a 27a Earned income credit (EIC) 27a qualifying child, attach Schedule EIC. Check here if you had not reached the age of 19 by December 31, 2021, and satisfy all other requirements for claiming the EIC. See instructions b Nontaxable combat pay election 27b Prior year (2019) earned income 270 28 Refundable child tax credit or additional child tax credit from Schedule 8812 28 3.000 29 American opportunity credit from Form 8863, line 8 29 30 Recovery rebate credit. See instructions 31 Amount from Schedule 3, line 15 31 32 Add lines 27a and 28 through 31. These are your total other payments and refundable credits 32 3,000 33 Add lines 25d, 26, and 32. These are your total payments 33 3,99 34 If line 33 is more than line 24, subtract line 24 from line 33. This is the amount you overpaid 34 Refund 35a Amount of line 34 you want refunded to you. If Form 8888 is attached, check here 35 Direct deposit? b Routing number c Type: Checking Savings See instructions. d Account number 36 Amount of line 34 you want applied to your 2022 estimated tax 36 Amount 37 Amount you owe. Subtract line 33 from line 24. For details on how to pay. see instructions 37 You Owe 38 Estimated tax penalty (see instructions) 38 Do you want to allow another person to discuss this return with the IRS? See instructions Yes. Complete Third Party below. Designee No

