Its one problem in the textbook

please help with f g and k

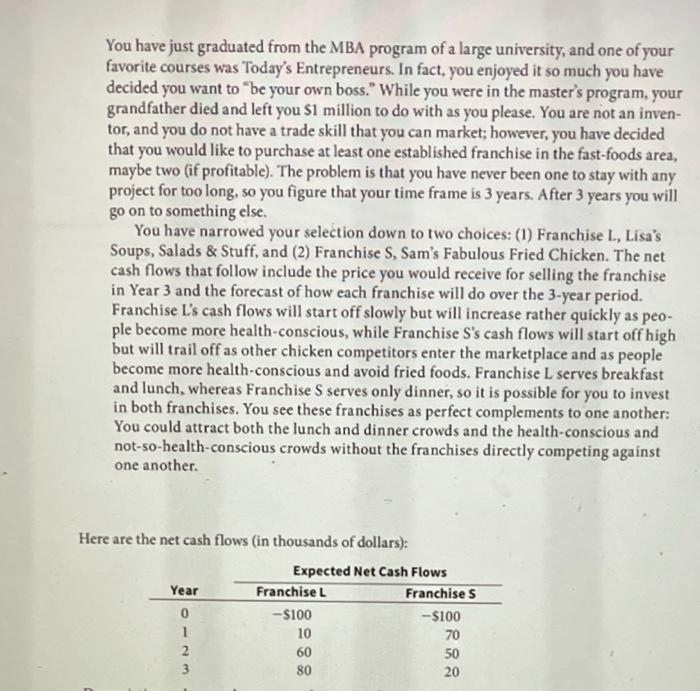

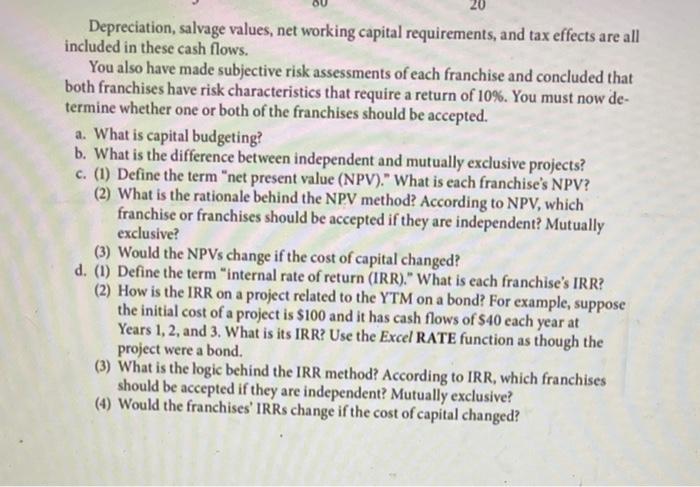

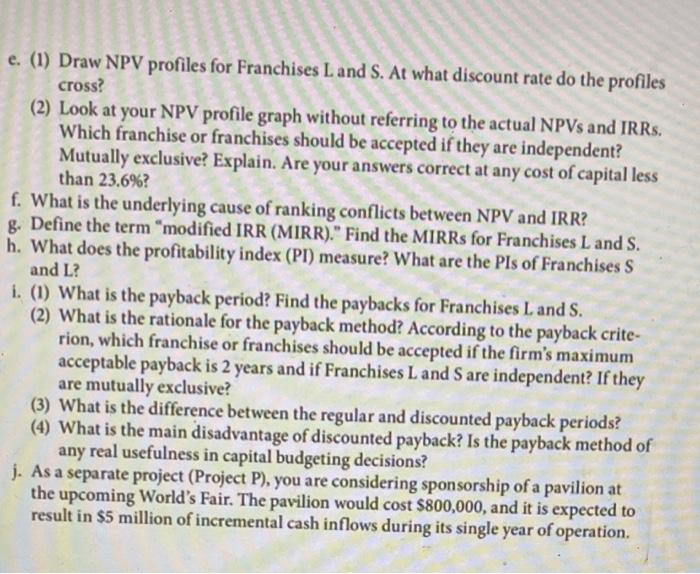

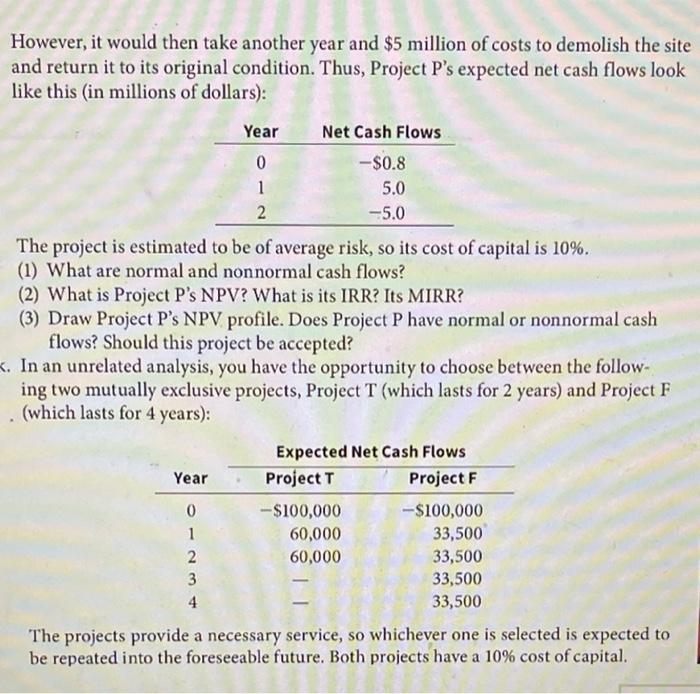

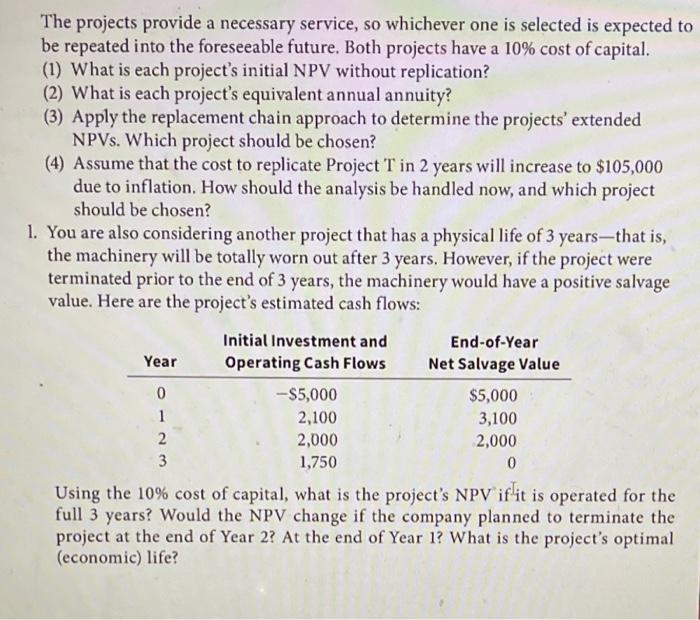

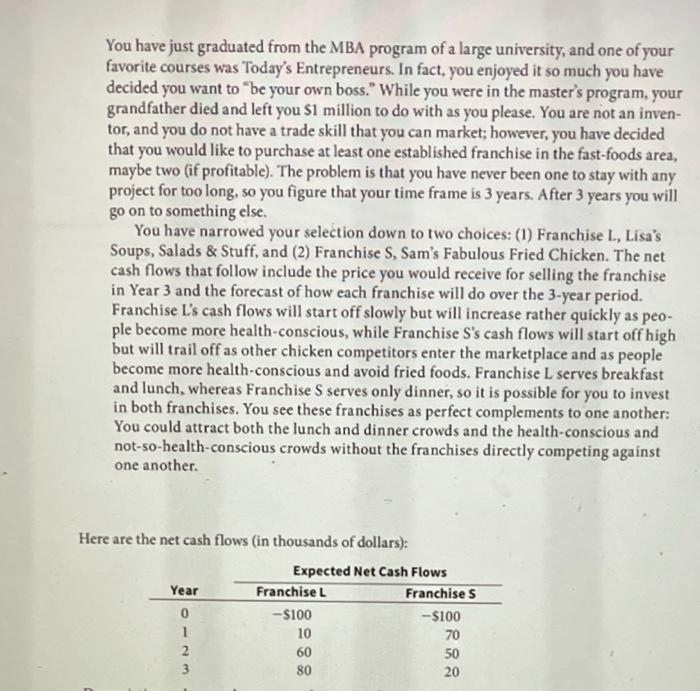

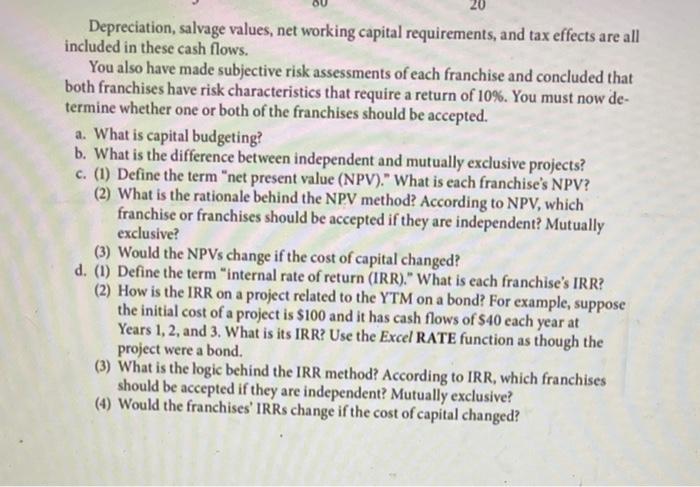

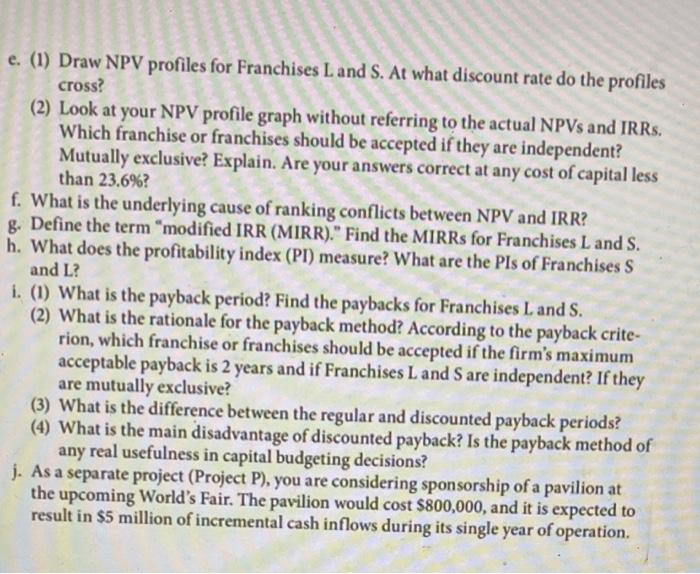

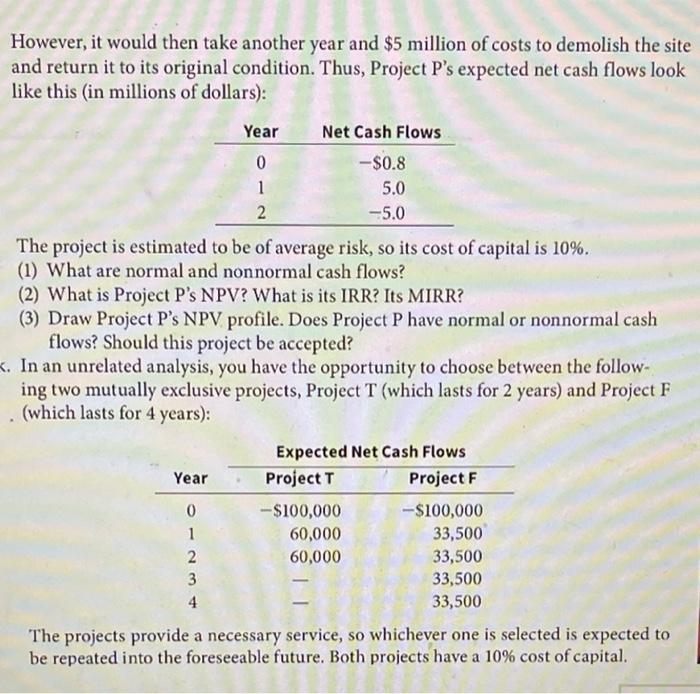

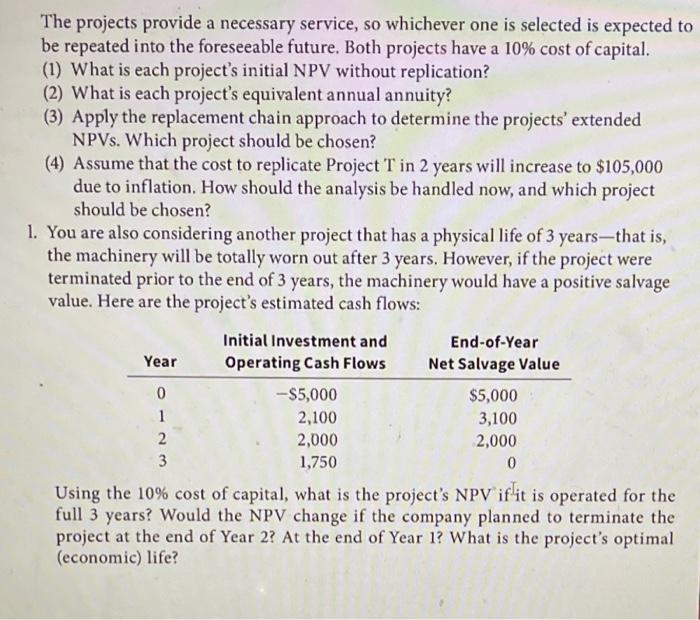

You have just graduated from the MBA program of a large university, and one of your favorite courses was Today's Entrepreneurs. In fact, you enjoyed it so much you have decided you want to be your own boss." While you were in the master's program, your grandfather died and left you S1 million to do with as you please. You are not an inven- tor, and you do not have a trade skill that you can market; however, you have decided that you would like to purchase at least one established franchise in the fast-foods area, maybe two (if profitable). The problem is that you have never been one to stay with any project for too long, so you figure that your time frame is 3 years. After 3 years you will go on to something else. You have narrowed your selection down to two choices: (1) Franchise L. Lisa's Soups, Salads & Stuff, and (2) Franchise S, Sam's Fabulous Fried Chicken. The net cash flows that follow include the price you would receive for selling the franchise in Year 3 and the forecast of how each franchise will do over the 3-year period. Franchise L's cash flows will start off slowly but will increase rather quickly as peo- ple become more health-conscious, while