Answered step by step

Verified Expert Solution

Question

1 Approved Answer

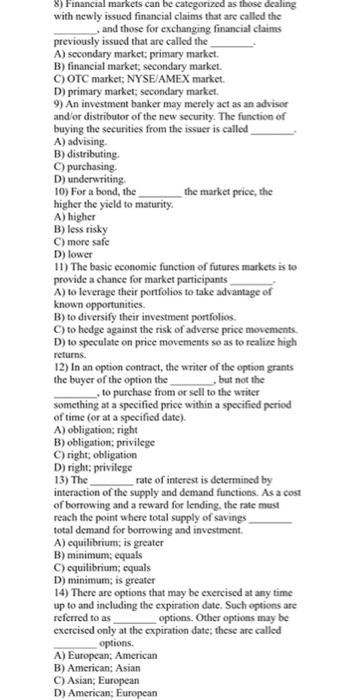

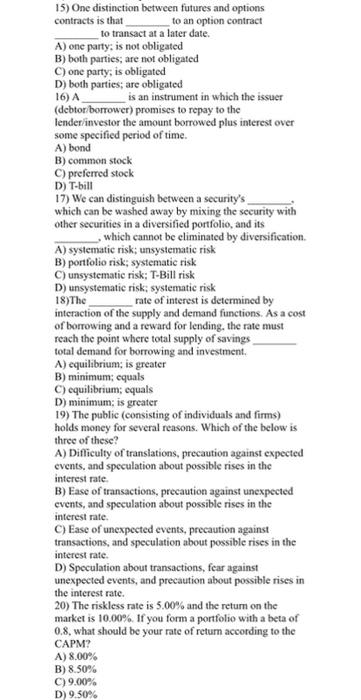

It's multiple questions! plz solve 1-20 1) Reversibility is referred to as A) the cost of investing in a financial asset and then getting out

