its the 11 part , not 12.

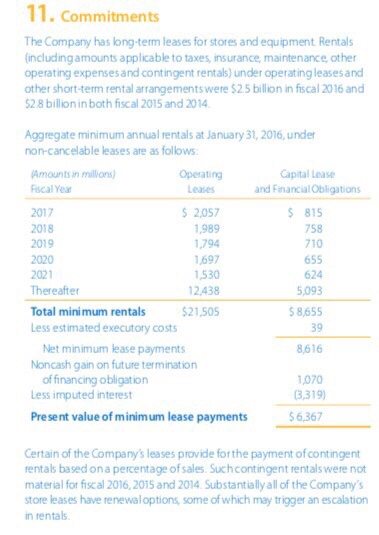

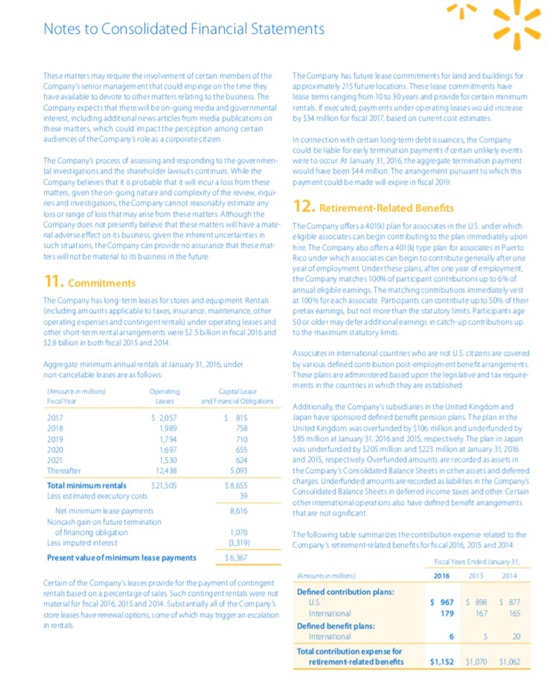

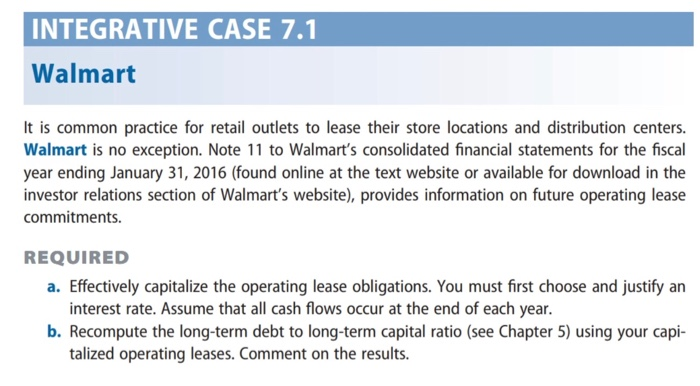

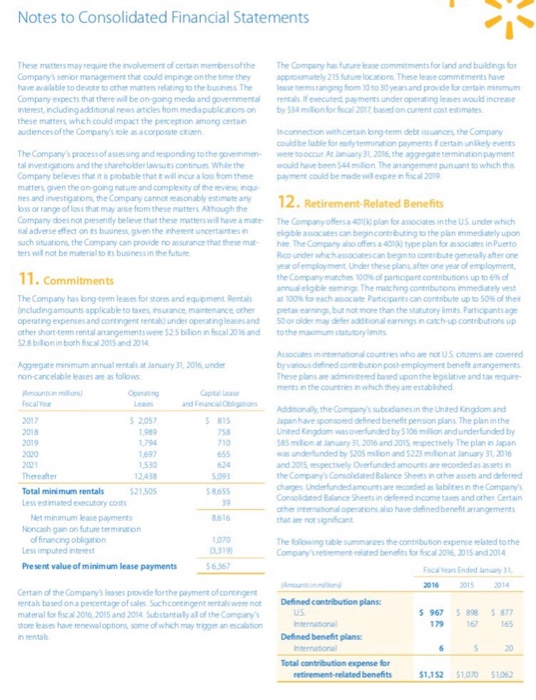

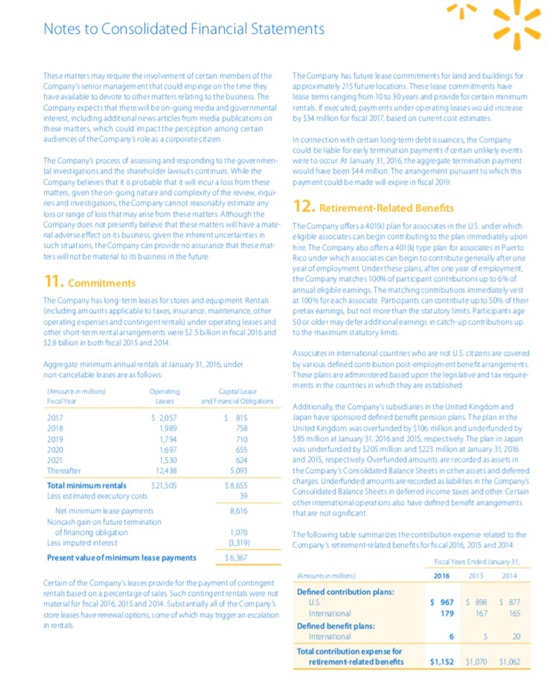

INTEGRATIVE CASE 7.1 Walmart It is common practice for retail outlets to lease their store locations and distribution centers. Walmart is no exception. Note 11 to Walmart's consolidated financial statements for the fiscal year ending January 31, 2016 (found online at the text website or available for download in the investor relations section of Walmart's website), provides information on future operating lease commitments REQUIRED a. Effectively capitalize the operating lease obligations. You must first choose and justify an interest rate. Assume that all cash flows occur at the end of each year. b. Recompute the long-term debt to long-term capital ratio (see Chapter 5) using your capi- talized operating leases. Comment on the results. Notes to Consolidated Financial Statements These matters may require the involvement of certain membersofthe The Company has futue lease commitments for land and buildings for Company's senior management that could impinge on the time they ximtely 215 uu locations These lease commtments have have available to devote to other mattens relating to the business The ms anging fiom 10 to 30yearsand provide for certain minimum Company expects that there wil be on-going meds and governmental rentals if cuted payments under operating leases would increase nterest, includingadditional news articles from medapublications onby 534 milion for fiscal 2017 based on current cost estimates these matters which could impact the perception among certan audencesof the Company's tole as acorpoate chuen Inconnection withcertan long-tem debe issuances the Company couldbe lable for eadytemination payments f certain unlkely events The Company's processof assessing and responding tothe govemmen-tooccur At January 31, 2016, the aggregate termination payment tal investigations and the shareholder lawsuits continues Whle the Company beleves that it s psobable that t wll incur a loss from these payment could be made willexpire in fical 2019 matters given the on-going nature and complexity of the neviewinu nes and investigations the Company canot reasionably estimute ary12. Retirement-Related Benefit would have been 544 milon The arangement pursuant to which ths ss or range of loss that may arse from these matters Although the Company does not presently believe that these matters wil have a mate The Companyoffers a 400 plan for associates in the US under which al adverse effect on ts business,given the inherent uncertaintesn such situations the Company can provide no assurance that these matheThe Compary aso offers a 4010) type plan for associates in Puerto ers well not be material to ts business in the future eigble assocates can begincontributing to the plan immediately upon Rco under whichassociates.can begin to contribute generalyafter one year ofemployment Under these plans after one year of employment theComprymatches 100% of participant contributions up to 6% of annual eligble eamings The matching contnibutions immedately vest 1.Commitments The Company has brg term leases for stores and equpment Rentals at 100-tr each a acate Part opnes can contnbate up to S0% of ther ncludingamounts applicable to taxes insurance maintenance otherpa earnings but not more than the statutory Iimits Participantsage operating expenses and contingent rentas) under operating leasesand 0or older may defer additional earnings in catch-up contributions up other shont-tem rental arrangementswere $25 bition in fucal 2016 and tothem statutory limits 28 bilionin both fiscal 2015 and 2014 ociates ininterational countries who are not US citizens are covered byvaniousdefined contrbution post-employment benefit amangements These plans ae administered based uponthe legis lative and tax require ments in the countries in which theyare established Aggregate minimum annual rentals at January 31,2016 und non-cancelable leases are as follows aptal Leas and Fnancial Obtions ocal Year Addisionaly the Company's subsidianes in the