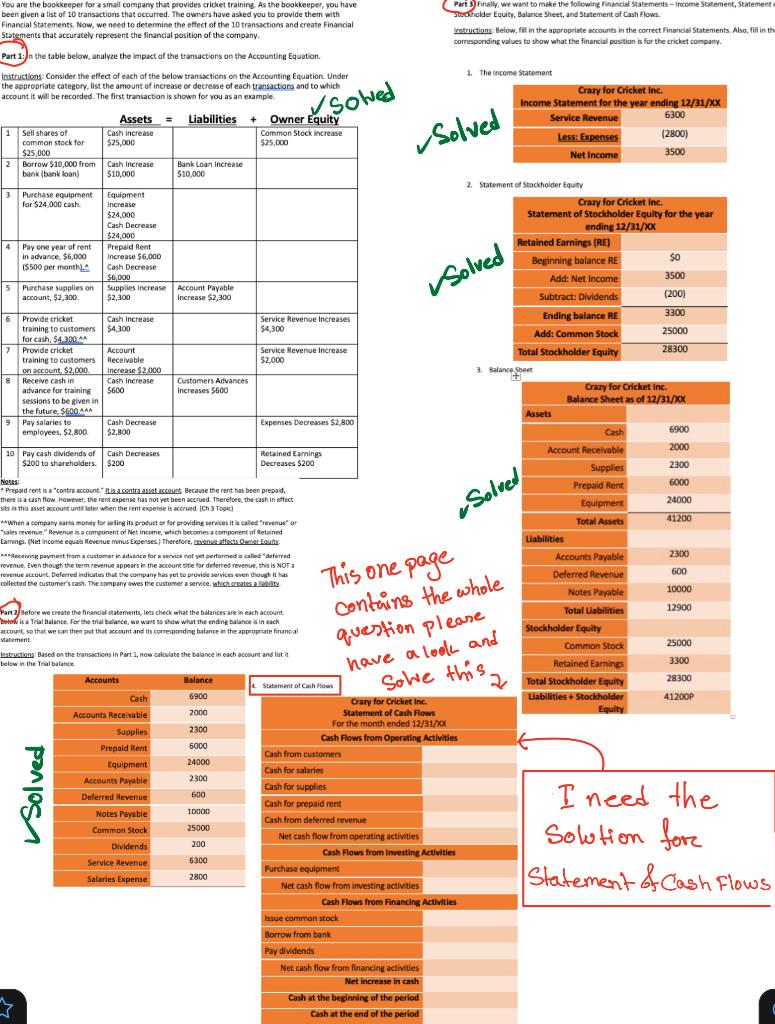

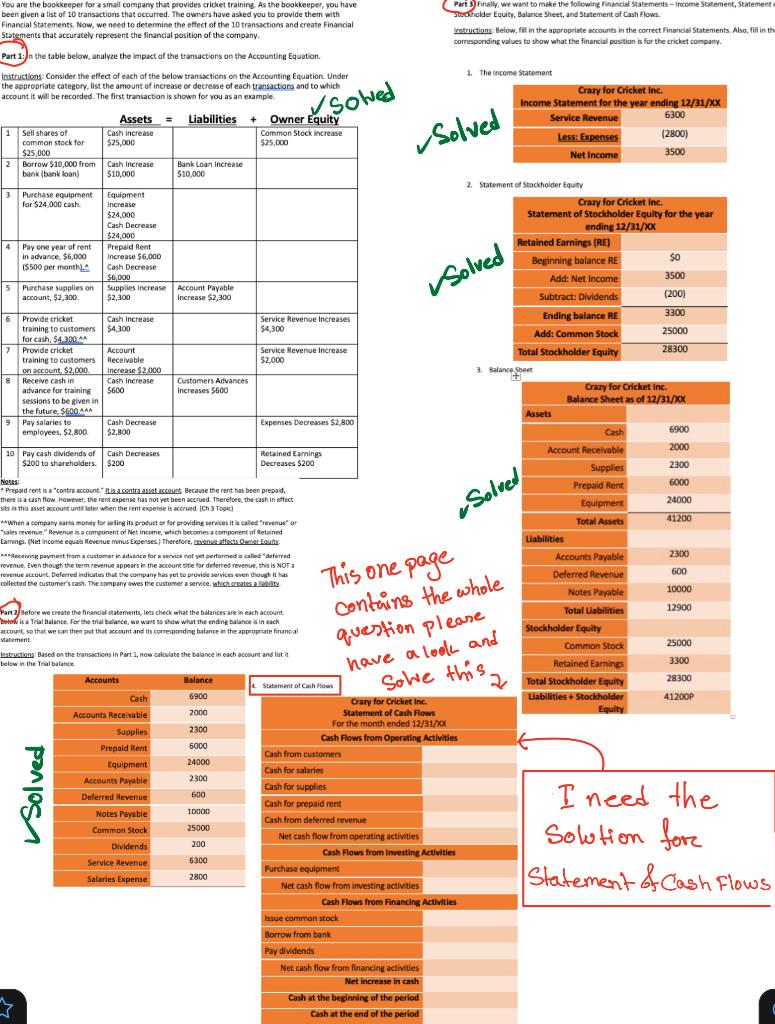

Its in The Question I have Enlarged it for you Please help me solve the last part