Image transcription text

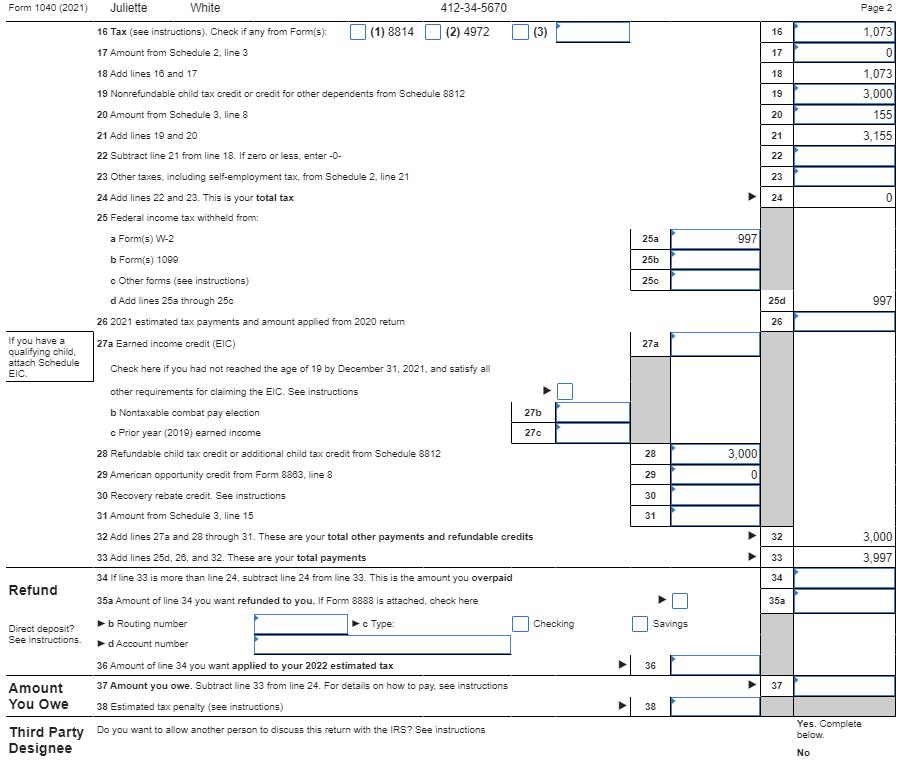

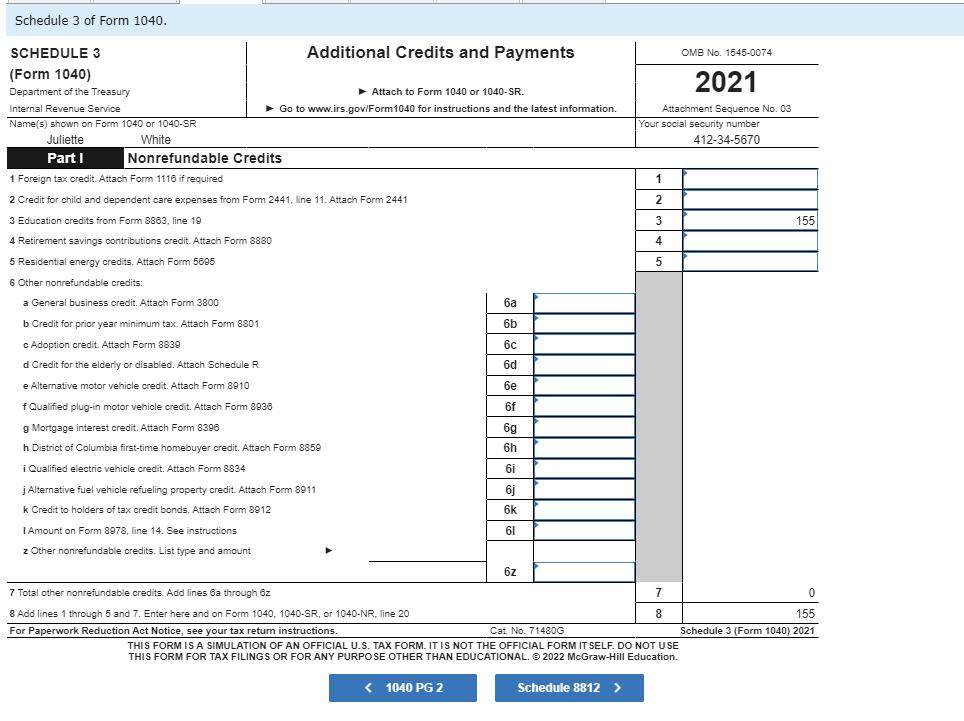

Schedule 3 of Form 1040. SCHEDULE 3 Additional Credits and Payments OMB No. 1545-0074 (Form 1040) Department of the Treasury Attach to Form 1040 or 1040-SR. 2021 Internal Revenue Service Go to www.irs.gov/Form1040 for instructions and the latest information. Attachment Sequence No. 03 Name(s) shown on Form 1040 or 1040-SR Your social security number Juliette White 412-34-5670 Part I Nonrefundable Credits 1 Foreign tax credit. Attach Form 1116 if required 1 2 Credit for child and dependent care expenses from Form 2441, line 11. Attach Form 2441 2 Education credits from Form 8863, line 19 3 155 4 Retirement savings contributions credit. Attach Form 8880 4 5 Residential energy credits. Attach Form 5695 5 6 Other nonrefundable credits: a General business credit. Attach Form 3800 6a b Credit for prior year minimum tax. Attach Form 8801 6b c Adoption credit. Attach Form 8839 60 d Credit for the elderly or disabled. Attach Schedule R 6d e Alternative motor vehicle credit. Attach Form 8910 f Qualified plug-in motor vehicle credit. Attach Form 8936 6f g Mortgage interest credit. Attach Form 8396 h District of Columbia first-time homebuyer credit. Attach Form 8859 6h i Qualified electric vehicle credit. Attach Form 8834 6i j Alternative fuel vehicle refueling property credit. Attach Form 8911 6j k Credit to holders of tax credit bonds. Attach Form 8912 6k I Amount on Form 8978, line 14. See instructions 61 z Other nonrefundable credits. List type and amount 6z 7 Total other nonrefundable credits. Add lines 6a through 6z 7 0 8 Add lines 1 through 5 and 7. Enter here and on Form 1040, 1040-SR, or 1040-NR. line 20 8 155 For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 71480G Schedule 3 (Form 1040) 2021 THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL. @ 2022 McGraw-Hill Education. < 1040 PG 2 Schedule 8812 >