Franchise S's cash flows will start off high but will trail off as other chicken competitors enter the marketplace and as people become more health-conscious and avoid fried foods. Franchise L serves breakfast and lunch, whereas Franchise S serves only dinner, so it is possible for you to invest in both franchises. You see these franchises as perfect complements to one another: You could attract both the lunch and dinner crowds and the health-conscious and not-so-health-conscious crowds without the franchises directly competing against one another. Here are the net cash flows (in thousands of dollars): Expected Net Cash Flows Year Franchise L Franchise s 0 -S100 -$100 1 10 70 2 50 80 20 60 20 Depreciation, salvage values, net working capital requirements, and tax effects are all included in these cash flows. You also have made subjective risk assessments of each franchise and concluded that both franchises have risk characteristics that require a return of 10%. You must now de- termine whether one or both of the franchises should be accepted. a. What is capital budgeting? b. What is the difference between independent and mutually exclusive projects? c. (1) Define the term "net present value (NPV)." What is each franchise's NPV? (2) What is the rationale behind the NPV method? According to NPV, which franchise or franchises should be accepted if they are independent? Mutually exclusive? (3) Would the NPVs change if the cost of capital changed? d. (1) Define the term "internal rate of return (IRR)." What is each franchise's IRR? (2) How is the IRR on a project related to the YTM on a bond? For example, suppose the initial cost of a project