It's multiple questions! plz solve 1-20

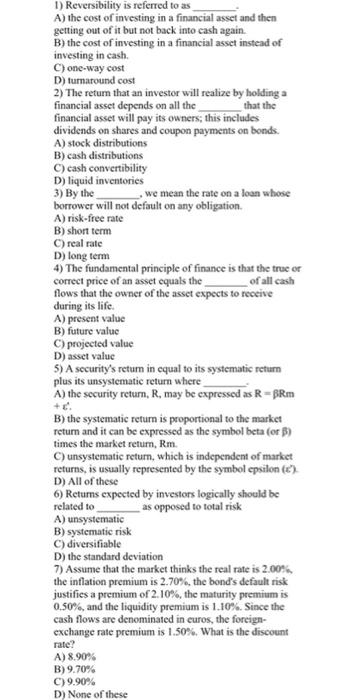

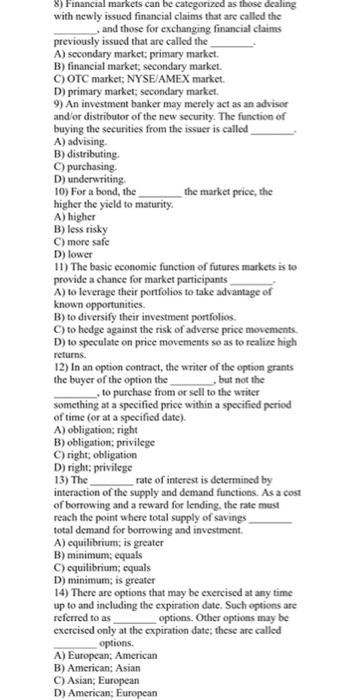

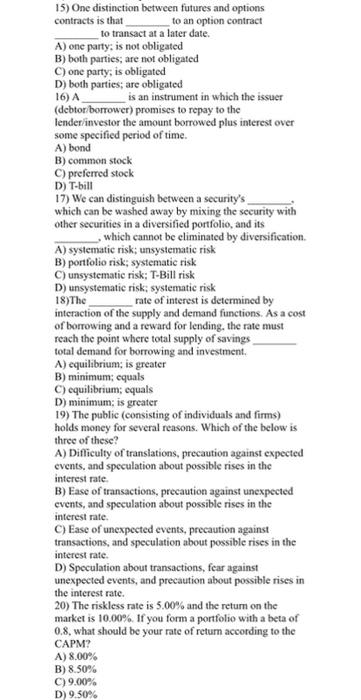

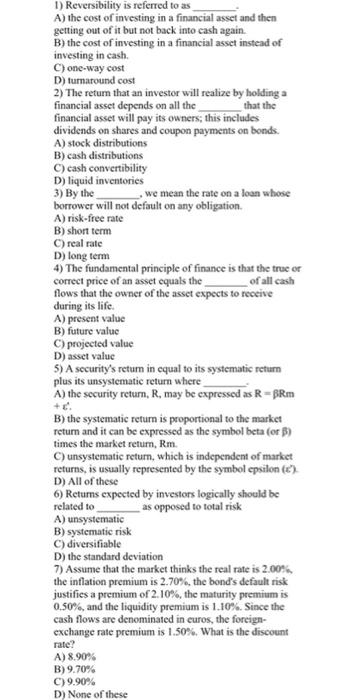

1) Reversibility is referred to as A) the cost of investing in a financial asset and then getting out of it but not back into cash again. B) the cost of investing in a financial asset instead of investing in cash. C) one-way cost D) turnaround cost 2) The return that an investor will realize by holding a financial asset depends on all the that the financial asset will pay its owners; this includes dividends on shares and coupon payments on bonds. A) stock distributions B) cash distributions C) cash convertibility D) liquid inventories 3) By the we mean the rate on a loan whose borrower will not default on any obligation. A) risk-free rate B) short term C) real rate D) long term 4) The fundamental principle of finance is that the true or correct price of an asset equals the of all cash flows that the owner of the asset expects to receive during its life. A) present value B) future value C) projected value D) asset value 5) A security's return in equal to its systematic return plus its unsystematic return where A) the security return, R, may be expressed as R-BRm +E. B) the systematic return is proportional to the market return and it can be expressed as the symbol beta (or) times the market return, Rm. C) unsystematic return, which is independent of market returns, is usually represented by the symbol epsilon (e). D) All of these 6) Returns expected by investors logically should be related to as opposed to total risk A) unsystematic B) systematic risk C) diversifiable D) the standard deviation 7) Assume that the market thinks the real rate is 2.00%, the inflation premium is 2.70%, the bond's default risk justifies a premium of 2.10%, the maturity premium is 0.50%, and the liquidity premium is 1.10%. Since the cash flows are denominated in euros, the foreign- exchange rate premium is 1.50%. What is the discount rate? A) 8.90% B) 9.70% C) 9.90% D) None of these 8) Financial markets can be categorized as those dealing with newly issued financial claims that are called the and those for exchanging financial claims previously issued that are called the A) secondary market; primary market. B) financial market; secondary market. C) OTC market; NYSE/AMEX market. D) primary market; secondary market. 9) An investment banker may merely act as an advisor and/or distributor of the new security. The function of buying the securities from the issuer is called A) advising. B) distributing. C) purchasing. D) underwriting. 10) For a bond, the higher the yield to maturity. the market price, the A) higher B) less risky C) more safe D) lower 11) The basic economic function of futures markets is to provide a chance for market participants A) to leverage their portfolios to take advantage of known opportunities. B) to diversify their investment portfolios. C) to hedge against the risk of adverse price movements. D) to speculate on price movements so as to realize high returns. 12) In an option contract, the writer of the option grants the buyer of the option the but not the to purchase from or sell to the writer something at a specified price within a specified period of time (or at a specified date). A) obligation; right B) obligation; privilege C) right; obligation D) right; privilege 13) The rate of interest is determined by interaction of the supply and demand functions. As a cost of borrowing and a reward for lending, the rate must reach the point where total supply of savings total demand for borrowing and investment. A) equilibrium; is greater B) minimum; equals C) equilibrium; equals D) minimum; is greater 14) There are options that may be exercised at any time up to and including the expiration date. Such options are referred to as options. Other options may be exercised only at the expiration date; these are called options. A) European; American B) American; Asian C) Asian; European D) American; European 15) One distinction between futures and options contracts is that to an option contract to transact at a later date. A) one party; is not obligated B) both parties; are not obligated C) one party; is obligated D) both parties; are obligated 16) A is an instrument in which the issuer (debtor/borrower) promises to repay to the lender/investor the amount borrowed plus interest over some specified period of time. A) bond B) common stock C) preferred stock D) T-bill 17) We can distinguish between a security's which can be washed away by mixing the security with other securities in a diversified portfolio, and its which cannot be eliminated by diversification. A) systematic risk; unsystematic risk B) portfolio risk; systematic risk C) unsystematic risk; T-Bill risk D) unsystematic risk; systematic risk 18) The rate of interest is determined by interaction of the supply and demand functions. As a cost of borrowing and a reward for lending, the rate must reach the point where total supply of savings total demand for borrowing and investment. A) equilibrium; is greater B) minimum; equals C) equilibrium; equals D) minimum; is greater 19) The public (consisting of individuals and firms) holds money for several reasons. Which of the below is three of these? A) Difficulty of translations, precaution against expected events, and speculation about possible rises in the interest rate. B) Ease of transactions, precaution against unexpected events, and speculation about possible rises in the interest rate. C) Ease of unexpected events, precaution against transactions, and speculation about possible rises in the interest rate. D) Speculation about transactions, fear against unexpected events, and precaution about possible rises in the interest rate. 20) The riskless rate is 5.00% and the return on the market is 10.00%. If you form a portfolio with a beta of 0.8, what should be your rate of return according to the CAPM? A) 8.00% B) 8.50% C) 9.00% D) 9.50%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started