Image transcription text

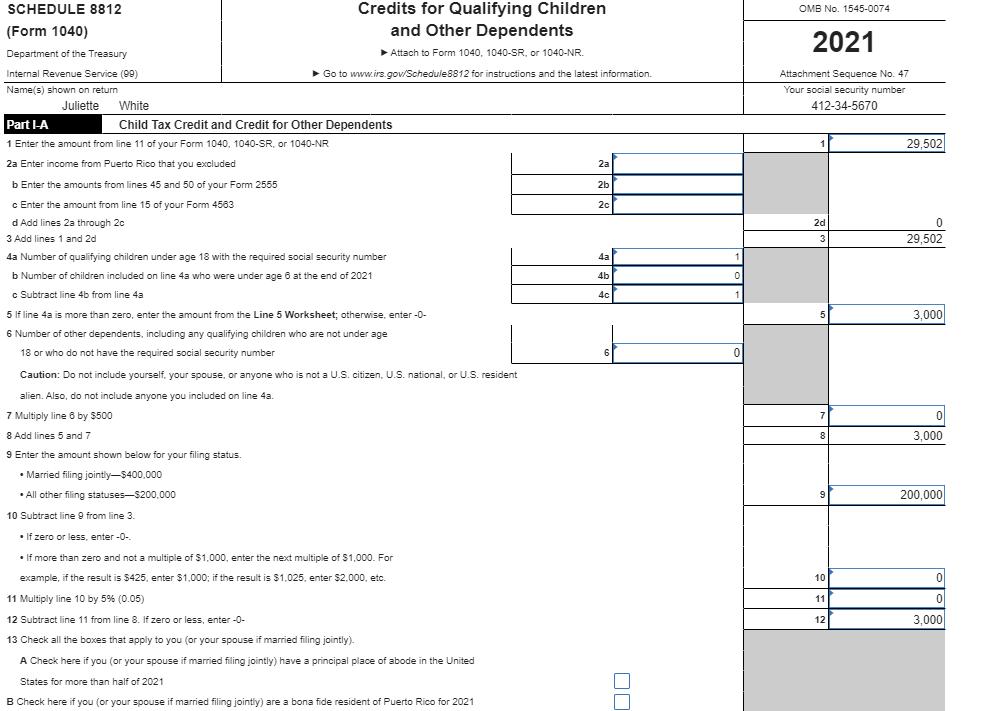

SCHEDULE 8812 Credits for Qualifying Children OMB No. 1545-0074 (Form 1040) and Other Dependents 2021 Department of the Treasury Attach to Form 1040, 1040-SR, or 1040-NR. Internal Revenue Service (89) Go to www.irs.gow/Schedule8812 for instructions and the latest information. Attachment Sequence No. 47 Name(s) shown on return Your social security number Juliette White 412-34-5670 Part I-A Child Tax Credit and Credit for Other Dependents 1 Enter the amount from line 11 of your Form 1040, 1040-SR. or 1040-NR 1 29,502 2a Enter income from Puerto Rico that you excluded 2a b Enter the amounts from lines 45 and 50 of your Form 2555 c Enter the amount from line 15 of your Form 4563 2c d Add lines 2a through 2c 2d 0 3 Add lines 1 and 2d 3 29,502 4a Number of qualifying children under age 18 with the required social security number b Number of children included on line 4a who were under age 6 at the end of 2021 c Subtract line 4b from line 43 Ac 5 If line 4a is more than zero, enter the amount from the Line 5 Worksheet; otherwise, enter -0- 3,000 6 Number of other dependents, including any qualifying children who are not under age 18 or who do not have the required social security number 0 Caution: Do not include yourself, your spouse, or anyone who is not a U.S. citizen, U.S. national, or U.S. resident alien. Also, do not include anyone you included on line 43. 7 Multiply line 6 by $500 8 Add lines 5 and 7 3.000 9 Enter the amount shown below for your filing status. . Married filing jointly-$400,000 . All other filing statuses-$200,000 6 200,000 10 Subtract line 9 from line 3. If zero or less, enter -0-. . If more than zero and not a multiple of $1,000, enter the next multiple of $1,000. For example, if the result is $425, enter $1,000; if the result is $1,025, enter $2,000, etc. 10 11 Multiply line 10 by 5% (0.05) 11 12 Subtract line 11 from line 8. If zero or less, enter -0- 12 3.000 13 Check all the boxes that apply to you (or your spouse if married filing jointly). A Check here if you (or your spouse if married filing jointly) have a principal place of abode in the United States for more than half of 2021 B Check here if you (or your spouse if married filing jointly) are a bona fide resident of Puerto Rico for 2021

