Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Its January 2015, you're in Paris and you have a borrowing limit of ?1,000,000 to invest for 5 years. The currencies available to you are

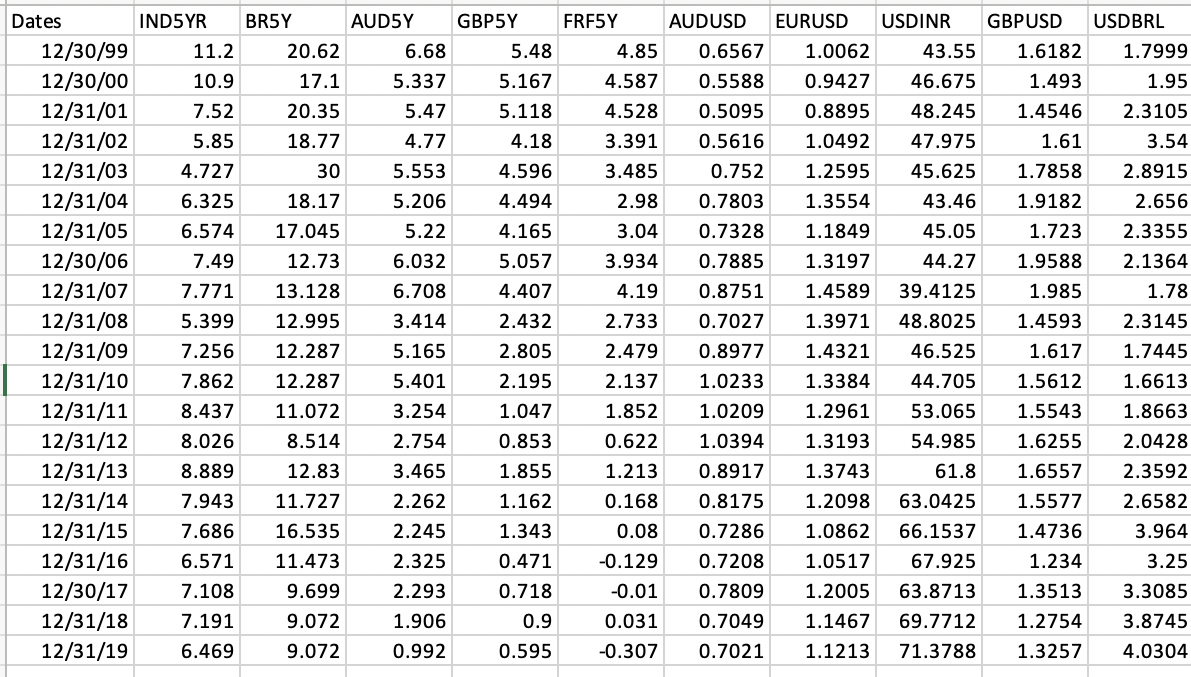

Its January 2015, you're in Paris and you have a borrowing limit of ?1,000,000 to invest for 5 years. The currencies available to you are GBP, BRL, INR and AUD. Your instrument of choice is 5-year government bonds of the respective country maturing in January 2020. You decide to put on a carry trade.

- Check the historical performance of the possible trades, which trade would you choose? (Hint: check performance every year from 2000 to 2015 ignore older data i.e. put on a trade every year for 5 years. You end up with 10 trades per currency. Which has the highest chance of profit? Which has the highest profit?)(total profits and % of profit in each currency)

- b. Which of the 5 trades yielded the most returns (in ?) (for all currencies)

c. What portion of the return was from FX and what portion from interest rates?(for all currencies)

Dates IND5YR BR5Y AUDSY GBPSY FRFSY AUDUSD EURUSD USDINR GBPUSD USDBRL 12/30/99 11.2 20.62 6.68 5.48 4.85 0.6567 1.0062 43.55 1.6182 1.7999 12/30/00 10.9 17.1 5.337 5.167 4.587 0.5588 0.9427 46.675 12/31/01 7.52 20.35 5.47 5.118 4.528 0.5095 0.8895 48.245 1.493 1.4546 1.95 2.3105 12/31/02 5.85 18.77 4.77 4.18 3.391 0.5616 1.0492 47.975 1.61 3.54 12/31/03 4.727 30 5.553 4.596 3.485 0.752 1.2595 45.625 1.7858 2.8915 12/31/04 6.325 18.17 5.206 4.494 2.98 0.7803 1.3554 43.46 1.9182 2.656 12/31/05 6.574 17.045 5.22 4.165 3.04 0.7328 1.1849 45.05 1.723 2.3355 12/30/06 7.49 12.73 6.032 5.057 3.934 0.7885 1.3197 44.27 1.9588 2.1364 12/31/07 7.771 13.128 6.708 4.407 4.19 0.8751 1.4589 39.4125 1.985 1.78 12/31/08 5.399 12.995 3.414 2.432 2.733 12/31/09 7.256 12.287 5.165 2.805 2.479 0.7027 0.8977 1.3971 48.8025 1.4593 2.3145 1.4321 46.525 1.617 1.7445 12/31/10 7.862 12.287 5.401 2.195 2.137 1.0233 1.3384 44.705 1.5612 1.6613 12/31/11 8.437 11.072 3.254 1.047 1.852 1.0209 1.2961 53.065 1.5543 1.8663 12/31/12 8.026 8.514 2.754 0.853 0.622 1.0394 1.3193 54.985 1.6255 2.0428 12/31/13 8.889 12.83 3.465 1.855 1.213 0.8917 1.3743 61.8 1.6557 2.3592 12/31/14 7.943 11.727 2.262 1.162 0.168 0.8175 1.2098 63.0425 1.5577 2.6582 12/31/15 7.686 16.535 2.245 1.343 0.08 0.7286 1.0862 66.1537 1.4736 3.964 12/31/16 6.571 11.473 2.325 0.471 12/30/17 7.108 9.699 2.293 0.718 12/31/18 7.191 9.072 1.906 0.9 12/31/19 6.469 9.072 0.992 0.595 -0.129 0.7208 -0.01 0.7809 0.031 0.7049 -0.307 0.7021 1.0517 67.925 1.234 3.25 1.2005 63.8713 1.3513 3.3085 1.1467 69.7712 1.2754 3.8745 1.1213 71.3788 1.3257 4.0304

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started