You are the bookkeeper for a small company that provides cricket training. As the bookkeeper, you have been given a list of 10 transactions that occurred. The owners have asked you to provide them with Financial Statements. Now, we need to determine the effect of the 10 transactions and create Financial Statements that accurately represent the financial position of the company. Part 1:n the table below, analyze the impact of the transactions on the Accounting Equation. Instructions: Consider the effect of each of the below transactions on the Accounting Equation. Under the appropriate category, list the amount of increase or decrease of each transactions and to which account it will be recorded. The first transaction is shown for you as an example. Assets = Liabilities 1 Sell shares of + Owner Equity Common Stock increase $25,000 common stock for $25,000 2 Borrow $10,000 from bank (bank loan) Bank Loan Increase $10,000 3 Purchase equipment for $24,000 cash. 4 Pay one year of rent in advance, $6,000 ($500 per month) 5 Purchase supplies on account, $2,300. 6 Provide cricket 7 8 Solved Cash increase $25,000 Cash Increase $10,000 Equipment Increase $24,000 Cash Decrease $24,000 Prepaid Rent Increase $6,000 Cash Decrease $6,000 Account Payable Supplies increase 100 $2,300 Increase $2,300 Cash Increase $4,300 Service Revenue Increases $4,300 Account Receivable Service Revenue Increase $2,000 training to customers for cash, $4,300 Provide cricket training to customers on account, $2,000. Receive cash in advance for training sessions to be given in the future, $600 Increase $2,000 Cash Increase $600 Customers Advances Increases $600 Expenses Decreases $2,800 Pay salaries to employees, $2,800. Cash Decrease $2,800 10 Pay cash dividends of Cash Decreases $200 Retained Earnings Decreases $200 $200 to shareholders. Notes: *Prepaid rent is a "contra account." It is a contra asset account, Because the rent has been prepaid, there is a cash flow. However, the rent expense has not yet been accrued. Therefore, the cash in effect sits in this asset account until later when the rent expense is accrued. [Ch 3 Topic) **When a company earns money for selling its product or for providing services it is called "revenue" or "sales revenue." Revenue is a component of Net Income, which becomes a component of Retained Earnings. (Net income equals Revenue minus Expenses) Therefore, revenue affects Owner Equity Receiving payment from a customer in advance for a service not yet performed is called "deferred revenue. Even though the term revenue appears in the account title for deferred revenue, this is NOT a revenue account. Deferred indicates that the company has yet to provide services even though it has collected the customer's cash. The company owes the customer a service, which creates a liability Part 2 Before we create the financial statements, lets check what the balances are in each account. Below is a Trial Balance. For the trial balance, we want to show what the ending balance is in each account, so that we can then put that account and its corresponding balance in the appropriate financial statement. Instructions: Based on the transactions in Part 1, now calculate the balance in each account and list it below in the Trial balance. Accounts Balance Cash 6900 2000 Accounts Receivable 2300 Supplies 6000 Prepaid Rent USERS 24000 Equipment DEM 2300 Accounts Payable CONS Deferred Revenue 600 Notes Payable 10000 Common Stock 25000 200 Dividends 6300 Service Revenue Salaries Expense 2800 Solved 4 Statement of Cash Flows Cash from customers Cash for salaries Cash for supplies Cash for prepaid rent Cash from deferred revenue Net cash flow from operating activities Purchase equipment Part 3 Finally, we want to make the following Financial Statements-Income Statement, Statement Stockholder Equity, Balance Sheet, and Statement of Cash Flows. Instructions: Below, fill in the appropriate accounts in the correct Financial Statements. Also, fill in the corresponding values to show what the financial position is for the cricket company. 1. The Income Statement Crazy for Cricket Inc. Income Statement for the year ending 12/31/XX Service Revenue 6300 Less: Expenses (2800) 3500 Net Income Crazy for Cricket Inc. Statement of Stockholder Equity for the year ending 12/31/XX Retained Earnings (RE) Beginning balance RE $0 Add: Net Income 3500 Subtract: Dividends (200) Ending balance RE 3300 Add: Common Stock 25000 Total Stockholder Equity 28300 Crazy for Cricket Inc. Balance Sheet as of 12/31/XX Cash 6900 Account Receivable 2000 Supplies 2300 6000 Prepaid Rent Equipment 24000 Total Assets 41200 2300 Accounts Payable Deferred Revenue 600 Notes Payable 10000 12900 Total Liabilities Stockholder Equity 25000 Common Stock Retained Earnings 3300 28300 Total Stockholder Equity Liabilities + Stockholder Equity 41200P I need the Solution for Statement & Cash Flows Solved 3. Balance Sheet + This one page contains the whole question please have a look and Sohe this. Crazy for Cricket Inc. Statement of Cash Flows For the month ended 12/31/XX Cash Flows from Operating Activities Net cash flow from investing activities Issue common stock Borrow from bank Pay dividends Solved Cash Flows from Investing Activities Cash Flows from Financing Activities Net cash flow from financing activities Net increase in cash Cash at the beginning of the period Cash at the end of the period 2. Statement of Stockholder Equity Solved 2 Assets Liabilities