Image transcription text

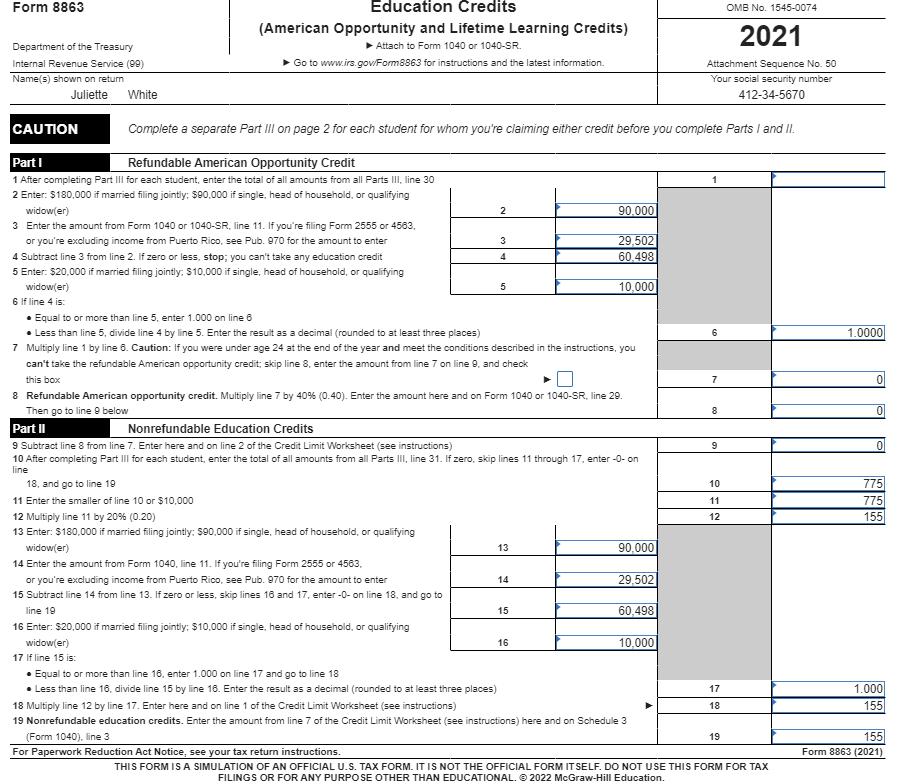

Form 8863 Education Credits OMB No. 1545-0074 (American Opportunity and Lifetime Learning Credits) Department of the Treasury Attach to Form 1040 or 1040-SR 2021 Internal Revenue Service (90) > Go to www.irs. gowForm8863 for instructions and the latest information. Attachment Sequence No. 50 Name(s) shown on return Your social security number Juliette White 412-34-5670 CAUTION Complete a separate Part Ill on page 2 for each student for whom you're claiming either credit before you complete Parts | and II. Part I Refundable American Opportunity Credit 1 After completing Part Ill for each student, enter the total of all amounts from all Parts Ill, line 30 2 Enter: $180,000 if married filing jointly: $90,000 if single, head of household, or qualifying widow(er) 90.000 3 Enter the amount from Form 1040 or 1040-SR. line 11. If you're filing Form 2555 or 4563, or you're excluding income from Puerto Rico, see Pub. 970 for the amount to enter 3 29,502 4 Subtract line 3 from line 2. If zero or less, stop; you can't take any education credit 60.498 5 Enter: $20,000 if married filing jointly: $10.000 if single, head of household, or qualifying widow(er) 10,000 6 If line 4 is: . Equal to or more than line 5, enter 1.000 on line 6 . Less than line 5, divide line 4 by line 5. Enter the result as a decimal (rounded to at least three places) 6 1.0000 7 Multiply line 1 by line 6. Caution: If you were under age 24 at the end of the year and meet the conditions described in the instructions, you can't take the refundable American opportunity credit; skip line 8, enter the amount from line 7 on line 9, and check this box 7 8 Refundable American opportunity credit. Multiply line 7 by 40% (0.40). Enter the amount here and on Form 1040 or 1040-SR. line 29. Then go to line 9 below 8 Part I Nonrefundable Education Credits 9 Subtract line 8 from line 7. Enter here and on line 2 of the Credit Limit Worksheet (see instructions) 9 0 10 After completing Part Ill for each student, enter the total of all amounts from all Parts Ill, line 31. If zero, skip lines 11 through 17. enter -0- on line 18, and go to line 19 10 775 11 Enter the smaller of line 10 or $10,000 11 775 12 Multiply line 11 by 20% (0.20) 12 155 13 Enter: $180,000 if married filing jointly: $90,000 if single, head of household, or qualifying widow(er) 13 90,000 14 Enter the amount from Form 1040, line 11. If you're filing Form 2555 or 4563. or you're excluding income from Puerto Rico, see Pub. 970 for the amount to enter 14 29.502 15 Subtract line 14 from line 13. If zero or less, skip lines 16 and 17, enter -0- on line 18, and go to line 19 15 60.498 16 Enter: $20,000 if married filing jointly; $10,000 if single, head of household, or qualifying widow(er) 16 10,000 17 If line 15 is: Equal to or more than line 16, enter 1.000 on line 17 and go to line 18 . Less than line 16. divide line 15 by line 16. Enter the result as a decimal (rounded to at least three places) 17 1.000 18 Multiply line 12 by line 17. Enter here and on line 1 of the Credit Limit Worksheet (see instructions) 18 155 19 Nonrefundable education credits. Enter the amount from line 7 of the Credit Limit Worksheet (see instructions) here and on Schedule 3 (Form 1040). line 3 19 155 For Paperwork Reduction Act Notice, see your tax return instructions. Form 8863 (2021) THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL. @ 2022 McGraw-Hill Education.