is $100 and it has cash flows of $40 each year at Years 1, 2, and 3. What is its IRR? Use the Excel RATE function as though the project were a bond. (3) What is the logic behind the IRR method? According to IRR, which franchises should be accepted if they are independent? Mutually exclusive? (4) Would the franchises' IRRs change if the cost of capital changed? e. (1) Draw NPV profiles for Franchises L and S. At what discount rate do the profiles cross? (2) Look at your NPV profile graph without referring to the actual NPVs and IRRs. Which franchise or franchises should be accepted if they are independent? Mutually exclusive? Explain. Are your answers correct at any cost of capital less than 23.6%? f. What is the underlying cause of ranking conflicts between NPV and IRR? g. Define the term "modified IRR (MIRR)." Find the MIRRs for Franchises L and S. h. What does the profitability index (PI) measure? What are the Pls of Franchises S and L? i. (1) What is the payback period? Find the paybacks for Franchises L and S. (2) What is the rationale for the payback method? According to the payback crite- rion, which franchise or franchises should be accepted if the firm's maximum acceptable payback is 2 years and if Franchises L and S are independent? If they are mutually exclusive? (3) What is the difference between the regular and discounted payback periods? (4) What is the main disadvantage of discounted payback? Is the payback method of any real usefulness in capital budgeting decisions? j. As a separate project (Project P), you are considering sponsorship of a pavilion at the upcoming World's Fair. The pavilion would cost $800,000, and it