Uhited Kingdom and lapanhave sponsoed defined benefit pension plans The plan inthe Unted Kingdom was overfunded by 5106 million and underfunded by 85 milion at lJanuary 31,2016 and 2015 respectvely The plan in Japan as underfunded by 205 milion and 5223 millionat January 31, 2016 and 2015 espectvely Overfunded amounts are recordedas assets in the Company's Consoldated Balance Sheets in other assets and deferred charges Underfunded amountsare recorded as labiltiesin the Company's onsoldated Balance Sheets in defered income taxes and other Certain other international operations also have defined benefit arrangements that are not signficant s 2057 1989 2017 2018 2019 2020 2021 Thereafter 5 815 758 1697 1530 655 1243 Total minimum rentals Less estimated executory cost 21,505 5 8655 39 8616 Net minimum lease payments Noncash gain on future termination of financing obligation Less imputed interest Pre sent value of minimum lease payments 1070 319 6367 The folowing table summanizes the contibution expense related to the Compary'sreementrelated benlits for fiscal 2016, 2015 and 2014 scal Years Ended y 3 015 2014 2016 Certain of the Company's leases provide forthe payment of contingent entab based ona pexcentage of sales Suchcontingent entals were notDefined contribution plans materal for fiscal 2016,2015 and 2014 Substantalyall of the Companys ore leases have renewaloptions some of which may trigger an escalationtional n rental 967 179 5 8985 8 167 Defined benefit plans: hternation 20 Total contribution expense for 1,152 51,070 51.062 interest-rate obligation. The swap fixes the firm's annual interest expense and cash expenditure to 496 of the $500,000 note. FD designates the swap contract as a cash flow hedge. INTEGRATIVE CASE 7.1 Walmart It is common practice for retail outlets to lease their store locations and distribution centers. Walmart is no exception. Note 11 to Walmart's consolidated financial statements for the fiscal year ending January 31, 2016 (found online at the text website or available for download in the investor relations section of Walmart's website), provides information on future operating lease commitments. REQUIRED a. Effectively capitalize the operating lease obligations. You must first choose and justify an interest rate. Assume that all cash flows occur at the end of each year. b. Recompute the long-term debt to long-term capital ratio (see Chapter 5) using your capi talized operating leases. Comment on the results. CASE 7.2 Notes to Consolidated Financial Statements These matters may require the involvement of certain members of the The Company has futuse lease commitments for land and buildings o Company's senior management that could mpinge on the time they eoximately 215 future locations. These lease commitments have have available to devote to other matters selating to the business The lease tems ranging fiom 10t0 30years and provide for certain minmum Company expects that there willbeon-going media and governmental rental f eveuted payments under operating leases would increase ntesest, including additional newsarticles fiom meda publicationson by 534 million for fscal 2017, based on cument cost estimate these matters, which could impactthe pesception among certain audiences of the Compary'srole as a corporate cite In connection with cetain long-tem debt ssuances,the Company could belable for early termination paymentsif centain unikely events The Company's process of assessing and responding to the governmen wese to occut At January 31.2016 the aggregate termination payment tal nvestigations and the shareholder lawsuts continues. While the Company beleves that t s probable that it will ncur a loss from these payment could be made will expine in focal 2019 matters,gven the on-going nature and complexity of the seview, inqui nes and investigations, the Compary cannot easonably estimate any 12. Retirement-Related Benefits oss or range of loss that may anise from these matters Although the Company does not presently believe that these mattes willhave a mate The Company offersa 4010) plan for associates in the US underwhich al adverse efflect on its business given the inherent uncertainties ieligible associates