Answered step by step

Verified Expert Solution

Question

1 Approved Answer

it's problem 5-3b I need to do a general journal and an analysis component so confused n/60, FOB shipping point. Analysis Component: You are working

it's problem 5-3b I need to do a general journal and an analysis component so confused

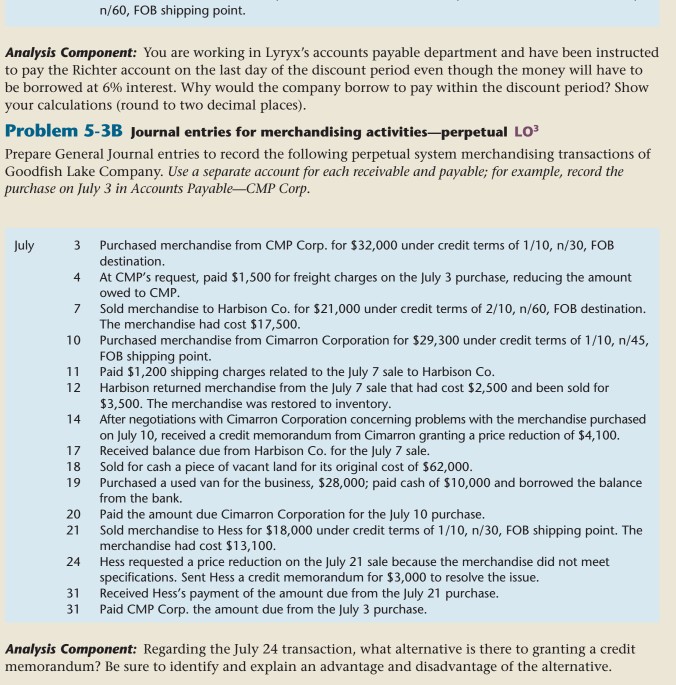

n/60, FOB shipping point. Analysis Component: You are working in Lyryx's accounts payable department and have been instructed to pay the Richter account on the last day of the discount period even though the money will have to be borrowed at 6% interest. why would the company borrow to pay within the discount period? Show your calculations (round to two decimal places) Problem 5-3B Journal entries for merchandising activities-perpetual LO3 Prepare General Journal entries to record the following perpetual system merchandising transactions of Goodfish Lake Company. Use a separate account for each receivable and payable; for example, record the purchase on July 3 in Accounts Payable CMP Corp July Purchased merchandise from CMP Corp. for $32,000 under credit terms of 1/10, n/30, FOB destination At CMP's request, paid $1,500 for freight charges on the July 3 purchase, reducing the amount owed to CMP Sold merchandise to Harbison Co. for $21,000 under credit terms of 2/10, n/60, FOB destination The merchandise had cost $17,500 Purchased merchandise from Cimarron Corporation for $29,300 under credit terms of 1/10, n/45, FOB shipping point. Paid $1,200 shipping charges related to the July 7 sale to Harbison Co Harbison returned merchandise from the July 7 sale that had cost $2,500 and been sold for $3,500. The merchandise was restored to inventory After negotiations with Cimarron Corporation concerning problems with the merchandise purchased on July 10, received a credit memorandum from Cimarron granting a price reduction of $4,100 Received balance due from Harbison Co. for the July 7 sale Sold for cash a piece of vacant land for its original cost of $62,000 Purchased a used van for the business, $28,000; paid cash of $10,000 and borrowed the balance from the bank. Paid the amount due Cimarron Corporation for the July 10 purchase Sold merchandise to Hess for $18,000 under credit terms of 1/10, n/30, FOB shipping point. The merchandise had cost $13,100 Hess requested a price reduction on the July 21 sale because the merchandise did not meet specifications. Sent Hess a credit memorandum for $3,000 to resolve the issue Received Hess's payment of the amount due from the July 21 purchase Paid CMP Corp. the amount due from the July 3 purchase 3 4 7 10 11 12 14 17 18 19 20 21 24 31 31 Analysis Component: Regarding the July 24 transaction, what alternative is there to granting a credit memorandum? Be sure to identify and explain an advantage and disadvantage of the alternativeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started