Answered step by step

Verified Expert Solution

Question

1 Approved Answer

its not a template Fein Company provided the following information relating to cash payments: a. Fein purchased direct materials on account in the following amounts:

its not a template

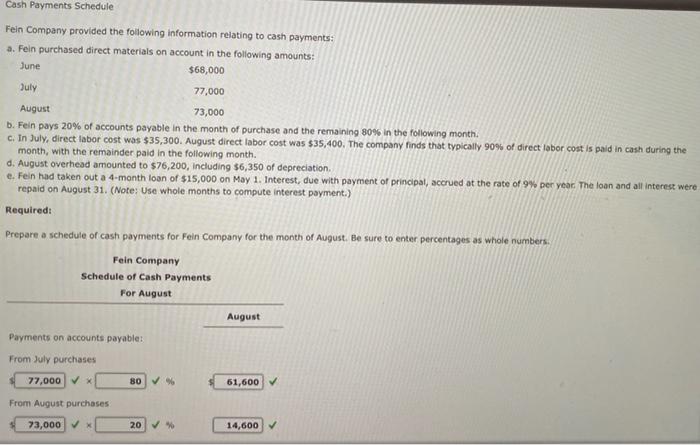

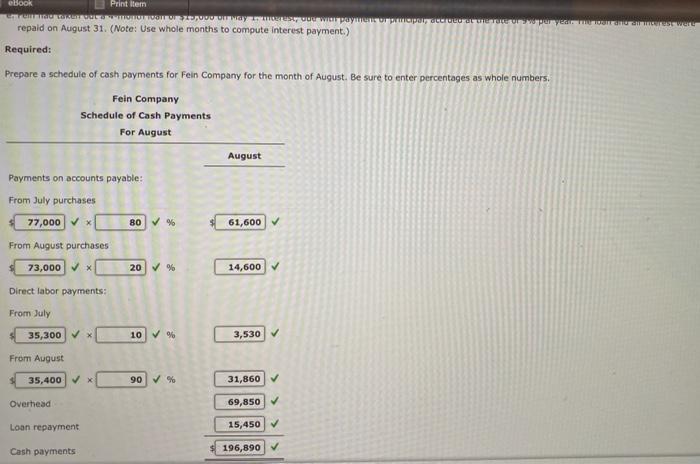

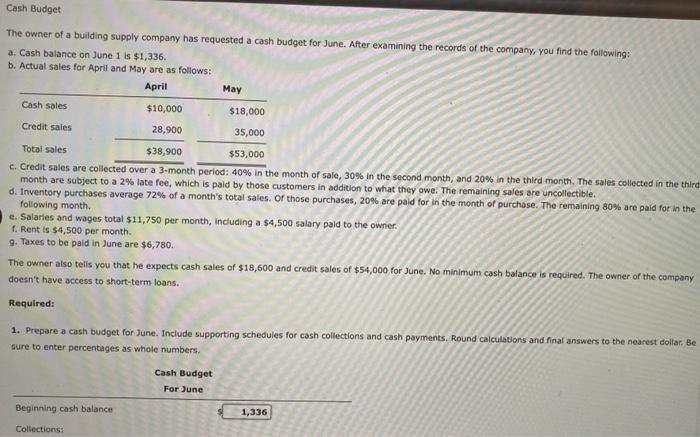

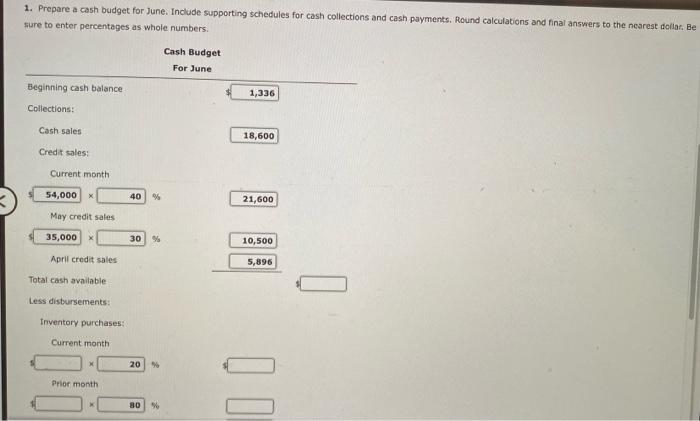

Fein Company provided the following information relating to cash payments: a. Fein purchased direct materials on account in the following amounts: b. Fein pays 20% of accounts payable in the month of purchase and the remaining 80% in the following month. c. In July, direct labor cost was $35,300. August direct labor cost was $35,400. The company finds that typically 909 of direct labor cost is paid in cash during the month, with the remainder paid in the following month. d. August overhead amounted to $76,200, including $6,350 of depreciation. e. Fein had taken out a 4-month loan of $15,000 on May 1. Interest, due with payment of princlpal, accrued at the rate of 9% per yeac The loan and all interest were repaid on August 31. (Note: Use whole months to compute interest payment.) Required: Prepare a schedule of cash payments for Fein Company for the month of August. Be sure to enter percentages as whole numbers. repaid on August 31. (Note: Use whole months to compute interest payment.) Required: Prepare a schedule of cash payments for Fein Company for the month of August. Be sure to enter percentages as whole numbers. The owner of a building supply company has requested a cash budget for June. After examining the records of the company, you find the following: a. Cash balance on June 1 is $1,336. b. Actual sales for April and May are as follows: month are subject to a 2%5 of a sate month period: 40% in the month of 30% in the second month, and 20% in the third month, The sales collected in the thir d. Inventory purchases average 72%, which is paid by those customers in addition to what they owe. The remaining sales are uncollectible, following month. e. Salaries and wages total $11,750 per month, including a $4,500 salary paid to the owner. f. Rent is $4,500 per month. 9. Taxes to be paid in June are $6,780. The owner also telis you that he expects cash sales of $18,600 and credit sales of $54,000 for June. No minimum cash balance is required. The owner of the company doesn't have access to short-term loans. Required: 1. Prepare a cash budget for June. Include supporting schedules for cash collections and cash payments. Round caiculatons and final answers to the nearest dollar. Be sure to enter percentages as whole numbers. 