Image transcription text

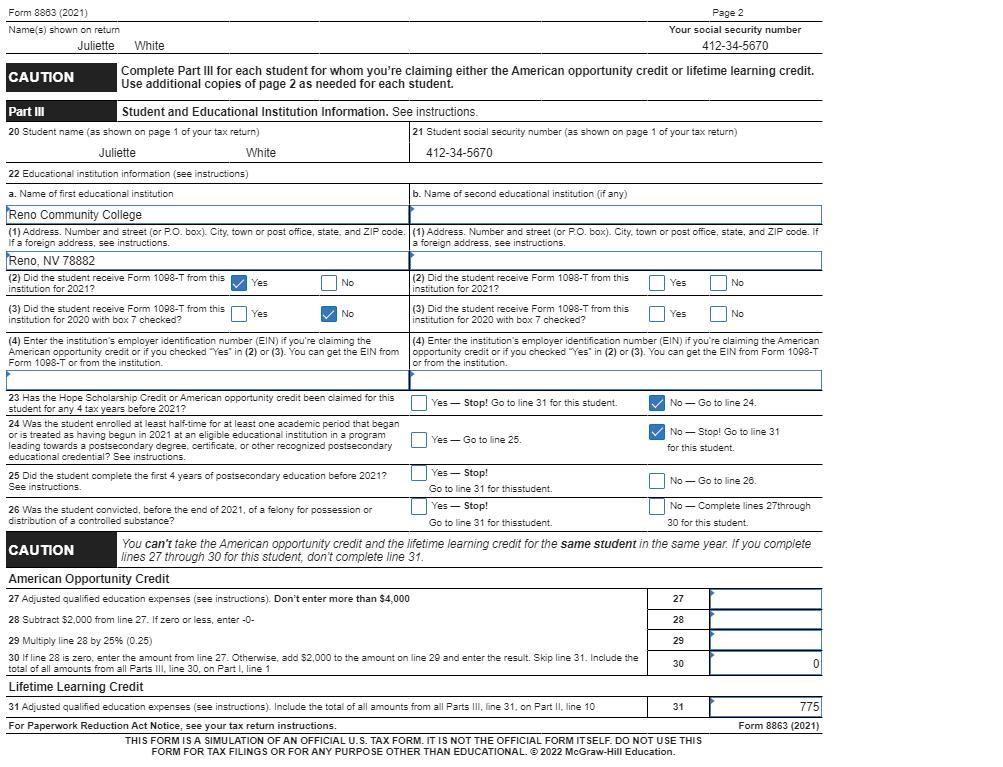

Form 8863 (2021) Page 2 Name(s) shown on return Your social security number Juliette White 412-34-5670 CAUTION Complete Part Ill for each student for whom you're claiming either the American opportunity credit or lifetime learning credit. Use additional copies of page 2 as needed for each student. Part III Student and Educational Institution Information. See instructions. 20 Student name (as shown on page 1 of your tax return 21 Student social security number (as shown on page 1 of your tax return) Juliette White 412-34-5670 22 Educational institution information (see instructions a. Name of first educational institution b. Name of second educational institution (if any) Reno Community College (1) Address. Number and street (or P.O. box). City, town or post office, state, and ZIP code. (1) Address. Number and street (or P.O. box). City. town or post office, state, and ZIP code. If If a foreign address, see instructions a foreign address, see instructions. Reno, NV 78882 (2) Did the student receive Form 1098-T from this institution for 2021? Yes No 2) Did the student receive Form 1098-T from this institution for 2021? Yes No (3) Did the student receive Form 1098-T from this ( Yes 3) Did the student receive Form 1098-T from this institution for 2020 with box 7 checked? No institution for 2020 with box 7 checked? Yes No (4) Enter the institution's employer identification number (EIN) if you're claiming the (4) Enter the institution's employer identification number (EIN) if you're claiming the American American opportunity credit or if you checked "Yes" in (2) or (3). You can get the EIN from opportunity credit or if you checked "Yes" in (2) or (3). You can get the EIN from Form 1098-T Form 1098-T or from the institution. or from the institution. 23 Has the Hope Scholarship Credit or American opportunity credit been claimed for this student for any 4 tax years before 2021? Yes - Stop! Go to line 31 for this student. No - Go to line 24. 24 Was the student enrolled at least half-time for at least one academic period that began or is treated as having begun in 2021 at an eligible educational institution in a program leading towards a postsecondary degree, certificate, or other recognized postsecondary Yes - Go to line 25. No - Stop! Go to line 31 or this student. educational credential? See instructions. 25 Did the student complete the first 4 years of postsecondary education before 2021? Yes - Stop! See instructions. Go to line 31 for thisstudent. No - Go to line 28 26 Was the student convicted, before the end of 2021, of a felony for possession or Yes - Stop! No - Complete lines 27through distribution of a controlled substance? Go to line 31 for thisstudent. 30 for this student. CAUTION You can't take the American opportunity credit and the lifetime learning credit for the same student in the same year. If you complete ines 27 through 30 for this student, don't complete line 31. American Opportunity Credit 27 Adjusted qualified education expenses (see instructions). Don't enter more than $4,000 27 28 Subtract $2,000 from line 27. If zero or less, enter -0- 28 29 Multiply line 28 by 25% (0.25) 29 30 If line 28 is zero, enter the amount from line 27. Otherwise, add $2,000 to the amount on line 29 and enter the result. Skip line 31. Include the total of all amounts from all Parts III, line 30, on Part I, line 1 30 Lifetime Learning Credit 31 Adjusted qualified education expenses (see instructions). Include the total of all amounts from all Parts III, line 31, on Part II, line 10 31 775 For Paperwork Reduction Act Notice, see your tax return instructions. Form 8863 (2021) THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL. @ 2022 McGraw-Hill Education.

