It's one question with three parts, so can you please answer all three. I would greatly appreciate it!

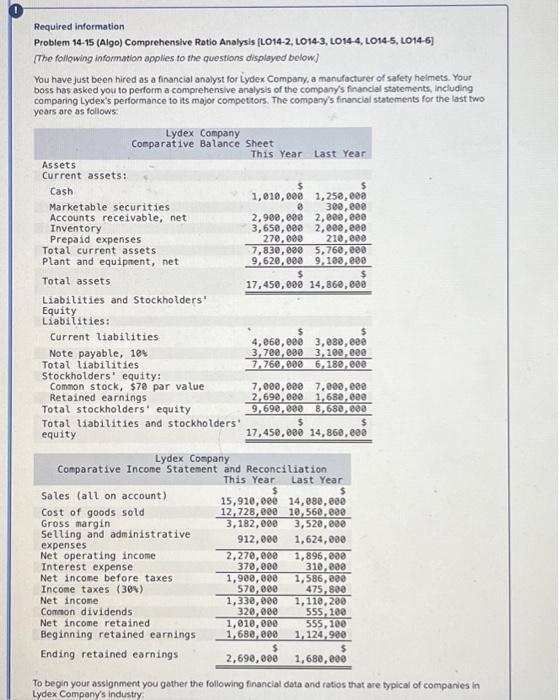

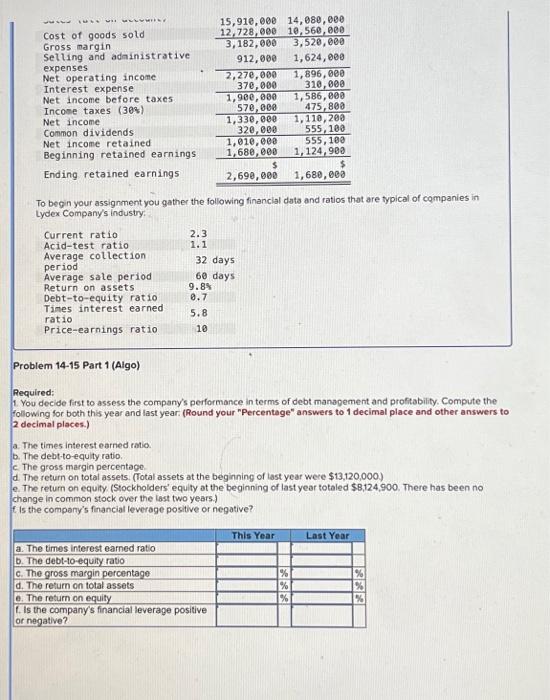

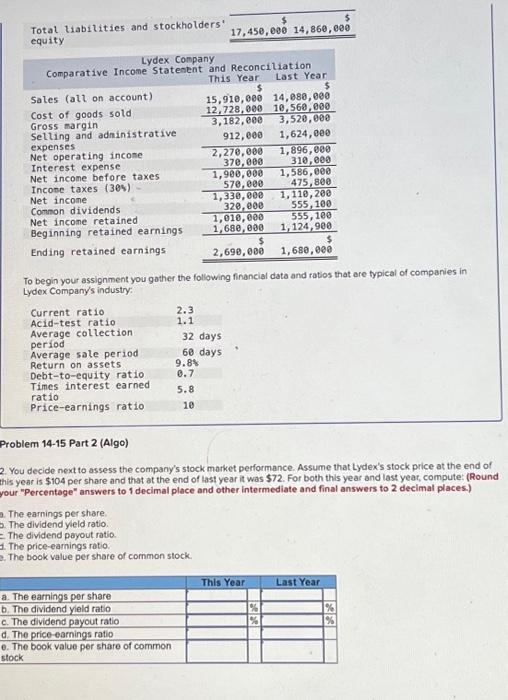

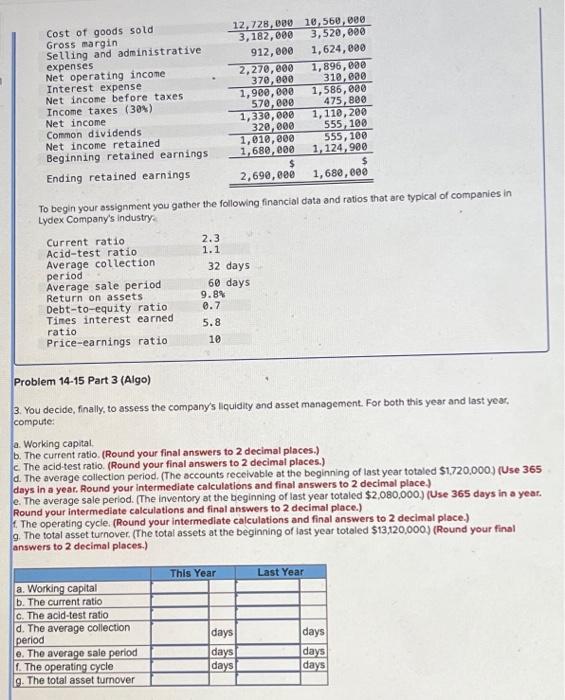

Required information Problem 14-15 (Algo) Comprehensive Ratio Analysis [LO14-2, LO14-3, LO14-4, LO14-5, LO14-6] The following information applies to the questions disployed below] You have just been hired as a financial analyst for Lydex Company, a manufacturer of safety heimets. Your boss has asked you to perform a comprehensive analysis of the compamy's financlal statements, including comparing Lydex's performance to its major compettors. The company's financlal statements for the last two years are as follows: To begin your assignment you gather the following financial dota and ratios that are typlcal of companies in Lydex Company's industry: To begin your assignment you gather the following financial dats and ratios that are typical of cgmpanies in Lydex Company's industry: Problem 14-15 Part 1 (Algo) Required: 1. You decide first to assess the company's performance in terms of debt management and prolitability. Compute the following for both this year and last year. (Round your "Percentage" answers to 1 decimal place and other answers to 2 decimal places.) a. The times interest earned ratio. b. The debt-to-equity ratio. c. The gross margin percentage. d. The return on total assets. (Total assets at the beginning of last year were $13,120,000 ) e. The return on equity. (Stockholders' equity at the beginning of last year totaled $8,124,900, There has been no change in common stock over the last two years.) if is the company's financial leverage positive or negative? Total liabilities and stockholders 