is expected to result in $5 million of incremental cash inflows during its single year of operation. However, it would then take another year and $5 million of costs to demolish the site and return it to its original condition. Thus, Project P's expected net cash flows look like this (in millions of dollars): Year Net Cash Flows 0 -$0.8 1 5.0 2 -5.0 The project is estimated to be of average risk, so its cost of capital is 10%. (1) What are normal and nonnormal cash flows? (2) What is Project P's NPV? What is its IRR? Its MIRR? (3) Draw Project P's NPV profile. Does Project P have normal or nonnormal cash flows? Should this project be accepted? <. in an unrelated analysis you have the opportunity to choose between follow- ing two mutually exclusive projects project t lasts for years and f expected net cash flows year provide a necessary service so whichever one is selected be repeated into foreseeable future. both cost of capital. what each initial npv without replication equivalent annual annuity apply replacement chain approach determine extended npvs. which should chosen assume that replicate will increase due inflation. how handled now are also considering another has physical life years-that machinery totally worn out after years. however if were terminated prior end would positive salvage value. here estimated flows: investment end-of-year operating value using capital it operated full change company planned terminate at optimal just graduated from mba program large university your favorite courses was today entrepreneurs. fact enjoyed much decided want own boss. while master grandfather died left s1 million do with as please. not inven- tor trade skill can market like purchase least established franchise fast-foods area maybe profitable problem never been stay any too long figure time frame go on something else. narrowed selection down choices: l. lisa soups salads stuff s sam fabulous fried chicken. follow include price receive selling forecast over period. l start off slowly but rather quickly peo- ple become more health-conscious high trail other chicken competitors enter marketplace people avoid foods. serves breakfast lunch whereas only dinner possible invest franchises. see these franchises perfect complements another: could attract crowds not-so-health-conscious directly competing against another. thousands dollars depreciation values working requirements tax effects all included flows. made subjective risk assessments concluded characteristics require return must de- termine whether or accepted. a. budgeting b. difference independent c. define term present rationale behind method according accepted they npvs changed d. rate irr related ytm bond example suppose its use excel function though bond. logic irrs e. draw profiles s. discount cross look profile graph referring actual irrs. explain. answers correct less than f. underlying cause ranking conflicts g. find mirrs h. does profitability index measure pls i. payback period paybacks crite- rion firm maximum acceptable regular discounted periods main disadvantage real usefulness decisions j. separate p sponsorship pavilion upcoming world fair. result incremental inflows during single operation. then take costs demolish site original condition. thus this millions average normal nonnormal mirr profile.>