Answered step by step

Verified Expert Solution

Question

1 Approved Answer

its the last pic -UUGI92429/questione Chapter 10 Assignment Question 9 of 15 > 0.67/1 Que M Current Attempt in Progress Que True V Banting Best

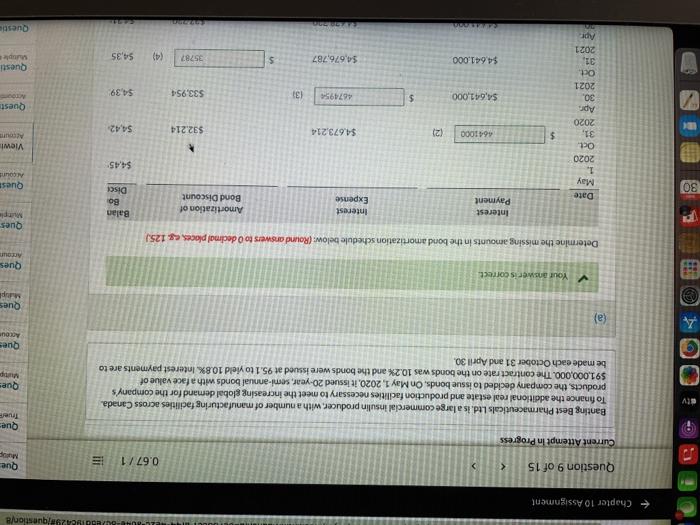

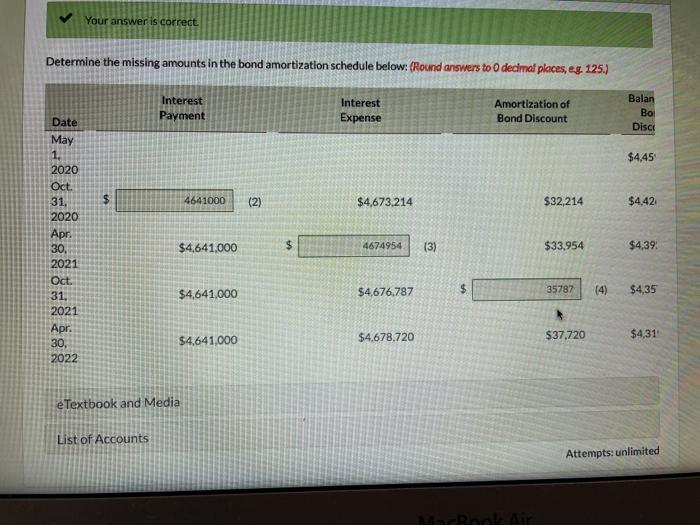

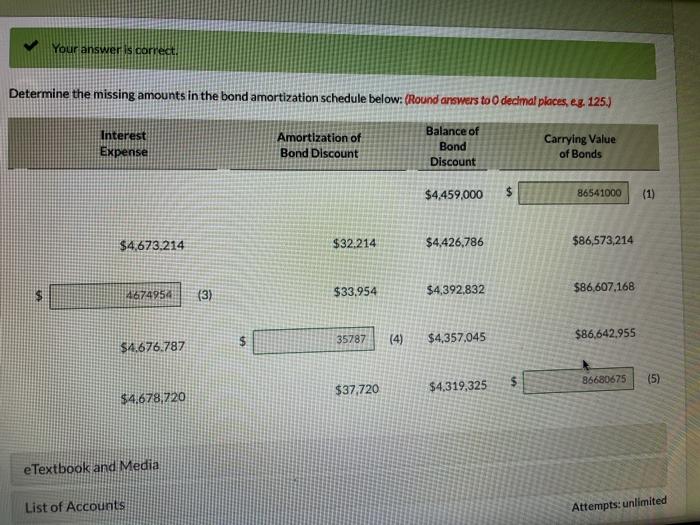

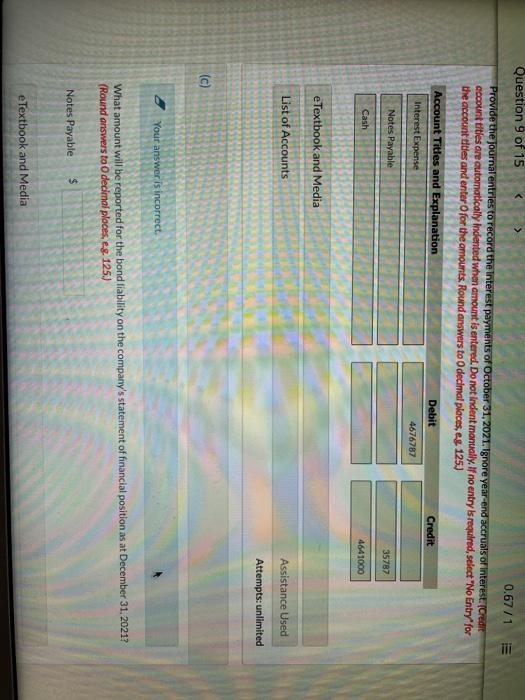

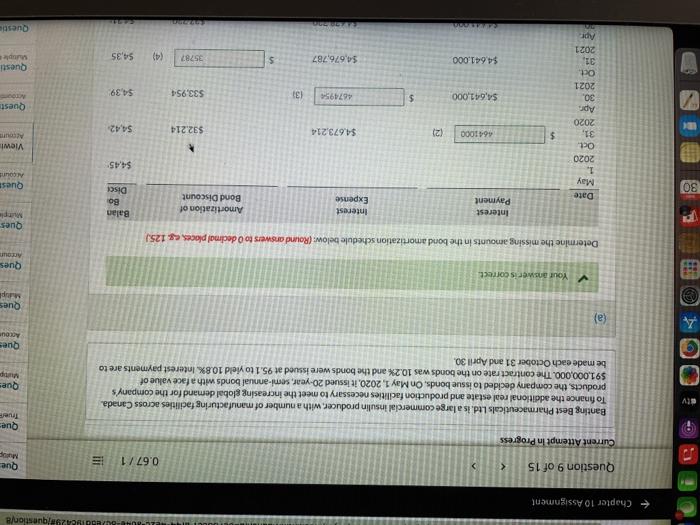

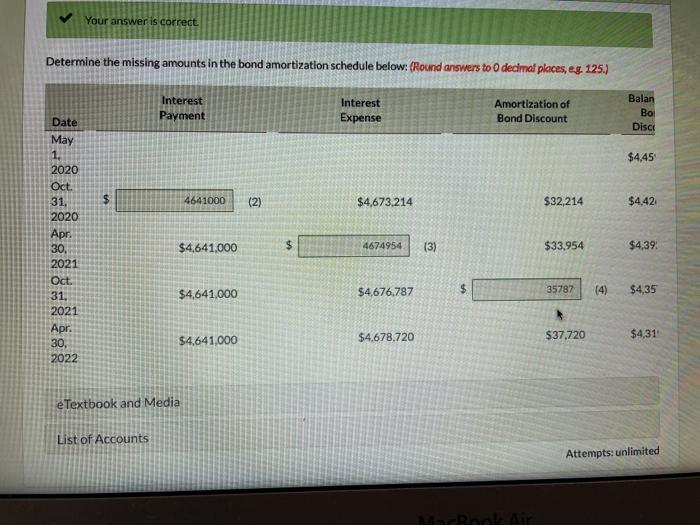

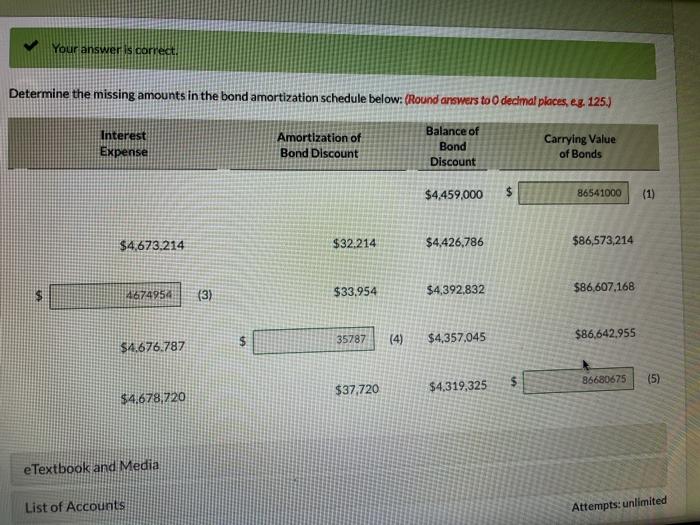

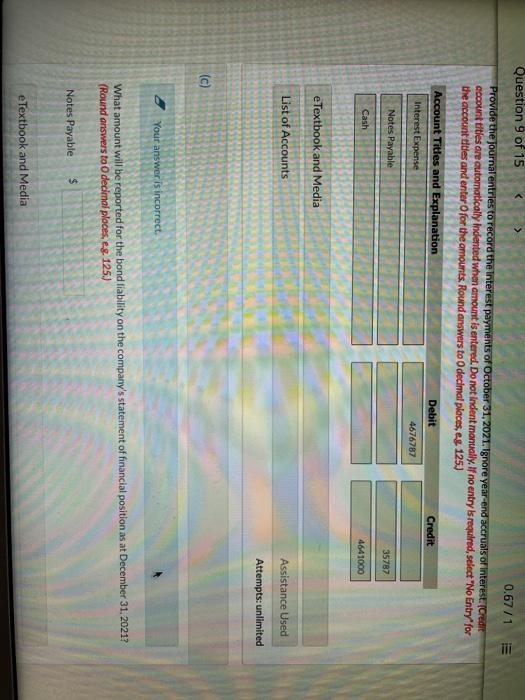

its the last pic -UUGI92429/questione Chapter 10 Assignment Question 9 of 15 > 0.67/1 Que M Current Attempt in Progress Que True V Banting Best Pharmaceuticals Ltd. is a large commercial insulin producer, with a number of manufacturing facilities across Canada. To finance the additional real estate and production facilities necessary to meet the increasing global demand for the company's products, the company decided to issue bonds. On May 1, 2020, it issued 20 year, semi-annual bonds with a face value of 591,000,000. The contract rate on the bonds was 10.2% and the bonds were issued