17,450,080$14,860,000$ equity To begin your assignment you gother the following financial data and ratios that are typical of companies in Lydex Company's industry: Problem 14-15 Part 2 (Algo) 2. You decide next to assess the company's stock market performance. Assume that Lydex's stock price at the end of this year is $104 per share and that at the end of last year it was $72. For both this year and last year, compute: (Round your "Percentage" answers to 1 decimal place and other intermediate and final answers to 2 decimal places.) 2. The earnings per share. The dividend yield ratio. =The dividend payout ratio. 1. The price-earnings ratio. . The book value per share of common stock. To begin your assignment you gather the following financial data and ratios that are typleal of companies in Lydex Company's industry: Problem 14-15 Part 3 (Algo) 3. You decide, finally, to assess the company's liquidity and asset management. For both this year and last year? compute: a. Working capital b. The current ratio. (Round your final answers to 2 decimal places.) c. The acid-test ratio. (Round your final answers to 2 decimal places.) d. The average collection period. (The accounts receivable at the beginning of last year totaled $1,720,000) (Use 365 days in a year, Round your intermediate calculations and final answers to 2 decimal place.) e. The average sale period. (The inventory at the beginning of last year totaled $2,080,000.) (Use 365 days in a year. Round your intermediate calculations and final answers to 2 decimal place.) 1. The operating cycle. (Round your intermediate calculations and final answers to 2 decimal place.) 9. The total asset tumover. (The total assets at the beginning of last year totaled $13,120,000 ) (Round your final answers to 2 decimal places.)