can begin contributing to the plan immediately upon would have been $44 million The anangement pursuant to which the such situations, the Company can provide no assurance that thesemat he The Company aho offers a 40100 type plan for assocates in Puerto ters will not be matenial to its business in the futu Rico under which associates can begin to contribute generally after on yearof employment Underthese plans after one year of employment theCongary matches 100% of part cpant contributions up to 6% of annual eligble eamings The matching contibutions immedatelyvest 11.Commitments The Company has bng-term leases for stores and equipment Rentals at t00% foreach associate Parbapants can contribute up to 50% d their ncluding amounts applicable to taxes, insurance,maintenance other pretaxearmings, but not more than the statutory limits Particpants age operating expenses and contingent rental under operating leases and 50or older may deferadditional eamings in catch-up contributions up other short-term entalarangements were $2 5bilion in fscal 2016 and to the maximum statutory imit 28 billion in both fiscal 2015 and 2014 Associates in international countries who are not US citcen are covered by various defined contr bution post-employment beneftarangements These plans are administered based upon the legs lative and tax equire ments in the countriesin which they are established Aggregate minimum annualsentalk at January 31,2016 under non-cancelable leases are as follows apital Leae nd Finncd Obligton Additionally, the Companys subsidiaries in the United Kingdom and Japan have sponsored defned beneft pension plans The plan in the United Kingdom was overfunded by $106 millon and underfunded by 85 million at January 31, 2016 and 2015, espectively The plan in Japan was underfunded by $205 million and $223 million at January 31,20 and 2015, respectively Overfunded amounts are recorded as assetsin the Company's Consolidated Balance Sheets in other assets and defemed charges Underfunded amounts are recorded as lablities in the Companys Consolidated Balance Sheets in defemed income taxes and other Cetai other intemationaloperations also have defined benefe aangements that are not signficant 2057 1989 2017 2018 2019 2020 2021 815 758 710 1697 1530 12438 Total minimum rentals$21,505 .093 8.655 39 8,616 ,030 6.367 Less estimated executory cost Net minimum lease payments Nonash gan on future temination of finanding obligaion Less imputed inteest The folowing table summarges the contribution expense nelated to the Company' retirement-related benefits forfscal 2016 2015 and 2014 Present valueofminimum lease payments Yeas Ended Janary 31 2016 2015 2014 Certain of the Company's leases provide for the payment of contingent rentals based on a percentage of sales Such contingent rentals were notDefined contribution plans material for fscal 2016 2015 and 2014 Substantially all of the Company stose leases have renewal options,some of which may trigger an escalation n rentas 967 $898 877 79 167 Defined benefit plans: nternat onal 20 Total contribution expense for retirement-related benefits 1,152 1,070 $1.6 IT. Commitments The Company has long-term leases for stores and equipment Rentals (includingamounts applicable to taxes, insurance, maintenance other operating expenses and contingent rentals) under operating leases and other short-term rental arrangementswere $2.5 billion in fiscal 2016 and 52 8 billion in both fiscal 2015 and 2014 Aggregate minimum annual rentals at January 31, 2016,under non-cancelable leases are as follows Operating Leases Capital Lease and Financial Obligations Amounts in millions) Fscal Year 2017 2018 2019 2020 2021 Thereafter Total minimum rentals Less estimated executory costs 2057 1,989 1,794 697 1,530 12,438 $21,505 815 758 710 655 624 5,093 58,655 39 Net minimum lease payments Noncash gain on future termination 8,616 of financing obligation Less imputed interest 1070 3,319) 6,367 Pre sent value of minimum lease payments Certain of the Company's leases provide forthe payment of contingent rentals based on a percentage of sales. Suchcontingent rentals were not material for fiscal 2016, 2015 and 2014 Substantially all of the