Image transcription text

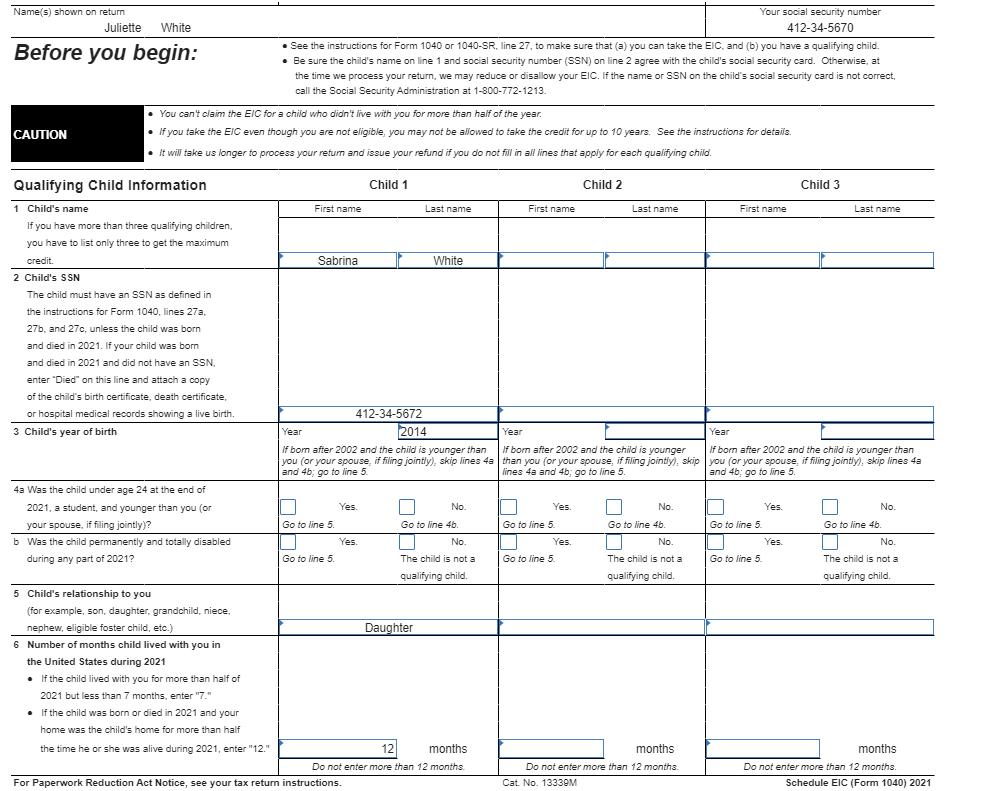

Name(s) shown on return Your social security number Juliette White 412-34-5670 Before you begin: . See the instructions for Form 1040 or 1040-SR. line 27, to make sure that (a) you can take the EIC, and (b) you have a qualifying child Be sure the child's name on line 1 and social security number (SSN) on line 2 agree with the child's social security card. Otherwise, at the time we process your return, we may reduce or disallow your EIC. If the name or SSN on the child's social security card is not correct, call the Social Security Administration at 1-800-772-1213. . You can't claim the EIC for a child who didn't live with you for more than half of the year. CAUTION If you take the EIC even though you are not eligible, you may not be allowed to take the credit for up to 10 years. See the instructions for details. . It will take us longer to process your refum and issue your refund if you do not fill in all lines that apply for each qualifying child Qualifying Child Information Child 1 Child 2 Child 3 Child's name First name Last name First name Last name First name Last name If you have more than three qualifying children. you have to list only three to get the maximum credit. Sabrina White 2 Child's SSN The child must have an SSN as defined in the instructions for Form 1040, lines 27a, 27b, and 27c, unless the child was born and died in 2021. If your child was born and died in 2021 and did not have an SSN. enter "Died" on this line and attach a copy of the child's birth certificate, death certificate. or hospital medical records showing a live birth. 412-34-5672 3 Child's year of birth Year 2014 Year Year f bom after 2002 and the child is younger than If born after 2002 and the child is younger If born after 2002 and the child is younger than you (or your spouse, if filing jointly), skip lines 48 | than you (or your spouse, if filing jointly), skip you (or your spouse, if filing jointly), skip lines 4a and 4b; go to line 5. lines 4a and 4b; go to line 5. and 4b; go to line 5. 43 Was the child under age 24 at the end of 2021, a student, and younger than you (or Yes . No. Yes. No. 0 Yes. No. your spouse, if filing jointly)? Go to line 5 Go to line 4b. Go to line 5. Go to line 4b. Go to line 5. Go to line 4b. Was the child permanently and totally disabled Yes No. Yes No. Yes. No during any part of 2021? Go to line 5. The child is not a Go to line 5. The child is not a Go to line 5. The child is not a qualifying child. qualifying child. qualifying child. 