at 95.1 to yield 10.8% Interest payments are to be made each October 31 and April 30. Ques Ques A (a) Ques Your answer is correct. Ques Determine the missing amounts in the bond amortization schedule below: (Round answers to decimal places, s. 125) Ques Mimpi Interest Payment Interest Expense Amortization of Bond Discount Balan Bo Disc 30 Quest Account $4,45 View Acum $ 4641000 (2) $4.673.214 $32.214 Date May 1. 2020 Oct. 31. 2020 Apr 30 2021 Oct 31. 2021 5442 Quest $4,641,000 $ 4674954 131 533,954 $4,39 $4,641.000 $4.676,787 5 Questi ple 35787 $4,35 Ar Questi Your answer is correct Determine the missing amounts in the bond amortization schedule below: (Round answers to O decimal places, eg 125.) Balan Interest Payment Interest Expense Amortization of Bond Discount Disc $4,45 $ 4641000 (2) $4,673,214 $32,214 $4,42 Date May 1. 2020 Oct. 31, 2020 Apr. 30, 2021 Oct. 31, 2021 Apr. 30 2022 $4,641,000 $ 4674954 (3) $33,954 $4,39 35787 $4.641,000 $4,676.787 (4) $4,35 $4.678.720 $4,641,000 $37,720 $4,31 e Textbook and Media List of Accounts Attempts: unlimited MacBook Air Your answer is correct. Determine the missing amounts in the bond amortization schedule below: (Round answers to decimal places, eg. 125.) Interest Expense Amortization of Bond Discount Balance of Bond Discount Carrying Value of Bonds $4,459.000 $ 86541000 $4,673.214 $32.214 $4,426,786 $86,573,214 4674954 (3) $33,954 $86,607.168 $4,392,832 35787 (4) $4,357,045 $86,642.955 $4.676,787 86680675 $37,720 $ (5) $4,319,325 $4.678,720 e Textbook and Media List of Accounts Attempts: unlimited Question 9 of 15 0.67/1 III Provide the journalentries to record the interest payments of October 31, 2021. Ignore year-end accruals of interest (Ordre account titles are automatically Indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account des and enter for the amounts. Round answers to decimal places, eg. 125.) Account Titles and Explanation Interest Expense Debit Credit 4676787 Notes Payable 35787 Cash 4641000 e Textbook and Media List of Accounts Assistance Used Attempts: unlimited Your answer is incorrect. What amount will be reported for the bond liability on the company's statement of financial position as at December 31, 2021? (Round answers to decimal places, c.8. 125.) Notes Payable $ e Textbook and Media