Company's store leases have renewal options, some of which may trigger an escalation n rentals INTEGRATIVE CASE 7.1 Walmart It is common practice for retail outlets to lease their store locations and distribution centers. Walmart is no exception. Note 11 to Walmart's consolidated financial statements for the fiscal year ending January 31, 2016 (found online at the text website or available for download in the investor relations section of Walmart's website), provides information on future operating lease commitments REQUIRED a. Effectively capitalize the operating lease obligations. You must first choose and justify an interest rate. Assume that all cash flows occur at the end of each year. b. Recompute the long-term debt to long-term capital ratio (see Chapter 5) using your capi- talized operating leases. Comment on the results. Notes to Consolidated Financial Statements These matters may require the involvement of certain membersofthe The Company has futue lease commitments for land and buildings for Company's senior management that could impinge on the time they ximtely 215 uu locations These lease commtments have have available to devote to other mattens relating to the business The ms anging fiom 10 to 30yearsand provide for certain minimum Company expects that there wil be on-going meds and governmental rentals if cuted payments under operating leases would increase nterest, includingadditional news articles from medapublications onby 534 milion for fiscal 2017 based on current cost estimates these matters which could impact the perception among certan audencesof the Company's tole as acorpoate chuen Inconnection withcertan long-tem debe issuances the Company couldbe lable for eadytemination payments f certain unlkely events The Company's processof assessing and responding tothe govemmen-tooccur At January 31, 2016, the aggregate termination payment tal investigations and the shareholder lawsuits continues Whle the Company beleves that it s psobable that t wll incur a loss from these payment could be made willexpire in fical 2019 matters given the on-going nature and complexity of the neviewinu nes and investigations the Company canot reasionably estimute ary12. Retirement-Related Benefit would have been 544 milon The arangement pursuant to which ths ss or range of loss that may arse from these matters Although the Company does not presently believe that these matters wil have a mate The Companyoffers a 400 plan for associates in the US under which al adverse effect on ts business,given the inherent uncertaintesn such situations the Company can provide no assurance that these matheThe Compary aso offers a 4010) type plan for associates in Puerto ers well not be material to ts business in the future eigble assocates can begincontributing to the plan immediately upon Rco under whichassociates.can begin to contribute generalyafter one year ofemployment Under these plans after one year of employment theComprymatches 100% of participant contributions up to 6% of annual eligble eamings The matching contnibutions immedately vest 1.Commitments The Company has brg term leases for stores and equpment Rentals at 100-tr each a acate Part opnes can contnbate up to S0% of ther ncludingamounts applicable to taxes insurance maintenance otherpa earnings but not more than the statutory Iimits Participantsage operating expenses and contingent rentas) under operating leasesand 0or older may defer additional earnings in catch-up contributions up other shont-tem rental arrangementswere $25 bition in fucal 2016 and tothem statutory limits 28 bilionin both fiscal 2015 and 2014 ociates ininterational countries who are not US citizens are covered byvaniousdefined contrbution post-employment benefit amangements These plans ae administered based uponthe legis lative and tax require ments in the countries in which theyare established Aggregate minimum annual rentals at January 31,2016 und non-cancelable leases are as follows aptal Leas and Fnancial Obtions ocal Year Addisionaly the Company's subsidianes in the Uhited Kingdom and lapanhave sponsoed defined benefit pension plans The plan inthe Unted Kingdom was overfunded by 5106 million and underfunded by 