5 Child's relationship to you (for example, son, daughter, grandchild, niece. nephew, eligible foster child, etc.) Daughter 6 Number of months child lived with you in the United States during 2021 . If the child lived with you for more than half of 2021 but less than 7 months, enter "7." If the child was born or died in 2021 and your home was the child's home for more than half the time he or she was alive during 2021, enter "12." 12 months months months Do not enter more than 12 months Do not enter more than 12 months. Do not enter more than 12 months For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 13339M Schedule EIC (Form 1040) 2021Assume the taxpayer does NOT wish to contribute to the Presidential Election Fund, unless otherwise stated in the problem. In addition, the taxpayers did NOT receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency during the year. Juliette White is a head of household taxpayer with a daughter named Sabrina. They live at 1009 Olinda Terrace, Apartment 5B, Reno, NV 78887. Juliette works at a local law firm, Law Offices of Dane Gray, and attends school in the evenings at Reno Community College (RCC). She is taking some general classes and is not sure what degree she wants to pursue yet. She is taking three units this semester. Full-time status at RCC is nine units. Juliette's mother watches Sabrina after school and in the evenings (no charge) so that Juliette can work and take classes at RCC. Social security numbers are 412-34-5670 for Juliette and 412-34-5672 for Sabrina. Their birth dates are as follows: Juliette, 10/31/1989; and Sabrina, 3/1/2014. The Form W-2 Juliette received from the Law Offices of Dane Gray contained the following information: Wages (box 1) = Federal W/H (box 2) = Social security wages (box 3) Social security W/H (box 4) = Medicare wages (box 5) = Medicare W/H (box 6) = Juliette also had the following expenses: Education expenses: Tuition for Reno Community College = $ 29,502.30 $ 997.14 $ 29,502.30 $ 1,829.14 $ 29,502.30 $427.78 $ 775 Prepare Juliette's federal tax return. Use Form 1040 and any additional appropriate schedules or forms she may need for credits. For any missing information, make reasonable assumptions. Use the appropriate Tax Tables and EIC table. Note: Input all the values as positive numbers. Instructions can be found on certain cells within the forms. Round your intermediate calculations and final answers to the nearest whole dollar amount. Do not skip rows, while entering in Dependents section of Form 1040 PG1.

Step by Step Solution

3.46 Rating (143 Votes )

There are 3 Steps involved in it

Here are the calculations for the lines requested on Form 1040 Line 22 ... View full answer

Get step-by-step solutions from verified subject matter experts