its the last pic -UUGI92429/questione Chapter 10 Assignment Question 9 of 15 > 0.67/1 Que M Current Attempt in Progress Que True V Banting Best Pharmaceuticals Ltd. is a large commercial insulin producer, with a number of manufacturing facilities across Canada. To finance the additional real estate and production facilities necessary to meet the increasing global demand for the company's products, the company decided to issue bonds. On May 1, 2020, it issued 20 year, semi-annual bonds with a face value of 591,000,000. The contract rate on the bonds was 10.2% and the bonds were issued at 95.1 to yield 10.8% Interest payments are to be made each October 31 and April 30. Ques Ques A (a) Ques Your answer is correct. Ques Determine the missing amounts in the bond amortization schedule below: (Round answers to decimal places, s. 125) Ques Mimpi Interest Payment Interest Expense Amortization of Bond Discount Balan Bo Disc 30 Quest Account $4,45 View Acum $ 4641000 (2) $4.673.214 $32.214 Date May 1. 2020 Oct. 31. 2020 Apr 30 2021 Oct 31. 2021 5442 Quest $4,641,000 $ 4674954 131 533,954 $4,39 $4,641.000 $4.676,787 5 Questi ple 35787 $4,35 Ar Questi Your answer is correct Determine the missing amounts in the bond amortization schedule below: (Round answers to O decimal places, eg 125.) Balan Interest Payment Interest Expense Amortization of Bond Discount Disc $4,45 $ 4641000 (2) $4,673,214 $32,214 $4,42 Date May 1. 2020 Oct. 31, 2020 Apr. 30, 2021 Oct. 31, 2021 Apr. 30 2022 $4,641,000 $ 4674954 (3) $33,954 $4,39 35787 $4.641,000 $4,676.787 (4) $4,35 $4.678.720 $4,641,000 $37,720 $4,31 e Textbook and Media List of Accounts Attempts: unlimited MacBook Air Your answer is correct. Determine the missing amounts in the bond amortization schedule below: (Round answers to decimal places, eg. 125.) Interest Expense Amortization of Bond Discount Balance of Bond Discount Carrying Value of Bonds $4,459.000 $ 86541000 $4,673.214 $32.214 $4,426,786 $86,573,214 4674954 (3) $33,954 $86,607.168 $4,392,832 35787 (4) $4,357,045 $86,642.955 $4.676,787 86680675 $37,720 $ (5) $4,319,325 $4.678,720 e Textbook and Media List of Accounts Attempts: unlimited Question 9 of 15 0.67/1 III Provide the journalentries to record the interest payments of October 31, 2021. Ignore year-end accruals of interest (Ordre account titles are automatically Indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account des and enter for the amounts. Round answers to decimal places, eg. 125.) Account Titles and Explanation Interest Expense Debit Credit 4676787 Notes Payable 35787 Cash 4641000 e Textbook and Media List of Accounts Assistance Used Attempts: unlimited Your answer is incorrect. What amount will be reported for the bond liability on the company's statement of financial position as at December 31, 2021? (Round answers to decimal places, c.8. 125.) Notes Payable $ e Textbook and Media

its the last pic

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started