85 milion at lJanuary 31,2016 and 2015 respectvely The plan in Japan as underfunded by 205 milion and 5223 millionat January 31, 2016 and 2015 espectvely Overfunded amounts are recordedas assets in the Company's Consoldated Balance Sheets in other assets and deferred charges Underfunded amountsare recorded as labiltiesin the Company's onsoldated Balance Sheets in defered income taxes and other Certain other international operations also have defined benefit arrangements that are not signficant s 2057 1989 2017 2018 2019 2020 2021 Thereafter 5 815 758 1697 1530 655 1243 Total minimum rentals Less estimated executory cost 21,505 5 8655 39 8616 Net minimum lease payments Noncash gain on future termination of financing obligation Less imputed interest Pre sent value of minimum lease payments 1070 319 6367 The folowing table summanizes the contibution expense related to the Compary'sreementrelated benlits for fiscal 2016, 2015 and 2014 scal Years Ended y 3 015 2014 2016 Certain of the Company's leases provide forthe payment of contingent entab based ona pexcentage of sales Suchcontingent entals were notDefined contribution plans materal for fiscal 2016,2015 and 2014 Substantalyall of the Companys ore leases have renewaloptions some of which may trigger an escalationtional n rental 967 179 5 8985 8 167 Defined benefit plans: hternation 20 Total contribution expense for 1,152 51,070 51.062 interest-rate obligation. The swap fixes the firm's annual interest expense and cash expenditure to 496 of the $500,000 note. FD designates the swap contract as a cash flow hedge. INTEGRATIVE CASE 7.1 Walmart It is common practice for retail outlets to lease their store locations and distribution centers. Walmart is no exception. Note 11 to Walmart's consolidated financial statements for the fiscal year ending January 31, 2016 (found online at the text website or available for download in the investor relations section of Walmart's website), provides information on future operating lease commitments. REQUIRED a. Effectively capitalize the operating lease obligations. You must first choose and justify an interest rate. Assume that all cash flows occur at the end of each year. b. Recompute the long-term debt to long-term capital ratio (see Chapter 5) using your capi talized operating leases. Comment on the results. CASE 7.2 Notes to Consolidated Financial Statements These matters may require the involvement of certain members of the The Company has futuse lease commitments for land and buildings o Company's senior management that could mpinge on the time they eoximately 215 future locations. These lease commitments have have available to devote to other matters selating to the business The lease tems ranging fiom 10t0 30years and provide for certain minmum Company expects that there willbeon-going media and governmental rental f eveuted payments under operating leases would increase ntesest, including additional newsarticles fiom meda publicationson by 534 million for fscal 2017, based on cument cost estimate these matters, which could impactthe pesception among certain audiences of the Compary'srole as a corporate cite In connection with cetain long-tem debt ssuances,the Company could belable for early termination paymentsif centain unikely events The Company's process of assessing and responding to the governmen wese to occut At January 31.2016 the aggregate termination payment tal nvestigations and the shareholder lawsuts continues. While the Company beleves that t s probable that it will ncur a loss from these payment could be made will expine in focal 2019 matters,gven the on-going nature and complexity of the seview, inqui nes and investigations, the Compary cannot easonably estimate any 12. Retirement-Related Benefits oss or range of loss that may anise from these matters Although the Company does not presently believe that these mattes willhave a mate The Company offersa 4010) plan for associates in the US underwhich al adverse efflect on its business given the inherent uncertainties ieligible associates can begin contributing to the plan immediately upon would have been $44 million The anangement pursuant to which the such situations, the