1. Prepare a cash budget for June. Include supporting schedules for cash collections and cash payments. Round calculations and final answers to the nearest doliaf. Be sure to enter percentages as whole numbers: Fein Company provided the following information relating to cash payments: a. Fein purchased direct materials on account in the following amounts: b. Fein pays 20% of accounts payable in the month of purchase and the remaining 80% in the following month. c. In July, direct labor cost was $35,300. August direct labor cost was $35,400. The company finds that typically 909 of direct labor cost is paid in cash during the month, with the remainder paid in the following month. d. August overhead amounted to $76,200, including $6,350 of depreciation. e. Fein had taken out a 4-month loan of $15,000 on May 1. Interest, due with payment of princlpal, accrued at the rate of 9% per yeac The loan and all interest were repaid on August 31. (Note: Use whole months to compute interest payment.) Required: Prepare a schedule of cash payments for Fein Company for the month of August. Be sure to enter percentages as whole numbers. repaid on August 31. (Note: Use whole months to compute interest payment.) Required: Prepare a schedule of cash payments for Fein Company for the month of August. Be sure to enter percentages as whole numbers. The owner of a building supply company has requested a cash budget for June. After examining the records of the company, you find the following: a. Cash balance on June 1 is $1,336. b. Actual sales for April and May are as follows: month are subject to a 2%5 of a sate month period: 40% in the month of 30% in the second month, and 20% in the third month, The sales collected in the thir d. Inventory purchases average 72%, which is paid by those customers in addition to what they owe. The remaining sales are uncollectible, following month. e. Salaries and wages total $11,750 per month, including a $4,500 salary paid to the owner. f. Rent is $4,500 per month. 9. Taxes to be paid in June are $6,780. The owner also telis you that he expects cash sales of $18,600 and credit sales of $54,000 for June. No minimum cash balance is required. The owner of the company doesn't have access to short-term loans. Required: 1. Prepare a cash budget for June. Include supporting schedules for cash collections and cash payments. Round caiculatons and final answers to the nearest dollar. Be sure to enter percentages as whole numbers. 1. Prepare a cash budget for June. Include supporting schedules for cash collections and cash payments. Round calculations and final answers to the nearest doliaf. Be sure to enter percentages as whole numbers Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started