Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Its from entrepreneurship. i want all the 10 answers it an request thankyou for your help Which of the following describes accounts receivable and inventory?

Its from entrepreneurship. i want all the 10 answers it an request thankyou for your help

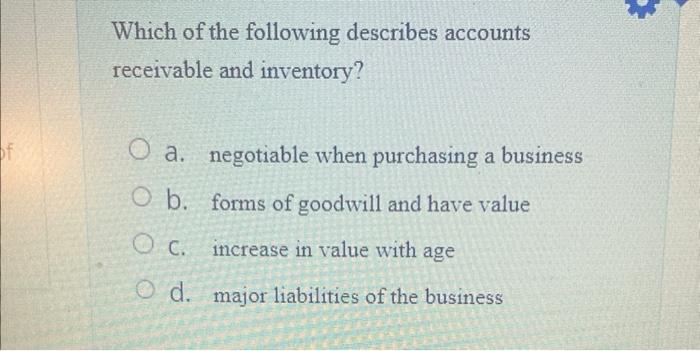

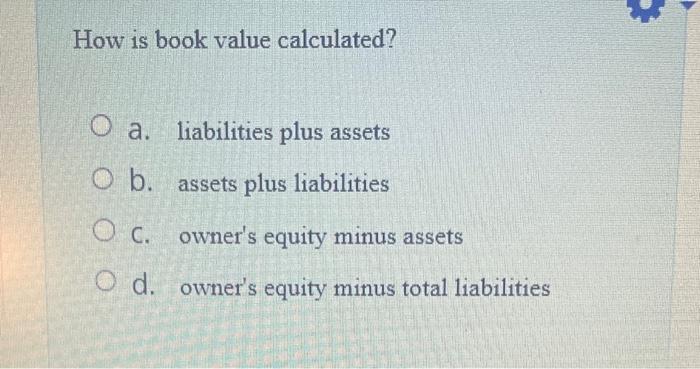

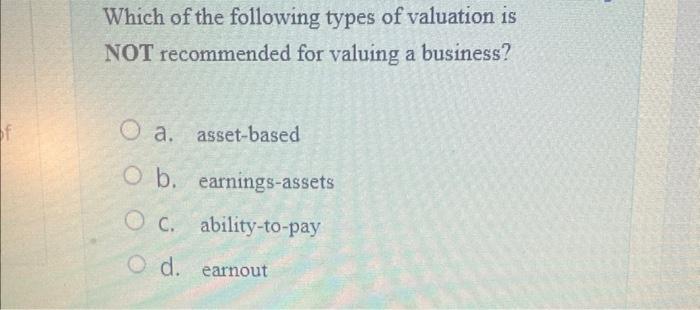

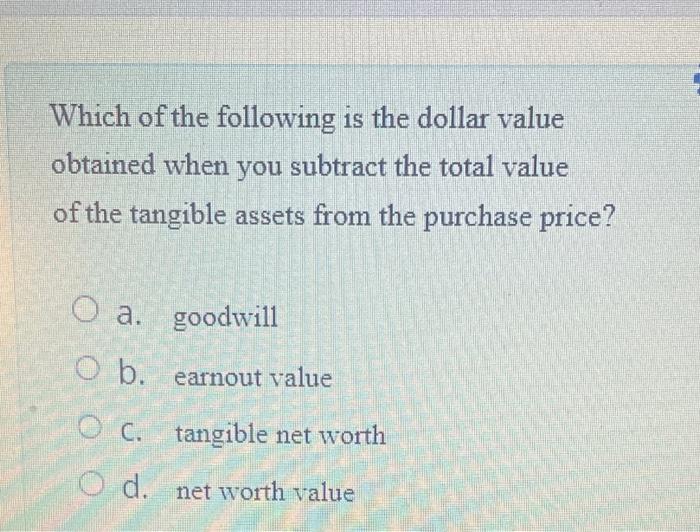

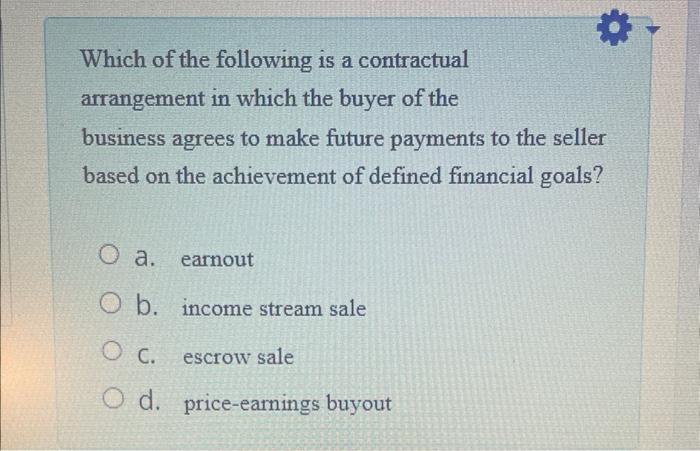

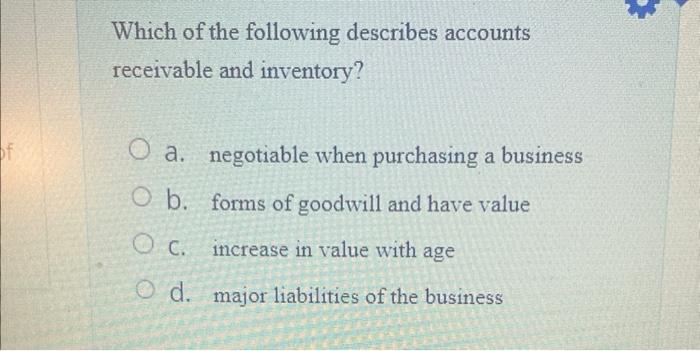

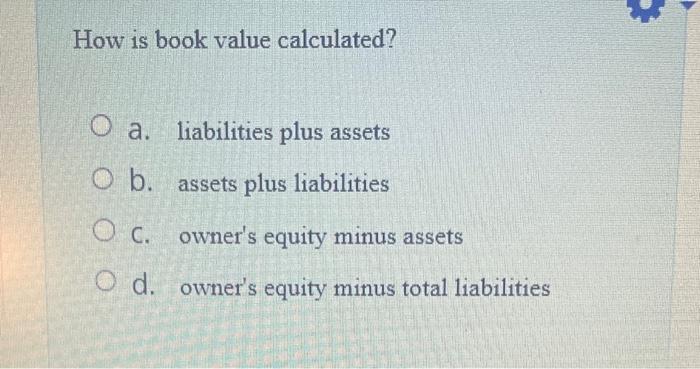

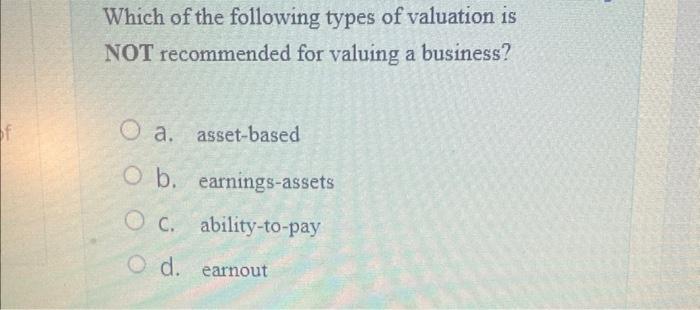

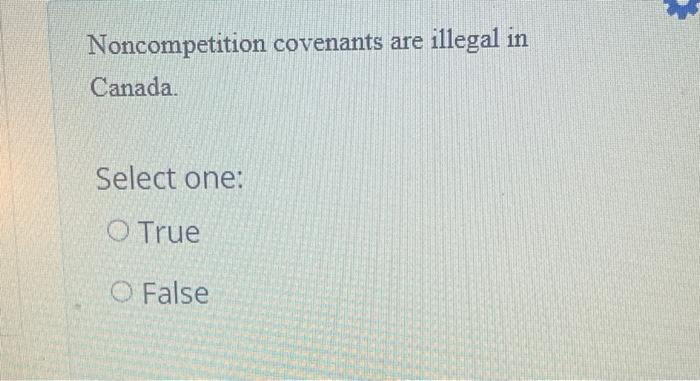

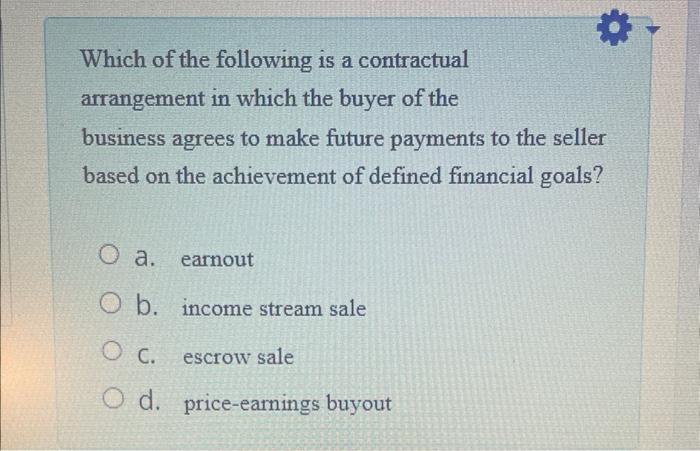

Which of the following describes accounts receivable and inventory? a. negotiable when purchasing a business b. forms of goodwill and have value C. increase in value with age d. major liabilities of the business How is book value calculated? a. liabilities plus assets b. assets plus liabilities C. owner's equity minus assets d. owner's equity minus total liabilities Which of the following types of valuation is NOT recommended for valuing a business? a. asset-based b. earnings-assets c. ability-to-pay d. earnout Which of the following is the dollar value obtained when you subtract the total value of the tangible assets from the purchase price? a. goodwill b. earnout value C. tangible net worth d. net worth value According to the author, which of the following is a common reason for purchasing an existing business? a. the business has a low price-earnings ratio b. the seller is having problems managing the business C. it is safer than starting a business yourself d. you are purchasing an existing income stream A lien is money held in escrow while you evaluate the business. Select one: True False According to the textbook, the classified ads are a good way to find the best business opportunities. Select one: True False Noncompetition covenants are illegal in Canada. Select one: True False Which of the following is a contractual arrangement in which the buyer of the business agrees to make future payments to the seller based on the achievement of defined financial goals? a. earnout b. income stream sale C. escrow sale d. price-earnings buyout

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started