Company can provide no assurance that thesemat he The Company aho offers a 40100 type plan for assocates in Puerto ters will not be matenial to its business in the futu Rico under which associates can begin to contribute generally after on yearof employment Underthese plans after one year of employment theCongary matches 100% of part cpant contributions up to 6% of annual eligble eamings The matching contibutions immedatelyvest 11.Commitments The Company has bng-term leases for stores and equipment Rentals at t00% foreach associate Parbapants can contribute up to 50% d their ncluding amounts applicable to taxes, insurance,maintenance other pretaxearmings, but not more than the statutory limits Particpants age operating expenses and contingent rental under operating leases and 50or older may deferadditional eamings in catch-up contributions up other short-term entalarangements were $2 5bilion in fscal 2016 and to the maximum statutory imit 28 billion in both fiscal 2015 and 2014 Associates in international countries who are not US citcen are covered by various defined contr bution post-employment beneftarangements These plans are administered based upon the legs lative and tax equire ments in the countriesin which they are established Aggregate minimum annualsentalk at January 31,2016 under non-cancelable leases are as follows apital Leae nd Finncd Obligton Additionally, the Companys subsidiaries in the United Kingdom and Japan have sponsored defned beneft pension plans The plan in the United Kingdom was overfunded by $106 millon and underfunded by 85 million at January 31, 2016 and 2015, espectively The plan in Japan was underfunded by $205 million and $223 million at January 31,20 and 2015, respectively Overfunded amounts are recorded as assetsin the Company's Consolidated Balance Sheets in other assets and defemed charges Underfunded amounts are recorded as lablities in the Companys Consolidated Balance Sheets in defemed income taxes and other Cetai other intemationaloperations also have defined benefe aangements that are not signficant 2057 1989 2017 2018 2019 2020 2021 815 758 710 1697 1530 12438 Total minimum rentals$21,505 .093 8.655 39 8,616 ,030 6.367 Less estimated executory cost Net minimum lease payments Nonash gan on future temination of finanding obligaion Less imputed inteest The folowing table summarges the contribution expense nelated to the Company' retirement-related benefits forfscal 2016 2015 and 2014 Present valueofminimum lease payments Yeas Ended Janary 31 2016 2015 2014 Certain of the Company's leases provide for the payment of contingent rentals based on a percentage of sales Such contingent rentals were notDefined contribution plans material for fscal 2016 2015 and 2014 Substantially all of the Company stose leases have renewal options,some of which may trigger an escalation n rentas 967 $898 877 79 167 Defined benefit plans: nternat onal 20 Total contribution expense for retirement-related benefits 1,152 1,070 $1.6 IT. Commitments The Company has long-term leases for stores and equipment Rentals (includingamounts applicable to taxes, insurance, maintenance other operating expenses and contingent rentals) under operating leases and other short-term rental arrangementswere $2.5 billion in fiscal 2016 and 52 8 billion in both fiscal 2015 and 2014 Aggregate minimum annual rentals at January 31, 2016,under non-cancelable leases are as follows Operating Leases Capital Lease and Financial Obligations Amounts in millions) Fscal Year 2017 2018 2019 2020 2021 Thereafter Total minimum rentals Less estimated executory costs 2057 1,989 1,794 697 1,530 12,438 $21,505 815 758 710 655 624 5,093 58,655 39 Net minimum lease payments Noncash gain on future termination 8,616 of financing obligation Less imputed interest 1070 3,319) 6,367 Pre sent value of minimum lease payments Certain of the Company's leases provide forthe payment of contingent rentals based on a percentage of sales. Suchcontingent rentals were not material for fiscal 2016, 2015 and 2014 Substantially all of the Company's store leases have renewal options, some of which may trigger an escalation n rentals

its the 11 part , not 12.

its the 11 part , not 12.